The bull market in US stocks, which began at the height of the epidemic panic and lasted for two years, nearly fell into a bear market on Friday. Fortunately, the reversal in the last hour helped it avoid bad luck. The S & P 500 index was 20% lower than its all-time high of 4796.56 for most of the afternoon, but the counterattack in the late afternoon helped recover the lost ground and closed basically flat. The last time we entered the bear market was in February 2020.

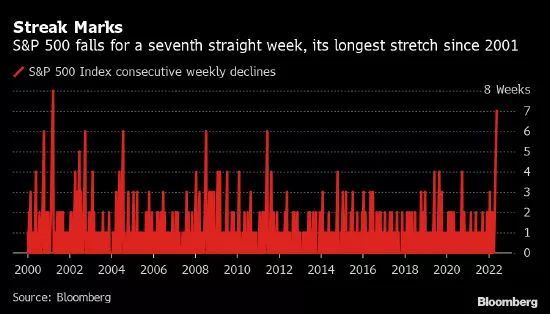

The benchmark stock market index fell for the seventh consecutive week, the longest weekly decline since March 2001; The Dow Jones Industrial Average fell for the eighth consecutive week, the longest consecutive decline since 1923. The Nasdaq 100 index, dominated by technology stocks, also fell for the seventh consecutive week, the longest consecutive decline since 2011.

The key to the rise and fall of the S & P 500 index lies in the Federal Reserve: it offered unprecedented growth protection measures in early 2020 to help the S & P 500 index more than double by the end of last year; Now, with inflation soaring, central bankers are withdrawing stimulus measures, and investors who believe a recession is almost inevitable are selling stocks.

"All this is driven by two factors that have been reiterated this week: inflation and how high it is, and how aggressively the Fed may control it," said art Hogan, chief market strategist at national securities.

Technology stocks were particularly a drag on the market, Apple And Amazon fell for the eighth consecutive week, and Tesla fell for the fourth consecutive week. The sector is under extensive pressure this year. According to S3 partners, technology stocks are the most short selling sector in the U.S. market, nearly one-fifth of all short positions. Especially software stocks.

Optional consumer stocks were the worst performers, down 34% since the S & P 500 hit an all-time high in January. The only sector rising this year is energy, up 42% over the same period.

Retail stocks tumbled

Friday's roller coaster market ended a turbulent week, and consumer stocks that flourished in the bull market finally plunged.

Target Corp. recorded its biggest decline since "Black Monday" in 1987, and Wal Mart suffered a similar fate the day before, as there were signs that soaring inflation was hurting U.S. consumers and eroding profit margins.

"The Fed has been the main driver of the market decline, but the latest news from retailers has increased concerns about the economic outlook," said Adam Phillips, managing director of portfolio strategy at EP wealth advisors. "Now that we have broken the 20% level, the biggest question will be where to go next?"

The S & P 500 index has entered a bear market 17 times since 1929, including this Friday, according to CFRA research. The longest one lasted 998 days (September 1929 to June 1932); The shortest time is only 33 days (February 19, 2020 to March 23, 2020).

According to the CFRA, the bear market has fallen by an average of about 38%, but the bear market has fallen by an average of less than 33% since 1946.

"This is bound to happen because I think bears want to push it over there. And quite a lot of people turn bearish," said Mike Mullaney, head of global market research at Boston partners. "Positions are catching up with popularity."