In 2017, Xiao Xu, a college student in Nanjing, finally chose to jump off the windowsill of the hotel because he owed 56 cash loans. In 2018, a 19-year-old girl ran away from home after she owed a cash loan, and her mother committed suicide under the pressure of debt collection. I wonder if the above words have reminded you of some long-standing memories Yes, today I want to talk to you about cash loan, which is also what we call microfinance

Hey, I know what you're trying to say.

Isn't it all five or six years ago? Why take out fried cold rice? "

Indeed, since 2017, microfinance has been stopped in China. The policy is tightening day by day, which is equivalent to choking the lifeline of the huge profits of microfinance

However

We believe that the fate of Microfinance: tightening policies, the closure of non-conforming enterprises and personnel changing careers.

The actual fate of Microfinance: leave China, go around the world and lie down and make a lot of money

It is understandable that who would be willing to give up the ultra-high interest rate of 500%.

I always remember that when P2P was the hottest in Hangzhou, one afternoon, I went to the ear shop near the company to collect ears.

As a result, the owner of the ear picking shop told me that if he wanted to engage in P2P in Southeast Asia, the thief would make money.

Huh? And this kind of operation?

At that time, I searched and found the news about the master. It was still a little late.

As early as the end of 2016, the first batch of enterprises to make cash loans in Southeast Asia had become popular

In that year, a large number of enterprises engaged in P2P cash loans, such as paipai loan, rong360 and Zhangzhong financial service, collectively moved.

This step of Chinese enterprises has directly increased the amount of online loans in Indonesia by more than eight times.

However, the short-lived cash lending storm in Southeast Asia lasted only two years.

The government couldn't stand it and officially took action.

Don't go too far with your enterprises. All those without business licenses will be banned. The products are all for you. "

Indonesia alone closed 826 unlicensed fintech companies at one time. The way of lending in Southeast Asia is hard to go

Like guerrilla warfare, these people turned to India next door, which was "more hungry and thirsty" after they finished fighting in Southeast Asia.

In 2020, China's P2P will be officially cleared.

On the other hand, in India, Chinese microfinance enterprises have found China in the golden period of credit in 2017.

The Indian people are like fish on the chopping board of these credit companies, allowing them to harvest wildly.

As one of the top ten emerging economies, India's economic growth rate once exceeded that of China. In 2018, India's GDP growth rate was 7.4%, while China's was 6.6%.

But money belongs to the tip of the pyramid.

More than half of India's national wealth is in the hands of that 1%. 16 personal wealth is equal to the wealth of 600 million people

And the other end of the lever?

Three quarters of Indians live on less than $3 a day. Two thirds of people live below the absolute poverty line

In order to hide the high interest rate when China releases microfinance, microfinance companies will launch additional charges such as handling fees and try their best to hide the high interest rate into additional conditions.

Pretend to be harmless, so as to deceive people into taking the bait.

But when lending in India, they have absolutely no need to hide high interest rates.

Because India's poor borrow to survive. Many times, it may just be for a meal**

Their most common loan amount is about 50-100 yuan. If you look at your spending quota, it's more than that.

You may be surprised that these microfinance companies robbed them. Why do Indians foolishly go to their place to borrow usury instead of going to a regular bank?

This is because microfinance app is their only choice.

Bank cards issued by the Bank of India each year account for only 3% of the total population. Three quarters of Indians cannot apply for credit cards.

Even if there is a credit card, 75% of users do not meet the bank's loan qualification.

Indians do not understand how high interest rates are, but they have only two choices: starvation or usury.

Even Xiaomi couldn't help but go to India and launch "micredit"

In addition, this credit product is mandatory on all MIUI phones

At the time of the pilot, a loan of nearly 280 million rupees was issued

Mobi magic, a joint venture between 360 and Kunlun world wide, is the top microfinance company in India.

At its peak, it can release 60000 orders a day, covering Africa, Southeast Asia and South America

Boston Consulting Group predicts that India's Internet loans will reach $1 trillion by 2024.

Cash loans have successfully found their home in India, and various credit platforms are blooming everywhere.

Everyone was in a frenzy of and credit.

Everything looks peaceful.

Until 2020, the outbreak of the epidemic broke the foam of peace

India has been closed due to the epidemic, and the resumption of work and production is far away, which has directly ignited India's credit market.

And triggered a series of explosions.

First, the Indian people.

60% of the newly added global poverty population after the epidemic comes from India, and another 75 million poverty population has been added in India. (note that the poverty line adopted here is the absolute poverty line of the minimum standard set by the United Nations)

Not only the Indians, but also the China credit corporation.

You don't have a job. Who will pay me back?

For lending companies, it is normal to have some uncollectible bad debts. With their high interest rate at the bottom of 300%, they still earn without losing.

However, once the bad debt rate soars too high and nearly half of the loans cannot be recovered, the situation will be different.

In order not to lose all their underpants, the restless credit company began to do it.

They use the app authority to collect users' personal information and carry out life-threatening serial calls and violent collection on debtors

Now, the Indian government also bombed. They finally realized that the situation was wrong.

But at that time, almost everyone in India was in debt of $1345.

For young people in India, the bar mitzvah is not a gift, but a debt. Like the once crazy Chinese youth, they owe multiple debts on various credit platforms

Under the violent collection, the first credit suicides in China occurred in India.

The disconnected and reconnected Indian government decided to "strangle" microfinance at one time.

They put almost all the credit institutions in a nest. No matter whether your institution is compliant or not, they will catch them first.

In India, 60% - 70% of microfinance products and procedures are operated by Chinese companies

All the Chinese companies were recruited in this fight.

After the arrest, it also limits interest fees, license issuance and product time. With a combination of punches, India's cash loan market is also under supervision.

However, the poor friends who are already familiar with their routine have guessed that the story is far from over.

After losing India and Southeast Asia, credit companies cleaned up and immediately rushed to the next continent.

Brazil and Mexico are the next targets

Chinacast.com: "Lei Jun is the largest Chinese lending to India?" ▼

Even Africa, where the Internet penetration rate is less than 33%, has been gnawed down by these microfinance companies.

A large number of Chinese fintech companies not only brought online payment and other technologies to Africa, but also brought microfinance.

Take opera, the second largest browser in Africa, which is controlled by Kunlun world wide, a Chinese enterprise, as an example.

Opera's opay is the largest online payment provider in Nigeria. Local people basically rely on opay for online payment. The status is almost the African version of Alipay.

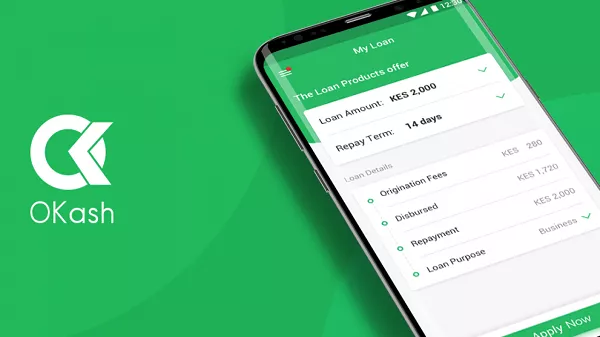

Relying on opay's online payment, opera has developed a variety of lending products for different countries: opay (Nigeria), cashbean (India), okash (Nigeria and Kenya) and opesa (Kenya)

Opay's microfinance app: okash ▼

In 2019, these credit businesses brought us $128.373 billion in revenue to opera, which supported the whole book of opera on its own.

Because the interest rate is too high, it is even targeted by short selling institutions.

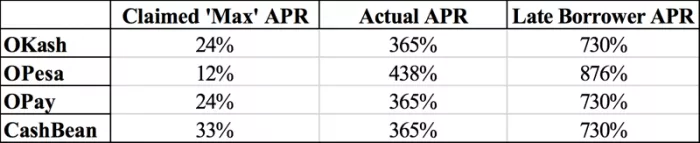

According to Hindenburg research, a short seller, opera claims that its credit platform has a maximum annual interest rate of 24%. But the survey found that the real annual interest rate reached 365%

Good guy, it's more than 10 times straight.

Source: hindenburgresearch ▼

At present, the Nigerian government is still vigorously introducing these financial technology companies.

It is estimated that after the complete introduction of online payment by Chinese enterprises, it will replace the status of traditional banks to a great extent.

As for how the story will develop in the future, there should be no need for you to say more.

In fact, even in India today, private high interest rate microfinance is still common.

If the poor are still there and the huge demand is still there, the market will not disappear

The new proposal of the Central Bank of India in 2021 relaxed financial supervision.

Regulations such as "the handling fee shall not exceed 1% of the total loan amount, and the lender shall not charge a fine to the borrower for delaying repayment of the loan" have been abolished to protect the poor.

This time, the private sector felt that it was doing well again and rallied to enter India again.

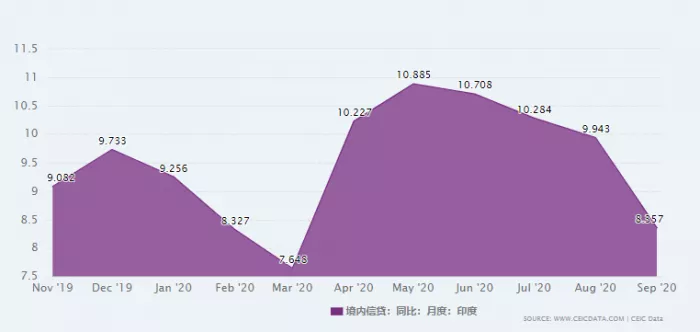

The cash loan business rebounded immediately after a slight decline in 2020. ▼

After the half-time break, the party continued.

This carnival, which spread all the way from China to Africa, began in the hands of a person who won the Nobel Peace Prize.

In 1976, Mohammed Yunus granted a small loan of $27 to 42 people in a small village. This is the first cash loan in the world

However, Yunus expected cash loans to "stay away from interests and focus on the poor" as the most basic principle of the industry.

Yunus said more than once, "the commercialization of microfinance is in the wrong direction. “

The Chinese government is also opening up microfinance for rural areas in some remote places. I hope to help them complete the first step of standing up.

However, in the eyes of some non compliant microfinance companies, the poor have changed from helping objects to making money.

The microfinance model itself is innocent, but the user's purpose has changed, and the final result has changed