"At present, the Nissan E-power model has a discount of 18000 yuan, and is also free of purchase tax, which is equivalent to saving more than 10000 yuan." "For Versailles, which is popular, there is no other discount except that the purchase tax is halved. However, there are price reduction subsidies in other model stores." "Now, the purchase tax of Haval H6 is reduced by half, and the other half of the 4S store will directly give you cash back."

Following the policy of reducing the purchase tax of some passenger cars by 60billion yuan in stages, the domestic car market has successively introduced the corresponding "overweight" reduction and exemption policies for car purchase preferences, and the 4S stores have also quickly followed up to join this "Carnival" of fuel vehicles.

Cuidongshu, Secretary General of the Federation of passenger cars, said that as a model for people's livelihood, fuel vehicles have a great significance in stimulating consumption and improving the car purchase demand of entry-level consumer groups. "The relaxation of the car purchase tax preference to 2.0L can also benefit the car exchange groups. The car exchange cycle will begin in 2022. If these consumer groups change cars effectively, they can support the incremental market of the car market." Based on this, the passenger Association predicts that the preferential policy of halving the purchase tax will drive an increase of 2million vehicles.

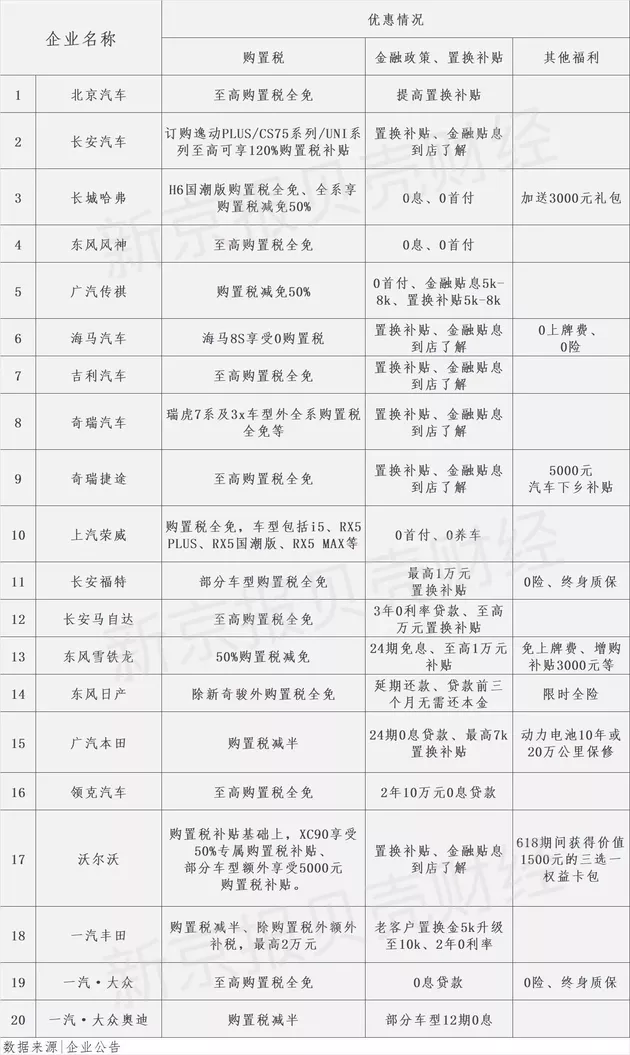

Subsidy tide of automobile enterprises: at least 13 brands are "free of purchase tax"

According to the announcement on reducing the purchase tax on some passenger cars jointly issued by the Ministry of Finance and the State Administration of Taxation, in order to promote automobile consumption and support the development of the automobile industry, the purchase tax on passenger cars with a displacement of 2.0 liters or less whose single vehicle price (excluding value-added tax) does not exceed 300000 yuan during the period from June 1, 2022 to December 31, 2022 will be halved.

The state has implemented unprecedented measures to promote consumption by halving the purchase tax, which has detonated the silent automobile market. Under the stimulation of macro policies, auto enterprises also quickly follow up.

Preferential policies for some brands. Drawing / baihaotian

According to the reporter's statistics, Chang'an automobile was the first to respond. On the basis of the national purchase tax exemption, it launched the "tax-free car purchase Festival" activity, and some models can enjoy the "total purchase tax exemption" or "up to 120% reduction". Geely Automobile launched the preferential policy of "all models enjoy the national purchase tax reduction policy by half, and some models enjoy the purchase tax exemption". Great Wall Haval has launched the purchase tax free preferential policy for its compact SUV Haval H6 national trendy models, and offered 1000 yuan of commercial insurance and other preferential policies for all its models.

Among the joint venture brands, Dongfeng Nissan is the first to launch preferential activities. Except for the new generation of Qijun, all its models can enjoy the purchase tax free activities. In addition, it also provides all risks insurance within a limited time. FAW Volkswagen brand reduced and exempted full purchase tax and commercial insurance subsidies for all models in the whole June.

Among luxury brands, FAW Volkswagen Audi was the first to respond to the policy. Audi q2l, A3, Q3 and A4L models can participate in the purchase tax reduction by half. In addition, even Volvo has introduced preferential subsidies for different models. Among them, even if XC90 is not within the scope of "halving the purchase tax", Volvo has also launched its activity of enjoying 50% exclusive purchase tax subsidy.

According to the statistics of shell finance reporter, as of press time, more than 20 brands, including BAIC motor, Chang'an Automobile and Chery Automobile, had issued preferential policies. Among them, at least 13 brands have launched preferential activities to reduce or subsidize the purchase tax of the other half on the basis of halving the national purchase tax.

During the field visit, most 4S stores of independent brands and joint venture brands also launched some preferential policies.

"At present, this model of b70s is in line with the manufacturer's policy, and the purchase tax is free. It is equivalent to half of the national reduction, and the manufacturer gives the other half of the subsidy." The salesperson of FAW Pentium 4S store said, "after enjoying the purchase tax preference, we need to confirm how much the price can be discounted."

The sales staff of Roewe also revealed that the rx5 plus can be nearly 20000 yuan cheaper with preferential prices and purchase tax. Chang'an auto salesperson said, "cs75 is the most favorable car at present, which can save more than 16000 yuan."

Among the joint-venture brands, the salesperson of FAW Toyota 4S store said, "the discount is almost the same as before, but the state has given the purchase tax reduction policy. At present, there are not many discounts for Asian dragon, corolla and other models."

The salesperson at the LinkedIn 4S store also revealed that the overall discount is not strong. "In fact, there is not much difference between buying a car now and in the past. LinkedIn's price is very transparent. Although there are tax incentives, there are fewer concessions than in the past. For example, LinkedIn 01 used to offer a discount of more than 10000 yuan. Now, even if the purchase tax is completely exempted, the concessions are basically gone." Said the above salesperson.

"Now our Xuanyi offers a discount of 18000 yuan and is free of purchase tax. The previous discount range was not so large, and the situation is very good." Dongfeng Nissan sales said.

However, some netizens reported that some 4S stores began to tighten the incentives for popular models at the same time of the introduction of the policy, so that the actual expenditure of consumers may not be affordable compared with that before the introduction of the policy.

A staff member of the dealer group also said frankly to the reporter, "the current situation is still uncertain. Car companies have introduced tax-free and preferential policies. Leaders are still meeting to discuss the price and profit space."

Experts predict that the annual sales growth is expected to turn from negative to positive

"For passenger cars with a displacement of 2.0 liters or less that does not exceed 300000 yuan, the vehicle purchase tax shall be halved." Following the release of the 60billion yuan purchase tax preference "big gift bag" by the national standing committee, the announcement on the reduction of purchase tax to promote automobile consumption was officially released.

In fact, this is not the first time that the state has reduced the purchase tax of some passenger cars. Previously, China had introduced two rounds of vehicle purchase tax preferential policies in 2009 and 2015, which had played a role in driving sales.

Compared with the previous policies, the purchase tax reduction policy locks the target vehicles at 2.0L and below displacement passenger vehicles of no more than 300000 yuan, directly expanding the scope of tax reduction.

In this regard, Wangdu, Deputy Secretary General of the China Automobile Circulation Association, said that the reason why the tax reduction policy adjusted the emission range from 1.6L to 2.0L was to adapt to the change of automobile consumption demand. It can cover more than 90% of the models in the passenger car market. Independent and joint ventures are fully covered, and imported luxury automobile enterprises are basically covered. In addition to promoting the first purchase demand in the incremental market, it can also promote the consumption upgrading in the stock market. At the same time, it will not adversely affect the existing market structure because of the policy, which will help to maintain the stable development of the automobile market after the end of the policy.

At the same time, "in the proposal for tax reduction submitted by the China Automobile Circulation Association to the government, it is clearly proposed that the target of tax reduction covers all models below 300000 yuan. From the level, it covers almost all middle and low-end models, and even some high-end models with low emission." Zhang Hong, Secretary General of new energy automobile branch of China Automobile Circulation Association, disclosed that the reduction standard of 300000 yuan reflects the principle of fairness and universal benefit to the greatest extent.

According to the insurance data in 2021, there are 16.95 million fuel passenger vehicles with a capacity of 2.0L or less. According to the price distribution calculation, the sales volume of fuel passenger vehicles with a capacity of 2.0L or less and less and less than RMB 300000 is about 16million, accounting for about 92% of the fuel passenger vehicles and 79% of the total sales volume of passenger vehicles.

"The release of the policy will effectively promote the automobile consumption market this year." Zhang Xiang, a distinguished expert of the China Federation of Expo think tanks, said. At the same time, he believes that the policy will be implemented from June 1 to December 31, and may be overdrawn in advance for next year's consumption.

With the recent departments and local governments actively launching the car market stimulus policy, the domestic car market is improving.

According to the latest data of the Federation of passenger cars, from the third week of May, the average daily retail volume of the domestic narrow passenger car market was 42000, a year-on-year decrease of 6% and a month on month increase of 47%; From May 1 to 22, the retail volume of the national passenger car market was 780000 units, a year-on-year decrease of 16%, but the decline was 22 percentage points narrower than that of the previous month, with a month on month increase of 34%. The passenger Federation predicted that the domestic retail sales of narrow passenger cars in May would increase by 26.4% month on month to 1.32 million, a year-on-year decrease of 19.0%.

"This tax reduction policy was issued at the stage of the improvement of the epidemic situation. The timing is accurate and the measures are powerful. It is expected to effectively stimulate consumption, boost the automobile market and change the current market environment where supply and demand are both weak." Wang Du said that with the implementation of preferential policies such as car purchase tax, it is expected that the domestic passenger car market will increase by millions, and the annual sales volume can change from negative to positive year-on-year.