On May 18, Eastern time, Cisco (csco.us), the founder of the Internet era and a veteran giant in the network equipment industry, released its third quarter financial report of fiscal year 2022. The data showed that the core financial indicators were lower than market expectations, and the company lowered its annual performance guidelines. This period is generally the strongest period of Cisco's performance in a year.

After the announcement of the latest results, Cisco's share price plummeted by nearly 21% in after hours trading that day, the largest drop in its history. As of the next day's normal trading hours, its share price plummeted by 13.73%. Brian Gilmartin, investment manager of Trinity asset management, recently wrote that since Cisco has been unable to compare with the "giant with high performance growth" for more than a decade, few institutional investors have heavily invested in Cisco. Gilmartin believes that the biggest reason for holding Cisco is that as a subject of technology stocks with a median growth scale, the overall increase of the stock is even lower than that of the market, but generally speaking, it can maintain a relatively stable increase during the correction of the market.

However, after Cisco announced its latest performance and future outlook, the defensive wall that "covered the bottom" of Cisco's stock price seems to have been broken. Cisco Q3 performance was lower than market expectations, and Cisco lowered its full year earnings forecast from $3.41 to $3.46 per share to $3.29 to $3.37. Analysts had generally expected the company's full year earnings per share to be $3.44. According to the latest guidelines, the annual revenue growth will be 2-3%, lower than the previous 5.5-6.5% expectation. Looking forward to the fourth quarter of fiscal year 22, Cisco expects its revenue to decline by 1% to 5.5%.

In addition to the latest performance, the trigger for this sell-off may also come from the performance teleconference management's outlook for the future. At the meeting, Goldman Sachs analysts pointed out that product orders were "far below the normal seasonal growth", but Cisco CEO chuck Robbins said that the "seasonal window" may no longer exist. Gilmartin believes that this may be the true situation. He points out that Cisco cannot replicate the annual growth pace of 50% to 100% as in the 1990s. However, since 2010, the average revenue growth of 4% and the average earnings per share growth of 8% should have been maintained. However, the guidelines show that Cisco can no longer achieve this.

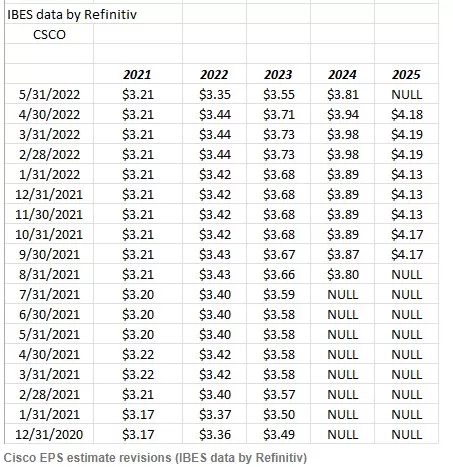

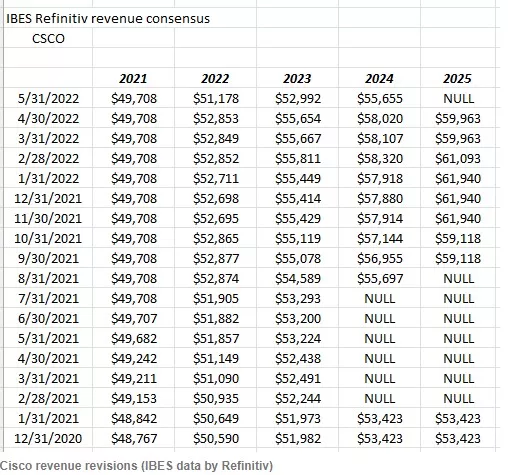

Performance expectations were revised down

It can be seen from the above two tables for statistics of earnings per share (EPS) and revenue expectation that the EPS expectation in 2022 is basically the same as that as of december31,2020. It is worth noting that the expected revenue of 2023 as of May 31, 2022 on the statistical date is even 4.5% lower than that of 2023 as of December 31, 2021.

Repurchase or difficult to support share price

When the US government passed the tax cut and Employment Act (tcja) in december2017, Cisco had $71.5 billion in cash and investment assets on its balance sheet, accounting for 40% of its market value, but today, the figure is about $20billion, accounting for only about 11% of Cisco's market value. From the beginning of 2018 to 2020, a large part of this $71.5 billion will be used for share repurchase.

On the basis of TTM (the last 12 consecutive months), Cisco's average dividend is about $6.1 billion. Gilmartin believes that the cash probability of $20billion in Cisco's account will be returned to shareholders through dividends, so the dividend scale may increase, but he said that this means that the stock repurchase scale may become more conservative.

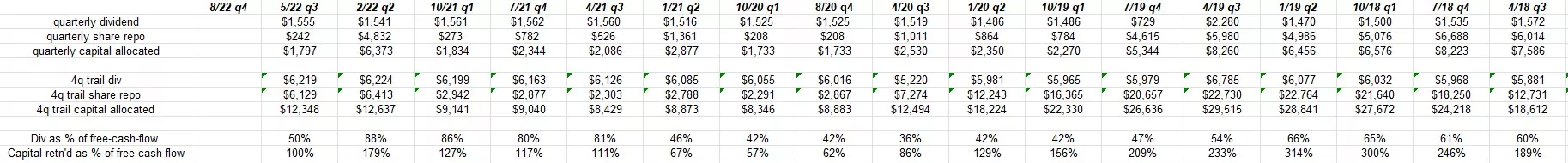

Gilmartin said that if investors are very interested in Cisco's dividend yield, they can track the dividend based on TTM, and then divide the amount by TTM free cash flow. Cisco's dividend may be paid from free cash flow in the future. The figure below shows the percentage of Cisco dividends in free cash flow calculated by Gilmartin.

Gilmartin said that it is estimated that the free cash flow of Cisco TTM will be about US $12.5 billion by the quarter of may2022 (not shown in the table). He also pointed out that the payment ratio cannot be used as a practical indicator to measure the safety of dividends.

"It's time to say goodbye to Cisco"

Gilmartin believes that it is more difficult to improve the return on investment in 2022 than in previous years, but the opportunities often belong to better companies. He believes that it is difficult for Cisco's stock price to recover. Instead of sticking to the stock, it is better to invest in another company with more optimistic long-term growth prospects.

Gilmartin said in the article that for Cisco, in the next few years, the growth prospect of Cisco's revenue will be difficult to improve to a large extent, because the company is still bound by the traditional network business and is struggling with security, new applications and other auxiliary services that have not yet shown an optimistic signal.

He pointed out that the "security or application" business in emerging fields has not seen significant growth, which may prove that Cisco's "future oriented" business seems to be a marginal product in its field. In Michael Porter's "competitive strategy" theory, Cisco now seems to be an "intermediate" enterprise, which often does not have any competitive advantage.

He also mentioned that, in contrast, Amazon (amzn.us), Google (google.us) and Microsoft (msft.us) have achieved large-scale expansion in new technology fields such as AI and cloud computing. At the same time, Cisco has spent a huge amount of shares and funds on acquisitions in the past 15 to 20 years. It seems that no acquisition has had a substantial positive impact on Cisco.

Gilmartin stressed that as the technology industry continued to emerge revolutionary technologies, he had to sell Cisco to find other outstanding technology companies. Gilmartin wrote: "the great Italian tenor Andre Bocelli sang a classic song called 'conte partiro', which means' it's time to say goodbye '. Now, I have to say this to Cisco."