AMD And MediaTek Experienced The Strongest Growth In 2021; NVIDIA And Qualcomm Followed Suit In Terms Of Growth Rate.

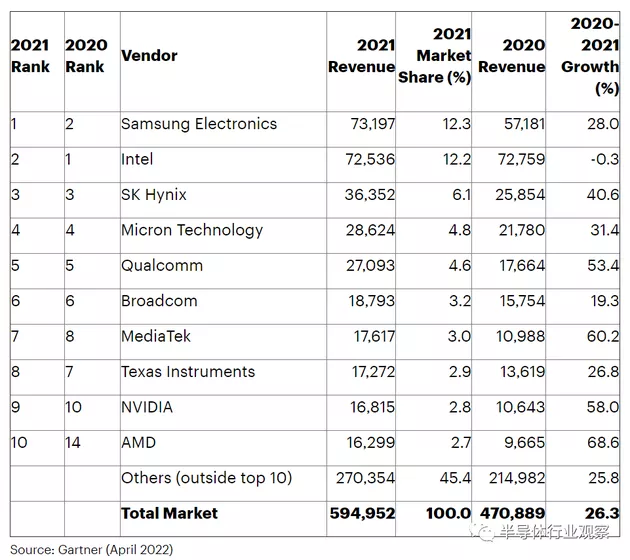

Revenue List Of Global Semiconductor Enterprises In 2021 (source: Gartner)

Gartner Said That The Global Chip Shortage In 2021 Affected The Global Semiconductor Manufacturers, And The Rise In Global Raw Material And Logistics Prices Promoted The Rise Of Semiconductor Average Shipping Price (ASP). Therefore, The Revenue Of Most Semiconductor Enterprises In The World Showed A Significant Growth Trend In 2021.

Unlike The Automobile, Industrial And Some Consumer Markets In 2020, Which Were Hit Hard By The Reduction Of Enterprise And Consumer Spending, The Demand Of Automobile And Industrial Markets Returned Strongly In 2021, And The Memory Market Also Continued To Benefit From The Main Trend Of Turning To Home / Mixed Work And Learning In Recent Years, As Well As The Growth Of Wireless Communication Business With The Development Of 5g, Which Accelerated The Improvement Of The Scale Of Semiconductor Market.

This Paper Focuses On The Revenue Data Of The Top Ten Semiconductor Enterprises To Explore What Industrial Trends Are Hidden Behind Them.

Data Center Or Maximum "air Outlet"

In Recent Years, The Data Center Has Become A Battleground For AMD, Intel And NVIDIA.

AMD

Amd Can Be Described As The "big Winner" On The List, Jumping From 14th To 10th In 2020. Its Annual Revenue Increased By 68% Year-on-year In 2021, And Its Performance In The Fourth Quarter Exceeded Expectations.

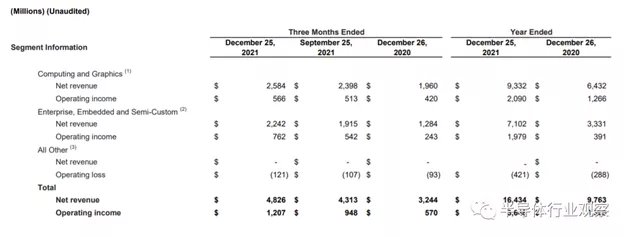

Amd Financial Report Data For Fiscal Year 2021 And The Fourth Quarter (source: AMD Financial Report)

Behind Its Excellent Performance, Amd Has Maintained A Sustained Growth In Turnover In The Computing And Graphics Business Unit And The Enterprise, Embedded And Semi Custom Business Unit.

AMD's Business Revenue Data In Fiscal Year 2021

Amd Said That Compared With $6.4 Billion In 2020, The Net Revenue Of The Computing And Graphics Business In 2021 Increased By 45% To $9.3 Billion, Mainly Due To The 57% Increase In The Average Sales Price, Partially Offsetting The 8% Decline In Shipments; The Net Revenue Of Enterprise, Embedded And Semi Customized Products Was US $7.1 Billion, An Increase Of 113% Over US $3.3 Billion In 2020, Mainly Driven By The Growth Of Sales Of Semi Customized Products And Epyc (Xiaolong) Server Processors.

It Is Understood That The Data Center Business Accounts For About 25% Of AMD's Total Revenue In 2021, Which Reflects AMD's Market Strategy Of Focusing On High-profit Data Center Products And High-end Ruilong Processors In 2021 Amid The Trend Of Semiconductor Shortage And Supply Chain Interruption Throughout The Year.

Su Zifeng, President And CEO Of AMD, Said That Due To The Increasing Use Of AMD Epyc Processors By Cloud Computing And Enterprise Customers, The Revenue Of Data Center Doubled Year-on-year.

In The Field Of Data Center, Amd Continues To Maintain A Strong Development Momentum In The Field Of Data Center. AMD Epyc Processor, Amd Insight Accelerator And Data Center Solutions Are Increasingly Adopted By New Customers And Expanded Cloud Products. In The Fourth Quarter Of 2021, More Than 130 Public Cloud Instances Based On AMD Products Were Launched.

It Is Reported That AMD Will Continue To Grow Its Core Business Rapidly In Fiscal Year 2022, Especially In The Server Business. Amd Predicts That The Annual Revenue In 2022 Will Increase By 31% To US $21.5 Billion, And The Revenue Of Data Center Accounts For About 30% Of The Total Revenue. It Can Be Seen That The Data Center Market Including Servers Will Be One Of AMD's Main Markets Next.

Not Only AMD, But Also The Layout For The Data Center Is The Focus Of Intel And NVIDIA.

In Recent Years, Intel, Which Has Established The Transformation Goal Of "taking Data As The Center", Has Continued To Enrich Its Layout In The Field Of Data Center Through Mergers And Acquisitions, Including The Acquisition Of High-quality FPGA And ASIC Companies, Coupled With The Research And Development Of Independent GPU, IPU, Neural Mimicry Chip And Quantum Computing Chip, As Well As The Research And Development Of Unified Programming Software Tool Oneapi, Realizing A Product Portfolio Covering Multiple Architectures.

NVIDIA Focuses On The Chip Route Of "GPU + CPU + DPU" In The Field Of Data Center. Therefore, NVIDIA First Spent $6.9 Billion To Acquire Mellanox, An Israeli Network Equipment Manufacturer, And Then Launched A Self-developed CPU For Large-scale Artificial Intelligence And High-performance Computing Applications In The Data Center - Grace Chip Based On ARM Architecture.

The Layout Of The Two In The Field Of Data Center Is Also Reflected In The Financial Report.

Yingweida

Old Rival Amd Doubled Its Data Center Business Year-on-year, Greatly Exceeding Market Expectations. NVIDIA's Data Center Business Also Brought Surprises And Handed Over A Good Answer,

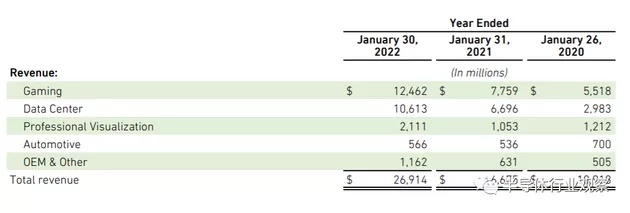

NVIDIA's Revenue Reached A Record $26.91 Billion In Fiscal Year 2022 (from February To January Of The Previous Year), An Increase Of 61% Compared With The Previous Year. Both Revenue And Gross Profit Margin Reached A Record High. In All Businesses, Especially The Company's Core Game Business And Data Center Business Showed High Growth, Accounting For More Than 85% In Total.

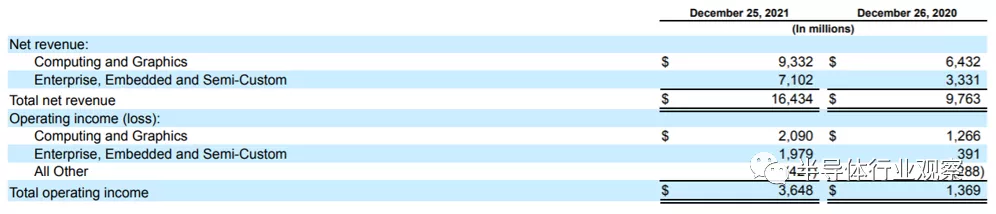

NVIDIA Fiscal Year 2022 Data (source: NVIDIA Financial Report)

Benefiting From The Strong Demand For Amp Architecture Products, NVIDIA's Game Revenue Increased By 61% Year-on-year To US $12.5 Billion, Which Reflects The Higher Sales Of Geforce GPU; Data Center Revenue Increased 58% Year-on-year To $10.6 Billion, A GPU For Training And Reasoning In Cloud Computing And Artificial Intelligence.

Among Them, The Growth Of Data Center Business Is Affected By The Capital Expenditure Of Cloud Manufacturers. Under The Epidemic, The Investment Of Core Cloud Manufacturers Remains At A High Level Of More Than 30%, While NVIDIA's Higher Growth Rate Mainly Comes From The Merger And Acquisition Of Mellanox And Endogenous Growth.

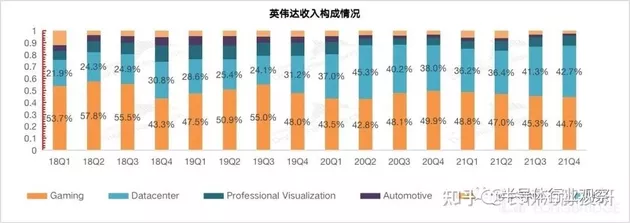

NVIDIA's Revenue Composition (source: Longbridge Dolphin Investment Research)

From The Perspective Of NVIDIA's Revenue Composition In Recent Years, Although The Game Business Is Still The Company's Largest Source Of Revenue In The Fourth Quarter Of Fiscal 2022, Its Proportion Has Declined To 44.7%. The Proportion Of Data Center Business Continues To Increase, From 20-30% To More Than 40%. It Is Expected To Surpass The Game Business And Become The Largest Business Of The Company In The Future. Especially After The Impact Of M & A Mellanox Gradually Faded, The Quarterly High Growth Reflects NVIDIA's Endogenous Growth Strength And The Potential Prospect Of The Data Center Market.

In The Future, With The Increasing Demand For Internet Data, The Data Center Business Is Expected To Become The "basic Disk" Of NVIDIA.

Of Course, As The World's Leading Computing Chip Company, NVIDIA's Products Can Be Used Not Only In Traditional Fields Such As Games And Data Centers, But Also In Emerging Fields Such As Autonomous Driving And Metauniverse. NVIDIA Can Be Seen Wherever There Is A Need For Data Computing.

Intel

Looking At Intel, Compared With The "pots Full" Of Other Manufacturers In The List, Intel Is Particularly Desolate. Net Income In 2021 Was $79.024 Billion, A Year-on-year Increase Of Only 1.5%. (different From Gartner Data, This Paper Adopts Enterprise Financial Report Data)

! Composition Of Intel's Financial Report And Revenue In 2021( Https://img.16k.club/techlife/2022-05-02/235545db15a30bff4403465190282ae1.webp)

Intel's 2021 Revenue And Revenue Composition Of Each Business (source: Intel Financial Report)

Among The Business Segments, The Fastest Growth Is The Internet Of Things And Automatic Driving. Among Them, The Annual Revenue Of The Internet Of Things Sector Was US $4 Billion, A Year-on-year Increase Of 33%; The Annual Revenue Of Mobileye Automatic Driving Was US $1.4 Billion, A Year-on-year Increase Of 43%. However, The Revenue Scale Of The Two Innovation Sectors Is Relatively Low, Which Is Difficult To Support Intel's Future Performance Growth. (and Intel Said It Would Launch Mobileye Independently By Mid-2022.)

Client Computing Division (CCG) And Data Center Division (DCG) Are The Core Sources Of Intel's Revenue, But Their Performance Is Sluggish.

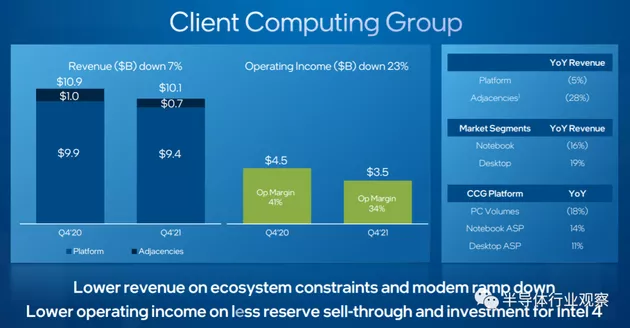

In The CCG Sector, The Annual Revenue In 2021 Was $40.5 Billion, A Slight Increase Of 1% Year-on-year, And Decreased By 7% In The Fourth Quarter Of 2021, With A Revenue Of $10.1 Billion. This Is The Main Factor That Drags Down Intel's Overall Performance.

Of Course, There Are Many Factors Restricting The Development Of CCG Business, Including Its Own Problems, The Shortage Of Chip Supply, Apple's Self-developed Chips And Many Other Factors. Intel Pointed Out That In Terms Of PC Processors, It Has Long Competed With AMD And Application Processors Designed Based On ARM Architecture, And This Competitive Environment Is Expected To Intensify In 2022.

For A Long Time, Apple's MAC Product Line Used Intel Chips. Since The Launch Of M1 Chip In 2020, Apple Began To Reduce Its Dependence On Intel. At Apple's Spring Product Launch Last Year, Cook Said That The Sales Of MACS Equipped With Apple's Self-developed Chip M1 Had Exceeded Those Equipped With Intel Processors.

As The World's Most Important Customer, Apple Has Encountered Challenges To Intel's Performance, Including A 7% Year-on-year Decline In Revenue From The Client Computing Division In The Fourth Quarter Of 2021, Which Is Due To The Shortage Of Chips And The Shift Of Apple Mac To Self-developed Chips. Driven By Apple, Other Brands May Increase Their Efforts In Arm Architecture, Including Qualcomm's Next-generation Processor Based On Arm, So As To Strengthen Qualcomm's Voice In PC Processors.

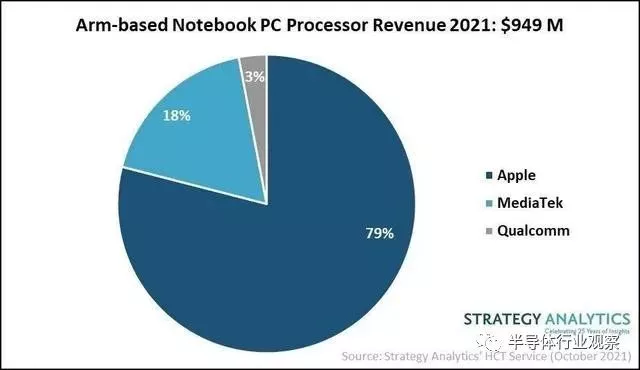

According To A Report Released Earlier By Strategy Analytics, The Revenue Of Arm Notebook Processor Is Expected To More Than Triple In 2021. Apple, MediaTek And Qualcomm Will Occupy The Largest Revenue Share Of The Arm Notebook Processor Market In 2021. In Terms Of Shipments, Arm Based Notebook Processors Will Account For More Than 10% Of The Total Shipments Of Notebook Processors. This Indicates That ARM Architecture Processors Will Rise Rapidly In The PC Market.

Not Only In Personal Computing, But Also In Other Markets Such As Cloud Computing, Enterprise And Edge Data Centers, Supercomputing And So On. Amazon Cloud Technology And Alibaba Cloud Have Already Made Layout Here. As The Overlord Of Mobile Chips, Arm Is Also Constantly Extending To PC, Server, Internet Of Things And Other Directions And Launching An Attack On Intel Territory.

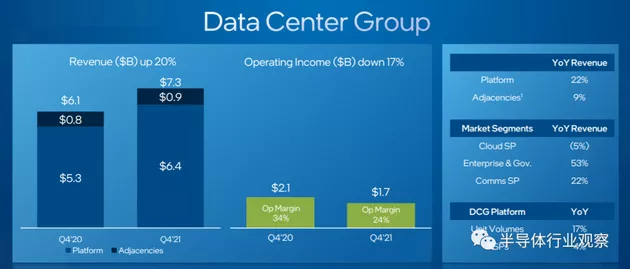

Perhaps The Most Direct Evidence Is That The Revenue Of Intel's Data Center Business Decreased By 1% Year-on-year In 2021. From The Financial Report, Intel's DCG Revenue In 2021 Was US $25.821 Billion, Slightly Lower Than US $21.603 Billion In 2020. Intel Said That The Decline Of Platform ASP Caused By Industry Parts Supply Restrictions And Competitive Environment Was The Main Reason For The Decline Of Business Revenue.

However, The Better Phenomenon Is That With The Adjustment Of Its Product Portfolio And The Recovery Of Customer Demand, Intel Data Center Business Unit Is Reversing Its Previous Decline. DCG's Revenue Hit A Record High Of US $7.3 Billion In The Fourth Quarter Of Last Year, With A Year-on-year Increase Of 20% And An Annual Revenue Of US $25.8 Billion. Among Them, The Servers Of Enterprises And Governments Recovered Strongly, And The Sales Increased By 53% Year-on-year.

Q4 Performance Data Of DCG Division In 2021

Intel May Be Back On The Fast Lane Of Data Center Business Growth. Even If The Revenue In The Data Center Business Stagnated Last Year, In Terms Of Market Share, Intel's Revenue In The Data Center Market Still Far Exceeds NVIDIA And AMD.

On The Whole, The Data Center Market Has Become A New Outlet For Industry Giants To Compete. We Should Actively Increase Investment And Product Layout Here. The Data Center Chip Market Is Dominated By Intel, NVIDIA And AMD.

In Terms Of Revenue Scale, Amd Still Lacks The Strength To Compete With Intel And NVIDIA In A Short Period Of Time. However, At Present, AMD's Strategy Is Flexible Enough To Outsource Its Chips To TSMC, Gradually Approach Intel And NVIDIA By Taking Advantage Of TSMC's Technical Advantages, And Then Make Up For Its Technical Shortcomings By Making Use Of Many Recent Acquisitions, Which Will Greatly Strengthen AMD's Competitiveness In The Data Center Chip Market.

"Residual Temperature" In The Consumer Market

From The Top Ten List, Qualcomm, MediaTek And Other mobile Phones Chip Giants Stand Out And Grow Strongly.

In 2021, MediaTek Delivered A "great Leap Forward" Revenue With Its Excellent Performance In 5g Market And Diversified Business Deployment. In 2021, The Overall Revenue Increased By More Than 50% Year-on-year.

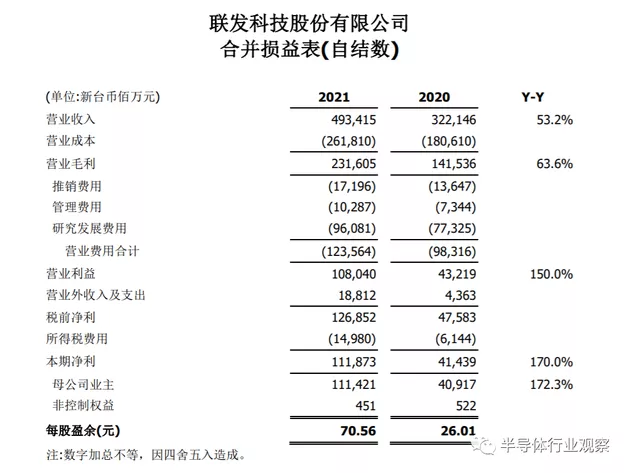

Figure Source: MediaTek Financial Report

Benefiting From Continuous Investment In Products And Technologies, The Chip Products Before MediaTek Have Covered Mobile Phones, Mobile Computing Devices And Smart TVs , IOT Products, Wireless Connection Devices, Power Management Chips, Etc.

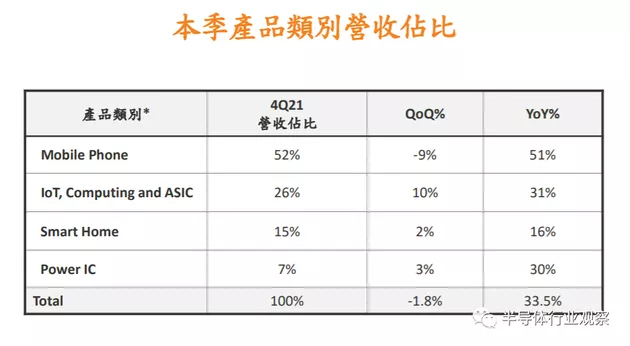

It Can Be Seen From Q4 Data In 2021 That The Revenue From Mobile Phone Business Is Still The Largest Revenue Component Of MediaTek.

Thanks To The 5g Market, Tianji 5g Chip Has Been Favored By Various Mobile Phone Manufacturers And Users. MediaTek Has Already Surpassed Qualcomm To Become The World's Largest Smartphone Chip Supplier. In The Statistics Of Global Smartphone AP / SOC Chipset Shipments In The Fourth Quarter Of 2021 Previously Released By Counterpoint, MediaTek Ranked First In Mobile Phone Chip Shipments For The Sixth Consecutive Quarter With A 33% Market Share.

Nowadays, With The Great Success Of Tianji 9000 Series, MediaTek Has Made A Lot Of Money.

According To The Economic Daily, MediaTek's Revenue In March Crossed The 50 Billion Mark For The First Time, Reaching 59.179 Billion New Taiwan Dollars (about 13.06 Billion Yuan), With A Monthly Increase Of 47.8%, Setting A Record For Single Month Revenue And Growth. Although MediaTek Did Not Disclose The Reasons For The Surge In Revenue, Combined With The Recent Intensive Model Release Of Domestic Manufacturers, It Is Not Difficult To Guess The Role Of Tianji 9000 In It.

Qualcomm Has Benefited From The Increase In The Number Of Customer Groups Brought About By Diversified Business Expansion, The Boost Of Market Demand After The Recovery Of The Epidemic, The Accelerated Penetration And Popularization Of 5g, And Huawei The Changes And Opportunities In The OEM Market Pattern Brought By The Exit Have Jointly Boosted Qualcomm's High Growth Performance Throughout The Year.

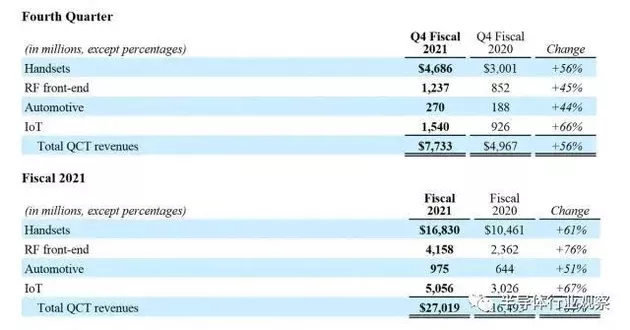

Qualcomm's Fy2021 Revenue Data

(source: Qualcomm Financial Report)

In Fiscal Year 2021, The Overall Revenue Of Qualcomm Chip Business QCT Was US $27.019 Billion, A Year-on-year Increase Of 64%. Qualcomm Attributed The Growth Of QCT Revenue In Fiscal Year 2021 To The Strong Market Demand For Smart Phones And Mobile Phone Chips And The Increased Demand For 5g Products From Apple And Other Major Mobile Phone Manufacturers.

Specifically, Qualcomm's QCT Business Is Divided Into Four Segments: Mobile Phone, RF Front End, IOT And Automobile. Throughout The Year, Each Segment Of QCT Increased By More Than 50% Year-on-year, And The Diversified Business Has A Strong Development Momentum.

Among Them, Mobile Phone Chips Are Still The Bulk Of Its Revenue. In The First Quarter Financial Report Of Fiscal Year 2022, Qualcomm Said That The Revenue Growth In The Quarter Was Mainly Driven By The 42% Growth Of Mobile Phone Chip Revenue, Especially The Year-on-year Growth Rate Of Xiaolong Chipset Business, Which Is The Core Component Of Android Mobile Phone, Was More Than 60%.

Looking Ahead, Qualcomm Believes That As The Industry Continues To Transition From 3G / 4G Multimodal Products And Services, It Is Expected That The New Demand Of Global Consumers For 3G / 4G / 5G Multimodal And 5g Products And Services Will Continue To Grow.

The Smartphone Market Has Paid Dividends To Mobile Phone Chip Manufacturers Such As Qualcomm And MediaTek.

Recently, However, A Series Of Spearheads Have Been Changing Direction. Whether It Is The Sharp Reduction In New Machine Orders By Major Domestic Mobile Phone Manufacturers Predicted By Guo Mingyu, An Analyst At Tianfeng International, Or The Sharp Decline In Domestic Mobile Phone Sales Data Released By Cinno Research, Are Sending A Negative Signal To The Consumer Market.

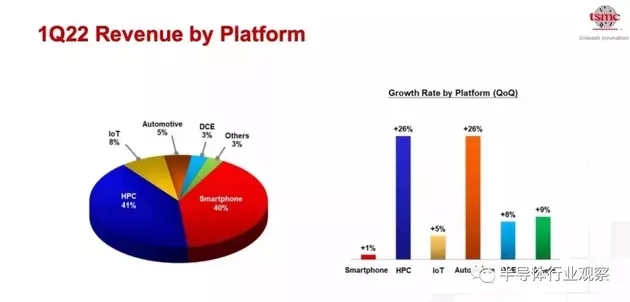

TSMC's Recently Disclosed Financial Report Also Shows That The Revenue Contributed By Mobile Phone Chips Fell To The Altar For The First Time In Recent Years And Was Surpassed By HPC. This Data Also Echoes With The Above Data Center Or Chengxin Tuyere.

TSMC Q1 Revenue Data In 2022

Source: TSMC Financial Report)

Perhaps It Was Aware Of The Changes In The Wind Direction Of The Mobile Phone Industry In Advance. At Qualcomm's Investor Conference Last Year, It Focused On Qualcomm's Layout In The Field Of Automatic Driving. Not Only In The Field Of Automatic Driving, From The Internet Of Things To Meta Universe Hardware, Qualcomm Has A Trend Of Diversified Development Of Chip Business In Recent Years To Get Rid Of The Constraints Of A Single Source Of Income.

Similarly, MediaTek Did Not Choose To Sit On The Sidelines. MediaTek Has Also Developed Into A Diversified Product Layout, Adjusted Its Formation Through Organizational Restructuring, Increased Its Development In The Fields Of Computing, Connection And Intelligent Terminal Platform, And Focused On The Three Revenue Drivers Of Mobile Phone, Intelligent Terminal Platform And Power Management.

In Addition, By The End Of 2021, MediaTek Had Directly Invested In More Than 20 Enterprises In Chinese Mainland, Most Of Which Focused On IC Design, RF Front-end, Software And Information Services. Some Of Them Have Grown Into "hard Core Companies" As Standard Setters In The Industry, Enabling MediaTek To Build An Ecological Chain In New Expanded Fields.

In The Face Of Potential Changes In The Wind Direction Of The Mobile Phone Industry, Qualcomm Chose To Expand The Value Boundary Across Industries, While MediaTek Paid More Attention To Giving Full Play To The Advantages Of The Industrial Chain And Cultivating New Growth Catalysts In Vertical Industries.

It Can Be Seen That In Today's Smart Phone Industry, Head Chip Manufacturers Have Made Preparations In Advance For The Possible Decline.

However, Some Voices Said That As The Product Form Of Smart Phones Becomes More And More Mature, Without A New Product Form Transformation (similar Function Machines Develop To Smart Machines), The Dividend Of The Future Industry Will Certainly Be A Downward Trend, Which Is Normal. In The Future, The Huge Potential Of HPC, Data Center And Automobile Chip Market Is Also True, But The Application Stock Of Mobile Phone Chip Market Will Not Shrink Much. Its Market Volume And Output Value Are Still Large Enough To Support The Basic Disk Of Any Semiconductor Company, And May Even Grow With The Development Of New Technologies.

Therefore, It Is Likely That The Mobile Phone Chip Market Will Keep Pace With The Data Center, Automobile Chip And Other Markets In The Future.

Success Is Also Stored, Failure Is Also Stored

Careful Observation Shows That In The Top Four Of The List, Except Intel, The Other Three Are Storage Manufacturers, And Samsung Is Back At The Top Of The List.

Gartner Said That One Of The Reasons For Samsung Semiconductor's Sharp Rise In Revenue Was The Strong Demand In The Storage Market And The Sharp Increase In The Shipment Of Storage Chips Used In PCs, Servers And Other Electronic Products.

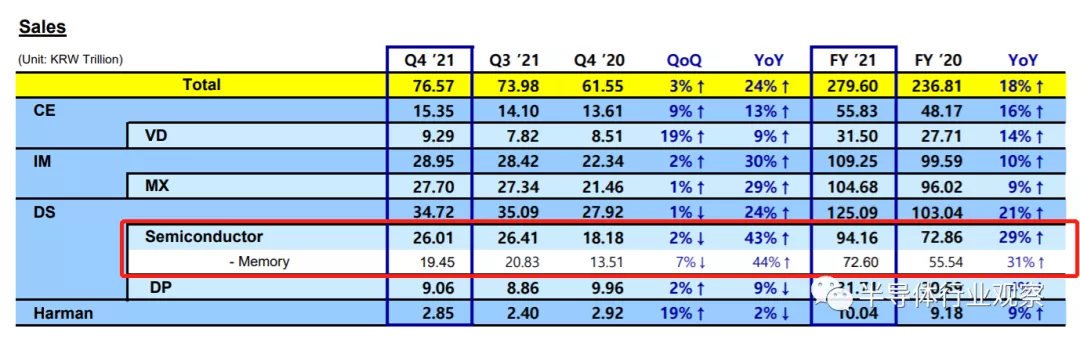

Samsung's Revenue Data For Fiscal Year 2021 (source: Samsung Financial Report)

This Can Be Verified From Samsung's Financial Report, In Which The Storage Business Increased By 31% Year-on-year.

In Terms Of DRAM, The Demand For Server DRAM Is Still Strong. Due To The Strong Demand For Game PC And The Growing Demand For Encryption Mining, Samsung Said It Would Actively Respond To The Increase In The Demand For Server And Graphics; In The NAND Field, Samsung Pointed Out That It Is Mainly The Data Center Customer To Server SSD, But The Interruption Of IC Component Supply Chain Has A Certain Impact On The Demand Of Client SSD.

In Recent Years, The Memory Market Has Benefited From The Main Demand Trend Towards Home / Mixed Work And Learning, Which Has Driven The Increased Server Deployment Of Super Large-scale Cloud Service Providers To Meet Online Work And Entertainment, As Well As The Surge In The Demand For PCs And Mobile Devices In The Terminal Market.

At The Same Time, The Sales Brought By The Shortage And Rising Price Also Raised The Annual Sales Level. According To Statistics, DRAM Market Increased By 42% And NAND Market Increased By 23% In 2021. Driven By Strong Demand, Memory Accounted For 27.9% Of Semiconductor Sales And Revenue Increased By 33.2% In 2021, An Increase Of US $41.3 Billion Over The Previous Year.

Samsung's Lead In The Market Is Mainly Affected By The Price Fluctuation Of Storage Products. Looking Back On History, Intel Gave Up The First Place For The First Time In 2017. Samsung's Performance Rose 52.6% In 2017, Mainly Due To The Rise In The Price Of Memory Chips Driven By Insufficient Supply. In 2017, The Price Of NAND Flash Memory Chips Increased By 17% And DRAM Memory Chips Increased By 44%. In 2019, Affected By The Decline In The Price Of Memory Chips, Samsung's Revenue Plunged By 29%, And Intel Returned To The First Place.

Although The Challenges Posed By The Epidemic And The Lack Of Core May Continue, Samsung Believes That The Demand For Memory Business Will Grow In 2022. With The Introduction Of New CPUs, The Demand For Servers And Data Centers Will Increase. With The Strengthening Of 5g Lineup, The Demand For It Investment And Mobile Devices Will Also Increase. Take High-value Solutions As The Core, Strengthen Cost Competitiveness And Market Leadership Through Industry-leading EUV Capabilities, And Actively Meet Market Demand By Expanding Cutting-edge Interfaces Such As Ddr5 And Lpddr5.

Similarly, With The Development Momentum Of The Memory Market, SK Hynix And micron Has Also Made A Big Increase.

Sk Hynix Had A Revenue Of US $36.326 Billion Last Year, Ranking Third In The List, An Increase Of 40.5% Compared With Us $25.854 Billion In 2020; Meguiar's Revenue Last Year Was $28.449 Billion, Up 29.1% From $22.037 Billion In 2020, Ranking Fourth.

As The Original Storage Plants Integrating DRAM And NAND Production Lines, SK Hynix And Meguiar Are Continuously Optimistic About The Development Of DRAM And NAND Market Demand This Year. Especially In The Face Of The Mainstream Application Markets Of PC, Data Center And Mobile Storage Products.

However, The Balance Between Supply And Demand Of Memory Chips Is Easy To Be Broken. It Can Be Seen From The Repeated Market Exuberance And Sharp Decline In The Past, And Even The Saying Of "memory Cycle" Appears In The Industry.

From The Current Trend Of The Industry, The Main Battlefield Of Memory Chips Is Moving From PCs To Servers In Data Centers. The Data Center Market Will Become An Important Engine Driving The Development Of The Storage Industry In The Next Few Years. This View Has Undoubtedly Formed A Consensus In The Industry, Including Promoting Remote Work And Online Learning To Improve The Demand For Cloud Storage, And Increasing The Capacity Of Data Center Operators To Meet The Surge In The Demand For Cloud Services.

As The Data Center Investment Becomes More Active, Storage Manufacturers Also Begin To Increase Their Layout Here, And The Shipment Of Storage Chips Is Expected To Usher In Rapid Growth.

With The Support Of Many Potential Markets, The Memory Recession May Not Come For The Time Being, But Industry Manufacturers Should Also Reasonably Plan Their Production Capacity Layout And Guard Against The Repetition Of "historical Tragedy".

Write At The End

Judging From The Main Track And Market Focus Of Enterprises On The List, The Data Center May Become The Next Industry Outlet; Although The Smart Phone Market Has Declined, The "basic Market" Is Still There; The Automobile Market Is Growing Rapidly, But The Current Proportion Is Still Low; Memory Chips Benefit From The Strong Demand In Many Markets And Are Ushering In Upward Opportunities...

Just Like The Golden Age Of Mobile Semiconductors, Curtain Call "Terminals Have An Absolute Say In The Semiconductor Industry. In The Past Two Decades, In The First Decade, PCs Have Driven The Growth Of The Global Semiconductor Industry. In The Next Decade, Mobile Phones Have Become The Main Driving Force For The Growth Of The Semiconductor Industry. As The Saying Goes, A Cycle Of Ten Years, The Current Smartphone Business Has Reached The Top, And May Not Be A Powerful Booster For The Development Of The Semiconductor Industry."

Now, New Markets Are Brewing And Are Competing To Become The Next Relay.

PS: The Revenue Data Of All Enterprises In This Article Are Based On The Annual Report Data Of Enterprises, Which Is Different From The Data In Gartner List.