The short video track is on fire and the liar is coming. "There are more than 1600 people in the group. Everyone is grabbing the subscription form." When grabbing the subscription order of 1000 yuan for the second time, Wang Lin (pseudonym) did not hesitate to transfer more than 1000 yuan to the bank account designated by the other party and wait for the rebate withdrawal. But then she was informed by the other party that the subscription form of 1000 yuan had been robbed, and she could only make up the price difference to "make a subscription form of 3000 yuan".

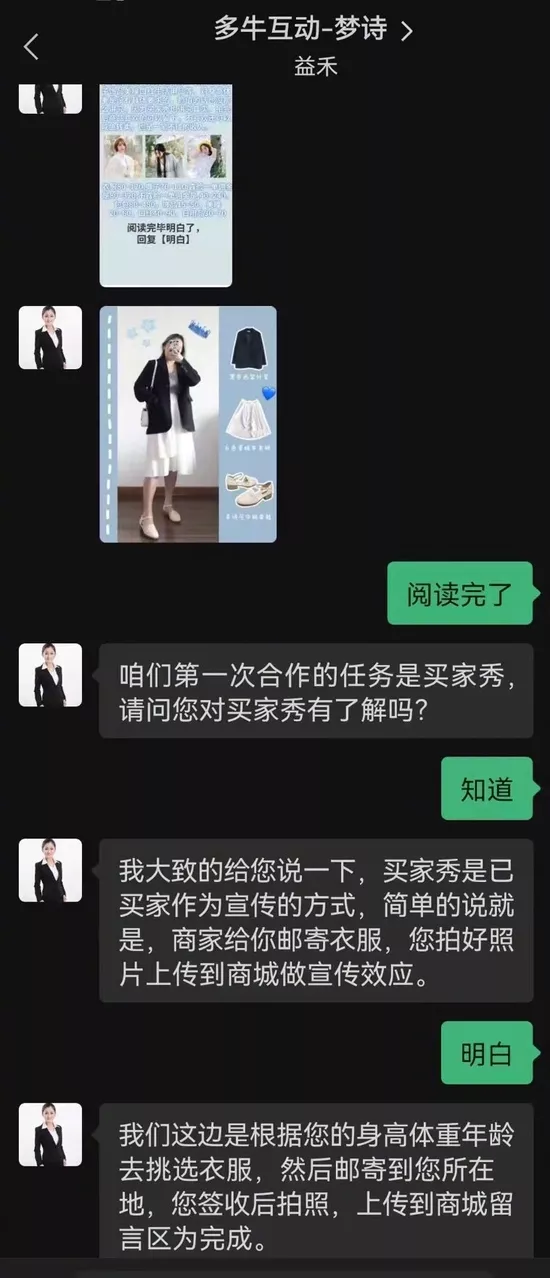

Chat records provided by the victim about the recruitment of fitting staff. Picture provided by the interviewee

Reporter / Li Menghan

Editor / Yue caizhou proofreading / Lu Xi

With the attitude of "try to transfer some more money", Wang Lin remitted another 2000 yuan, but was told again that the 3000 yuan subscription form was also robbed, so she could only continue to make up the price difference and make a 5000 yuan subscription form.

At this time, Wang Lin reacted that she had been cheated!

Recently, a number of netizens with similar experience with Wang Lin reported that they were cheated in applying for part-time fitting staff on the short video platform - the swindler took the recruitment of fitting staff as the reason, let himself download the app, and pulled himself into the app task group. Then he began to brush the list to do the task, and was cheated out of all his savings in the last step. Among them are full-time Baoma, single mother, unemployed youth, etc. the amount cheated ranges from several hundred yuan to more than 200000 yuan.

"In addition to me, most of the others in the group are entrusted," said a victim.

According to the investigation by the shell finance reporter of the Beijing News, there are not a few cases of bill swindling fraud under the pretext of recruiting platform fitting staff and platform praise staff. Due to the changeable methods of such fraud and the strong anti reconnaissance awareness of criminal gangs, it is often difficult to recover money after filing a case.

Many cheated netizens said they trusted the short video platform and hoped that the platform could be strictly reviewed and assume regulatory responsibilities.

So, should the short video platform bear some responsibility in this fraud case? Some experts believe that the platform profits from advertising and should undertake corresponding audit obligations for advertising; Some experts also believe that the advertisement does not contain obvious traces of fraud. The platform only needs to fulfill the ordinary duty of care during the audit and ban the advertisement in time after the fraud occurs.

A new type of bill swiping scam dressed in a recruitment coat appeared, and the thousand layer routine of swindlers was revealed

On April 26, when Wang Lin was brushing the short video platform, she saw a job advertisement for a fitting clerk. The advertisement said that the goods sent and photographed were free. Only the buyer's show was left, and there was a lot of Commission for each order. Wang Lin, who is unemployed at home, filled in her contact information in the advertising link of the short video platform with the mentality of trying.

The next day, Wang Lin received a return call and added the other party's wechat. Subsequently, Wang Lin was recommended to the company's customer service and downloaded an app called "duoniu" under the instruction of the customer service. Then Wang Lin, who successfully registered, was assigned a special receptionist.

On duoniu app, Wang Lin was pulled into two groups. One is the logistics group, which is specially used to update the logistics information of goods sent and photographed; The other is the task group. The receptionist said that while waiting for logistics, the group friends can "do some small tasks and earn some pocket money" in the task group.

Encouraged by the receptionist, Wang Lin began to try to accept small orders in the task group. At first, in order to pay attention to pinduoduo or Taobao stores, she could get a rebate of 2.8 yuan per order, and Alipay would arrive in seconds. The receptionist said that newcomers who have just joined the group need to make a new subscription form. After completing the subscription form three times, they can become regular employees, and the rebate amount of paying attention to the store will also be doubled. The so-called subscription form is to cooperate with businesses to create traffic, and get a rebate after a certain amount is advanced by transfer.

Wang Lin told the reporter of shell finance that subscription forms are distributed in three time periods every day in the task group. The amount of transfer and advance payment includes 100 yuan, 300 yuan, 500 yuan, 1000 yuan, 3000 yuan to 30000 yuan, and the rebate profit is 20% - 30%. To receive the subscription form, group friends need to reply the amount of the form they want to make immediately after the task is released, and send the screenshot to the personal receptionist. Then, according to the bank account provided by the receptionist, the receptionist will help recharge the transferred amount to their "peak business" account. After 5 to 10 minutes, the rebate will arrive. Individuals can bind their bank card for withdrawal.

After trying the tasks of 100 yuan once, 500 yuan twice and 1000 yuan once, Wang Lin began to "grab orders" on her mobile phone every day. From 9:30 to 10:00 every day is the check-in time. You can get 5 yuan red envelope on the first day, 15 yuan for three consecutive days, 45 yuan for seven consecutive days, and so on. You can get 888 yuan for one month. After signing in, there will be about 15 attention orders in the group every day, which will be distributed every half an hour, interspersed with three subscription orders, "the group is crazy".

The respondent failed to pass the cash withdrawal application at Summit commerce. Picture provided by the interviewee

Wang Lin recalled that a group of friends in the group showed a screenshot of their 30000 large single cash withdrawal to the account. Another group of friends said that they had done this for a long time and had no problems. When a group of friends questioned the authenticity of the peak business website, the managers claimed that "peak business has cooperation with the national anti fraud app and can be used safely". In addition, in order to appease the group, in the logistics group, the management personnel will update the logistics information of goods sent and photographed every day. Some netizens in the group said they had received clothes sent and photographed, and even took photos to show them to the group.

However, what she doesn't know is that the people in the group who show off that they make a lot of money are tuo.

Until she finally withdrew from the group, Wang Lin didn't receive the clothes. The 3000 yuan transferred by Wang Lin is still unable to be withdrawn. The personal receptionist, subscription form tutor and wechat customer service added at the beginning will not reply to the message after Wang Lin explicitly refused to add money to make a large list.

At present, Wang Lin has reported to the police for five days, and the case has not made further progress. Relevant data show that the number of victims who have been cheated by contacting the fitting man advertisement through the short video platform has increased to hundreds, and the amount cheated ranges from several hundred yuan to more than 200000 yuan.

Shell finance reporter found that at present, the "fitting man" is searched on the short video platform, and the first search result is the anti fraud publicity short video of the national anti fraud center. The prompt message of "Beware of fraud trap" will appear below the search result.

The short video platform is targeted by swindlers. Beware of the four major drainage scams

In fact, in recent years, with the popularity of short video, criminals also began to focus on the short video platform, and there are many cases of fraud using the platform. In August 2021, a report released by the short video platform showed that it banned more than 800000 accounts suspected of fraud in half a year and intercepted more than 1 million videos suspected of fraud off the shelf. In half a year, 57 online fraud gangs were cracked down and 273 suspects were arrested.

According to the report of another short video platform, in 2021, it cooperated with all parties to crack down on black and gray products, shut down more than 500000 fraud related accounts, submitted more than 17000 fraud related clues through the online system of the anti fraud platform, and cooperated with local public security departments to crack down on 25 fraud related groups offline.

So, why are short video platforms targeted by swindlers, and what are the new routines of these scams?

For the fraud on the short video platform, Gansu anti fraud Center issued an important early warning on May 6. The warning said that with the increasing popularity of short videos, many swindlers aimed at this "fat meat" and waited for the opportunity to implement all kinds of fraud. The main fraud methods are:

Part time advertisements were released through the short video platform. After the victim added the other party as a friend, the other party lured the victim to swipe the bill on the virtual website on the grounds that swiping the short video can make money, and finally cheated the victim into recharging and transferring money for many times, but he was unable to withdraw cash.

Through the live broadcast of stock investment propaganda, the victim was lured to watch the open class of stock investment in the group chat after adding contact information. Then, the customer service lured the victim to buy shares on the virtual investment website on the grounds of low investment and high return on new share listing, but ultimately failed to get back the principal and income.

Through the private letter contact of the short video platform, they gradually developed into boyfriend and girlfriend with the victim. On the grounds that they have channels to help the victim make money, they tricked the victim into investing and gambling on strange websites. The victim was unable to withdraw cash after multiple investments, and the other party also lost contact.

The fraudster pretended to be the customer service of the short video shopping platform, told the victim that the quality of the goods he bought was unqualified, and wanted to carry out the refund business, lured the victim to fill in his personal information and SMS verification code in the unfamiliar website, and then transferred the funds in the victim's account.

In this regard, Gansu anti fraud center reminded consumers not to believe in false advertisements, do not add strange friends, do not answer strange calls, and quit strange group chat in time when watching short videos. Anyone who invites you to swipe or invest in financial management is a liar. If you receive a call claiming to be the platform customer service, please contact the regular customer service in the background of the platform for verification. Please download the national anti fraud center app to add a layer of security to your mobile phone. In case of fraud, please call the police immediately.

Does the short video platform fulfill its audit obligations? Who is responsible for the victim

After being defrauded of a large amount of savings, some victims believed that the audit of the short video platform was not rigorous and did not fulfill their regulatory obligations for advertising. They fell into the trap of swindlers step by step because they trusted the platform, and they complained on the platform for many times, but the coordination failed.

So, in this fitting fraud case, does the platform need to be responsible for the victim? After the occurrence of fraud, what disposal obligations should the platform fulfill?

In this regard, Meng Zedong, a lawyer of Beijing Yingke Law Firm, believes that as an Internet information service provider, the short video platform will usually benefit from the advertising promotion process of businesses. It should fulfill the corresponding audit obligations for the advertisements pushed by businesses, and bear certain platform responsibilities in the fraud cases of fitting staff. Meng Zedong said that in the process of helping businesses promote advertising, the platform should implement the obligation of comprehensive review, including prior, during and after the review: in advance, the platform should conduct a more substantive review of businesses' qualifications and the potential risks of businesses publishing advertising; During the event, the platform shall review the actual content in the merchant's advertisement and take certain measures for the risks in the communication process; After the event, when the platform receives the user's complaint, it should disconnect the advertising link in time to strengthen the post event supervision.

Meng Zedong said that although the platform should bear a certain responsibility, the size of the responsibility still needs to be determined by the court according to the specific situation. Once the court determines that the platform has not fulfilled the corresponding supervision and audit obligations, the platform also needs to bear a certain liability for compensation.

Zhou Liang, a lawyer from Beijing Yingke Law Firm, believes that the short video platform only needs to fulfill the ordinary duty of care when reviewing advertisements, that is, if there is no sign of fraud in the content of the fitting man's advertisement, there is no problem in the normal push of the advertisement by the platform, and there is no need to bear responsibility for the subsequent fraud of the merchant. If the platform finds that the advertising content has a certain tendency of fraud, it has the obligation to prompt the user and strictly review the advertisement; If the correlation between advertising and fraud is not high, there is no need for people to criticize the platform too much and strictly review advertising.

Zhou Liang suggested that although the platform does not have to bear such responsibilities, it should have the responsibility of a large platform. For example, after the fraud, it should use the advantages of the platform to summarize the victim's information, actively guide the victims to protect their rights according to law, and cooperate with the victims to report to the public security organ; In addition, for this fraud, the platform can also reflect on the introduction of relevant measures to avoid the recurrence of similar events.

For such telecommunications fraud, what should consumers pay attention to?

Meng Zedong told the shell finance reporter that he once met a victim of telecommunications fraud, who was cheated of more than 400000. It was 20 years after the case was filed that the police informed him that the cheated money was recovered. According to Meng Zedong's analysis, most of these Telecom fraud gangs are distributed overseas and well-organized. Before fraud, detailed fraud plans will be formulated, and the flow direction of fraud amount is complex, making criminal investigation more difficult. In this regard, Meng Zedong reminded the public that it is difficult to recover money from telecommunications fraud. We should have a reasonable understanding of money and never covet small bargains.

Zhou Liang also reminded consumers to think twice when they encounter pie falling from the sky. Once there is an abnormality, they should be more cautious.