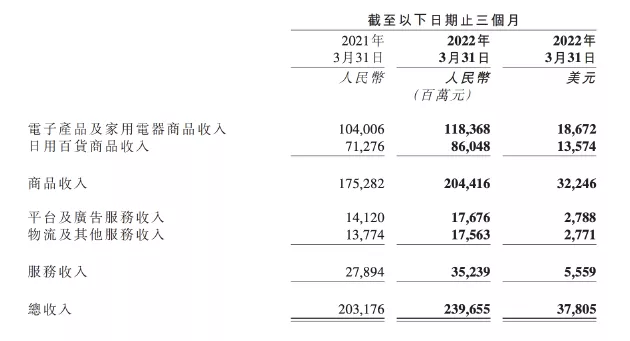

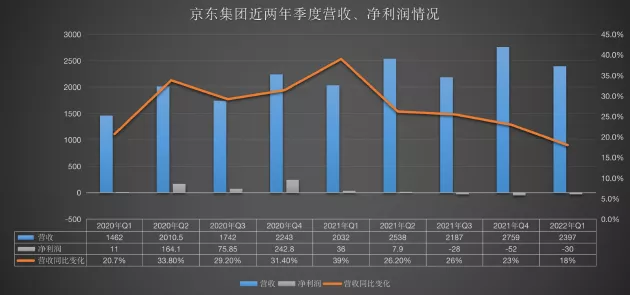

JD group (NASDAQ: JD) took the lead in handing over the first quarterly report. According to the financial report released by JD on May 17, the total revenue of JD in the first quarter of this year was 239.7 billion yuan, an increase of 18% year-on-year, and the market is expected to be 236.7 billion yuan. The operating profit was 2.4 billion yuan, compared with 1.7 billion yuan in the same period last year. The net loss attributable to ordinary shareholders was 3 billion yuan, while the net profit in the same period last year was 3.6 billion yuan.

For the reasons for the loss, JD explained that it was mainly due to the continuous investment in infrastructure, technology research and development, employee compensation and welfare, reducing the impact of the epidemic and transferring profits to consumers. Meanwhile, since JD completed the transaction of subscribing for the ordinary shares issued by dada group in February, dada's revenue was also reported in the first quarter of JD.

As of the closing of US stocks on May 17, JD rose 4.15% to close at US $53.67.

Xu Lei: the epidemic put pressure on the retail business, and the number of order cancellations increased in April

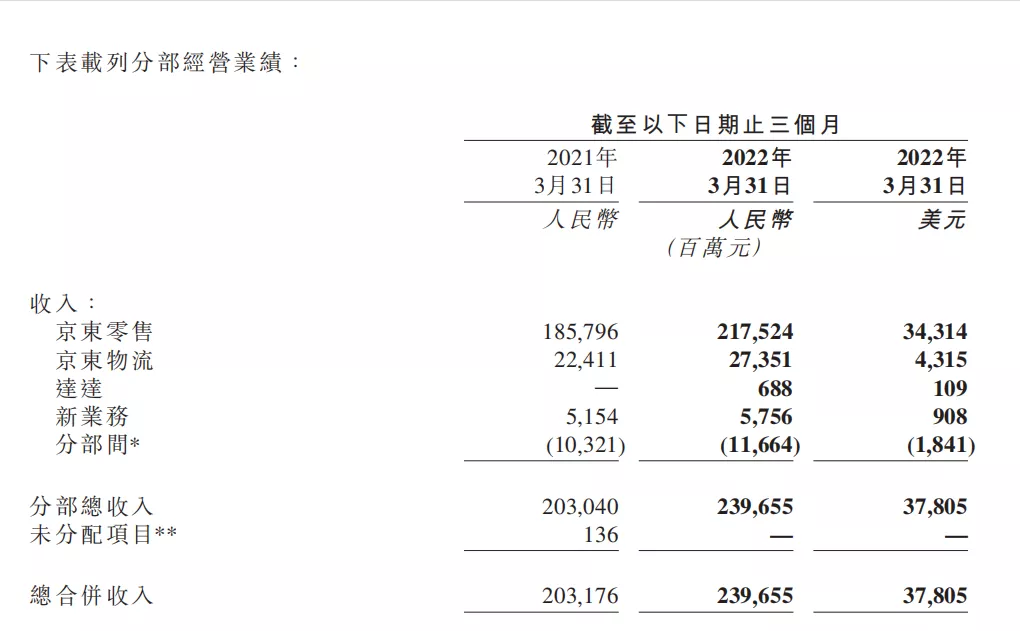

From the breakdown data, JD's total revenue is mainly divided into four parts: retail, logistics, Dada and new business. The financial report shows that under the influence of the epidemic, JD's core business retail is still relatively stable, with a total revenue of 217.524 billion yuan, a year-on-year increase of 17.07%, and its operating profit of 7.891 billion yuan, a year-on-year increase of 7.5%.

In the conference call, JD CEO Xu Lei was also asked about the specific impact of the epidemic. He admitted that the number of order cancellations increased significantly in April and had improved by May. Meanwhile, big cities including Beijing, Shanghai, Guangzhou and Shenzhen were affected by the epidemic, and inventory sales of communication electronics and clothing slowed down.

Xu Lei said that Omicron has a dual impact on online and offline consumption. He believes that the test of the epidemic situation gives JD's supply chain ability and organization and scheduling ability the opportunity to test and iterate. "In the environment of increasing uncertainty under the influence of the epidemic, Jingdong is not only more strictly controlling the investment rhythm and focusing on efficiency, but also better reducing costs and increasing efficiency and resisting the impact of external factors."

For the upcoming 618, Xu Lei said that under the impact of offline consumption, brands and businesses may more actively invest in the online e-commerce shopping festival, which will also improve the performance of the second quarter as much as possible.

It is worth noting that the overall number of active users of JD has increased: the financial report shows that the number of active purchase users of JD in the past 12 months has increased by 16.2% to 580.5 million compared with 499.8 million in the same period in 2021. In particular, the average shopping frequency of users in the first quarter of this year hit a record high, and the average contribution income value (ARPU) of users was close to the highest in three years.

According to the financial report, in addition to the previously mentioned impact of the epidemic and R & D investment, JD's loss in the first quarter was due to other reasons. Some of them were caused by investment losses: JD's investment loss in the first quarter was 1.1 billion yuan calculated by the equity method, and its profit in the same period last year was 700 million yuan. JD said that it was mainly due to the losses of several investees accounted by the shared equity method.

There is also the impact of the merger of dada: other non operating losses in the first quarter were 3.9 billion yuan, compared with a profit of 2 billion yuan in the same period last year. JD said that the loss was mainly due to the recognized loss of 3.6 billion yuan caused by the change in the share price of dada and the change in the fair value of investment securities caused by the market price fluctuation of equity investment of listed companies.

The loss of community group purchase decreased month on month, and the "shutdown and transfer" has been adopted

Another reason for JD's loss comes from new businesses, mainly including community group buying businesses such as Jingxi and Jingxi Pinpin.

The financial report showed that the loss range of the new business sector decreased month on month. An operating loss of 2.39 billion yuan was recorded in the first quarter, compared with 2.28 billion yuan in the same period last year, which was narrowed compared with the huge loss of 3.22 billion yuan in the previous quarter.

"In the first quarter, the operation efficiency of Jingxi Pinpin was improved." Xu Lei said in the teleconference that due to the continuous pressure on user growth since the end of last year, the new business sector will be adjusted in the first quarter, and the projects unfavorable to short-term commercialization will be shut down and transferred. In the future, it will continue to focus on key businesses. Xu ran, CFO of jd.com, also said that jd.com has taken new cost control measures since March.

Earlier, surging news reporters had learned that Jingxi business department had carried out the dismissal and Optimization in some areas, with a proportion of about 10-15%, mainly focusing on Jingxi business.

The loss of JD logistics fell year-on-year, and the order fulfillment rate of JD logistics was basically normal except Shanghai

Jingdong Logistics, another "big spender", performed well this quarter.

According to the financial report, the total revenue of JD logistics in the first quarter was 27.4 billion yuan, a year-on-year increase of 22%, of which the revenue of external customers reached 16 billion yuan, accounting for 58.4%, and the revenue of customers from integrated supply chain reached 17.9 billion yuan; After adjustment, the net loss was 798 million yuan, with a loss of 1.366 billion yuan in the same period last year, a year-on-year decrease of 41.6%.

"Except for Shanghai, the performance rate of JD orders is basically normal." Xu Lei said that in the future, JD will continue to strengthen its supply chain, warehousing, distribution, performance and algorithm capabilities to meet the needs of the macro environment.

As for the role played in Shanghai's anti epidemic, JD logistics said that more than 80000 tons of materials, including rice flour, grain and oil, medicine, mother and baby supplies, have been transported to Shanghai by air, sea, railway and highway; Mobilize more than 4000 front-line employees such as express brothers and sorters across the country to support the operation and material distribution in Shanghai.

Meanwhile, JD logistics also landed more than 1600 contactless community supply stations, deployed more than 100 intelligent express vehicles and dozens of indoor distribution robots to carry out contactless distribution of materials for closed communities, shelter hospitals and other places.

By early May, JD logistics had resumed national logistics for businesses in Shanghai, Jilin and other places, basically realizing full and normal business. The order volume of Shanghai businesses in JD had recovered to more than 60% before the closure of the epidemic. In addition, JD has helped businesses reduce operating costs by reducing "three fees" and other supporting measures. As of early May, JD has reduced fees for settled businesses by more than 200 million yuan.

As of March 31 this year, JD logistics has operated about 1400 warehouses, including the cloud warehouse area managed by JD logistics, with a total storage area of more than 25 million square meters. Compared with the fourth quarter of 2021, JD logistics added 100 warehouses in one quarter, and the total storage area increased by 1 million square meters.