In the past month, after a bull market that has been growing for more than 13 years in a row, US stocks turned around and fell all the way. The collapse caused many people to panic. But for the technology circle, this is just a water stock market. In fact, the undercurrent is surging underwater - the options of unlisted star unicorns have collapsed in the secondary market valuation, and the companies about to be listed may face bloody IPOs. The fund companies that once led the industry are facing huge losses, and the investment banks that injected hot money into the whole industry have also turned their bow to seek self-protection.

Compared with these, the sharp decline in the stock market is just the tip of the iceberg.

Easy money, gone

This week, Softbank said that its investment in technology start-ups would shrink significantly by about 50% - 75% after its investment in technology fell by billions of dollars. Many companies invested by Softbank have felt headache for the next round of financing.

Tiger global, another 21 year old investment bank, has lost $17 billion in the selling of technology stocks this year. This is one of the biggest losses in the history of hedge funds and is definitely worth recording in the history of fund investment failure. According to the financial times, according to the calculation of the hedge fund of Edmond de Rothschild group, the money lost by Tiger Global's hedge fund funds in the past four months is almost two-thirds of their earnings after 2001.

Brad Gerstner of altimeter, an analyst, said hedge funds did not hedge enough against this wave of market volatility.

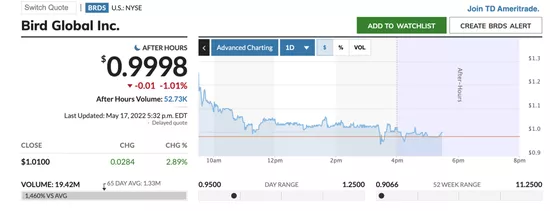

At the same time, Goldman Sachs also made some changes. Due to the increasingly strict regulatory review of SPAC listing in the United States, they are turning around and away from the SPAC market. In addition to regulatory issues, spac listed companies have performed quite poorly in the market in the past period of time. For example, the stock of bird, a scooter company, fell below $1 recently. As of press time, its after hours price is US $0.99. When it was listed six months ago, its first day share price was about $8 / share. If it falls below $1 in a row, the company will have to announce delisting.

Screenshot from MarketWatch

The situation in cryptocurrency may be worse. In addition to the stable currency Luna, the value has fallen to almost zero, and the value of coinbase has fallen by 80%. Even its CEO Brian Armstrong said: if the company has problems and faces bankruptcy, users are likely to be unable to get back their cryptocurrency.

Tough start-ups: no recession equals growth

Of course, investment banks' reduction of investment is bound to bring life and death challenges to downstream start-ups.

If it is said that in the past few years, it is one of the rules for Silicon Valley to obtain growth by burning money, obtain higher valuation, and find more "disk takers", then now, holding tight the money bag and reaching the end with the least money is the new lesson for the CEOs of start-ups.

Now, for start-ups, there is no "easy money". According to protocol, in the future, the financing available to start-ups will be reduced by 70-80% in the short term.

According to the data released by CB insights, global venture capital raised $14.3 billion in 8835 transactions in the first quarter of 2022, down about 20% from the previous quarter.

"Since the beginning of this year, the continuous adjustment of the open market has been affecting the sentiment of the private market." PayPal founder coo David sacks told the media. The most panic is that those investors who have invested in growth companies have not been affected much for the time being.

CrunchBase's data also confirmed his view. Seed round startups raised a total of US $3 billion in April 2022, a year-on-year increase of 14%. However, investment in late stage start-ups fell by 19% year-on-year.

A whole generation of young entrepreneurs and investors have joined the industry in the second half of the bull market that has grown continuously over the past 13 years. Bill Gurley, a benchmark investor, was worried about this in an interview.

"This descent will be surprising and very painful. We are standing on the edge of a cliff." He said.

Some investors compare the current situation to that before the storm in 2000 and 2007. This even reminds people of a warning issued by Sequoia Capital in 2008 - Rip, good day. The low tide life-saving guide for start-ups, which can still be found at present, is still kept in a public document. In that life-saving guide, Sequoia Capital said that the founders would cut costs and spend every dollar on themselves.

Screenshot from Sequoia Capital's official website

Not only is it a warning from investors, such a real example is also happening in the real Silicon Valley.

For example, last month, fast, a one click payment start-up that raised $120 million in investment, told investors that they planned to cut more than half of their jobs and seek sellers to take over the offer. However, as the financing money has been burned out and no one took the offer in the cold winter, the start-up company with a valuation of $11 billion announced the news of complete closure a few days later. Insiders told the media that the reason for the company's closure was to burn money too fast and recruit too many staff.

Too fast expansion means startups have to lay off workers - Cameo has laid off a quarter of its employees, thrasio has laid off a fifth of its employees and on deck has laid off a quarter of its employees in the past month alone.

People in the investment circle told business insider that most of the reason is that the financing funds for private placement are becoming less and less. These companies that burn money too fast find it difficult to obtain the expected financing.

According to the statistics, the total amount of investment in tech crun in the past 12 months is 47 billion dollars, which is the lowest in the past 4 months.

In short, for these companies, the next step is not to rely on huge financing, but to seriously think about how to reschedule their expenditure and find ways to maintain their existing cash reserves for a longer time. Justin Kahl and David George of a16z even released a framework to educate entrepreneurs to save cash and complete future scenario planning. At the same time, they also said that they need to recalculate the current valuation of the company.

In this bad market, many star enterprises have played their best, hoping to accumulate more winter food before the market cools down completely. Some of them choose to postpone the deadline of this round of financing in the financing process.

The latest case is faire. This is an e-commerce company with high growth in the past few years. According to techcrunch, the company recently extended the time limit of its round g financing and raised an additional $416 million, doubling the amount of this round of financing compared with the previous round. Last November, it announced that the amount of round g financing was US $400 million.

However, compared with the substantial increase in the amount of financing, the company's valuation has not changed much - only $200 million more than $12.59 billion when the g-round financing was launched last November. Durable capital partners, D1 Capital Partners and dragoneer investment group participated in this round of financing. The postponement of this round of financing allowed the company to save an additional $400 million when the cold winter came. The total financing figure of this round reached 816 million US dollars.

Such an approach is not the only one in Silicon Valley. More and more companies choose to postpone their completed or ongoing financing rounds to allow more VC to enter.

Unexpected movement of the secondary market

Startups are now facing more than just reduced revenue. Another big problem is the rapid contraction of valuation. In specific areas, when the share price of leading enterprises after listing falls and the market value is halved, it is bound to affect the valuation and market expectation of unlisted companies on the same track. For example, doordash's share price fell from $245 at the end of last year to $65 today, down about 74%. This decline may directly lead to a decline in the valuation of instacart, a similar company in the capital market.

This week, instacart officially submitted its IPO application to the US government. It was originally a happy event for many years, but it was regarded by a large number of people as the last step in a desperate situation - bleeding to market in a market that has fallen sharply.

David summed up the current situation: today's start-ups may not expect to go public. Because at present, the market value correction of such growth companies in the open market (stock market) is becoming more and more serious.

In addition to the possibility of bloody meat cutting in the listing, many unlisted star companies also face an embarrassment - due to the decline in valuation and the discount of their options in the secondary market. For example, unlisted companies such as cameo, thrasio and udacity encountered the dilemma of selling at a discount in the process of trading in the secondary market.

"Overall, it is generally believed that companies financing in 2021 are currently experiencing 40% - 60% discounts," Andrea walne, a partner at Manhattan venture partners, a commercial bank that specializes in buying secondary shares from existing shareholders such as founders and employees, told business insider.

According to CrunchBase, about $329.5 billion poured into start-ups last year, an increase of 92% over 2020. In this process, even the founders of start-ups are worried about overvaluation and rapid growth. But with venture capital suddenly locked up this year, inflation is getting more and more serious, and the economy is generally facing contraction. This situation is getting worse.

A New York secondary market trader told the media that in his opinion, the market has not reached the worst time.

SaaS startups were hardest hit. Karim nurani, CEO of linqto, said that in the secondary market, the option value of many companies of this type has been cut in half. He said that there are three main sources of selling in the secondary market. First, some employees of companies to be listed are selling their outstanding shares. Some may be life needs and some may be panic. They don't want to go public with the company and want to try to stop bleeding in advance to reduce the risk.

Half of this may be due to panic. Some startup employees under the age of 35 have never experienced this market before. They want to sell because they are scared of changes they have never seen.

In addition, some early-stage venture funds are selling their shares, hoping to lock in some profits before prices fall further. Hussein kanji, a partner at Hoxton ventures, an early-stage investment firm in London, said, "as long as we exit at a relatively reasonable price, it's not as profitable as in the bull market, but it's passable."

Finally, large cross-border funds are involved in venture capital. They may face margin calls on publicly traded stock portfolios, so they are selling unlisted shares to raise cash.

"In the secondary market, they contact us every day and let us buy their shares at a 60% discount." An anonymous secondary market trader in New York said. In a bear market, everyone tries to get a better flow of money, so more and more people come to find them every day. "When the stock market fell sharply this month, many people who found us went crazy." He said.

In a word, the money in the market is becoming less and less. In the current situation, crazy growth is no longer the only measure of a start-up company. More importantly, the company wants to achieve its goals, how much time and cost it needs, and whether it can survive the "cold winter".

More and more people began to ask: is it 2018 or 2008?

No one doubts that this is a bad time.