One of the major events in the "cryptocurrency world", which has been the subject of a lot of bad news recently, is the collapse of LUNA coin, a cryptocurrency on Terra. The cryptocurrency, which once had tens of billions of dollars in assets, fell to near zero in a short period of time, leaving countless investors who had gotten into the cryptocurrency with "zero" assets.

This algorithmic stablecoin that caused the 'cryptocurrency earthquake', although it seems quite formal, is actually just an algorithmic game full of 'Ponzi scheme' atmosphere. After it started to de-anchor from the UST stablecoin, there was chaos in the market for the closed, dumped and bottomed ......LUNA coins.

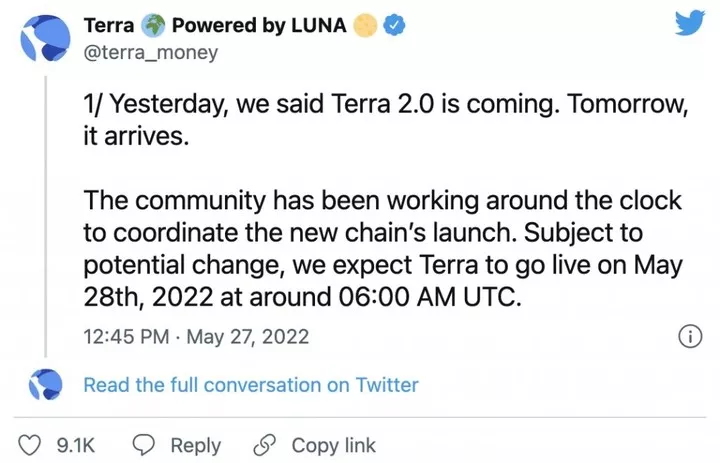

▲Image from: coinmarketcap

Despite a brief price recovery, the cryptocurrency LUNA has not been able to resist the collapse of the cryptocurrency, dropping wildly to less than $1. At today's price of $0.0001683, the LUNA coin that once was can be said to be "running out of steam".

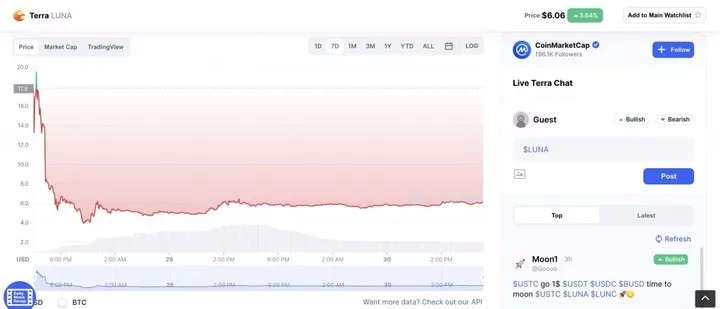

But the company behind Terra, TerraForm Labs and founder Do Kwon, still haven't given up. early May LUNA coins started to crash and in less than a month the new Terra 2.0 went live on May 28, 2022 at 6am UTC.

▲Image from: Twitter

According to Do Kwon's 'revival plan' and his emphasis on the current Terra ecosystem being more important than UST. The original Terra blockchain was split into two chains, the old and the new. Terra 2.0 on the new chain takes the name of the LUNA token but does not take the mechanism previously associated with the UST algorithm stable coin, while the old chain is renamed Terra Classic (with the token changed to LUNC).

▲ Image from: Twitter

In the Terra 2.0 program, new LUNA cryptocurrencies will be "airdropped" to holders of UST and LUNC tokens in order to compensate those holders. The number of new cryptocurrencies to be airdropped varies depending on the number of holdings and the length of time.

▲ Image from: Mashable

Terra has now officially launched its airdrop, and the exchanges that support Terra 2.0 include FTX, Bitfinex, GateIO, Firecoin, Kucoin, Bitrue, Bybit and Binance, but the processing speed of the major exchanges is not consistent at the moment. However, the new coin holders who have received the 'airdrop' are quite 'silent' in their approach and reaction.

▲Image from: Twitter

The opening price of Terra 2.0 peaked at $19.54, but it couldn't stop the rapid decline and the price is now down over 70% and hovering around $6. Some investors who lost money and were airdropped new Terra 2.0 (LUNA coins) also seem to have sold the new coins they received to cover some of their losses, although what they could cover is a drop in the bucket.

▲Image from: coinmarketcap

Prior to the launch of the new coin, the Terra team mentioned on the official Twitter account, "Terra 2.0 brings the same ideals you first fell in love with, world-class UI/UX, our amazing LUNAtic community, and the deep and talented pool of developers who built DeFi."

▲Image from: CoinGape

The shock and fallout from this 'cryptocurrency earthquake' in Terra has yet to fully dissipate, and no matter how you look at it, it doesn't seem like a good time to launch Terra 2.0, judging by the market reaction so far. Although the team still has ambitions, many investors have lost faith in it. Going forward, I wonder how many more people will be able to 'take the bait'.