A financial report called "Waterloo", Tencent showed its fatigue After the closing of Hong Kong stocks on May 18, Beijing time, Tencent Holdings (0700. HK) released the performance report for the first quarter of 2022: in 2022q1, it achieved a revenue of 135.471 billion yuan, flat year-on-year, with zero growth for the first time since its listing; The net profit was 23.413 billion yuan, a year-on-year decrease of 51%; Under non international financial reporting standards, the net profit was 25.545 billion yuan, a year-on-year decrease of 23%, which was the third consecutive quarter of negative year-on-year growth of single quarter net profit after 2021q3 (net profit decreased by 2% year-on-year) and 2021q4 (net profit decreased by 25% year-on-year).

In a word: the cut in net profit and stagnant growth may be Tencent's worst financial report. It is true that when Tencent "elephant turns around", the income structure will inevitably increase construction investment from virtual to real, and the performance will naturally be under pressure in the short term. However, the long-term stability established by Tencent is becoming a "comprehensive war" under the impact of supervision (game, content, financial Technology), epidemic situation and economic situation.

In this regard, Wang Ruchen, a senior media person, believes that Tencent was too stable in the past and established track and mode advantages, but now the challenge is to be tested in all directions and multiple businesses at the same time. "Although the unsealing of the epidemic situation will be stimulated to some extent, the overall challenge faced by Tencent will not change."

Tencent is tired

Throughout 2021, Tencent has been struggling in the turmoil. The fluctuation of its share price continues until 2022. The performance is reflected in the financial report, and it is difficult to hide the decline.

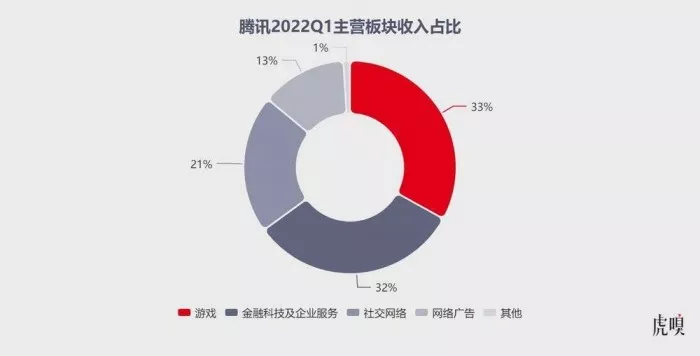

As for the main business, the revenue of Tencent 2022q1 value-added services (including games, videos, etc.) was 72.7 billion yuan, accounting for 54% of the total revenue; The revenue of financial technology and enterprise service sector was 42.77 billion yuan, accounting for 32%; Online advertising revenue was 17.988 billion yuan, accounting for 13%.

First, Tencent's game business "stalled". In 2022q1, the game revenue of Tencent's local market decreased by 1% to 33 billion yuan, while the mobile game revenue, which accounts for a large proportion, decreased by 3% year-on-year. It is true that "pulling the crotch", mainly due to the decline in the game revenue of "Tianya Mingyue swordsman Tour" and "call of duty mobile game" and Tencent's elimination cycle of juvenile protection policies; As for the international market, the game revenue increased by 4% to 10.6 billion yuan, mainly due to the revenue growth brought by games such as valorant and tribal conflict.

Caibao said that during the epidemic period, the game industry was still in a downward trend, and the global game market was affected by the decline of online entertainment after the continuous liberalization of the epidemic. Therefore, Tencent's game business did not perform well in 2022q1, but the "stalled" games once again became the business that supported Tencent's highest proportion of total revenue.

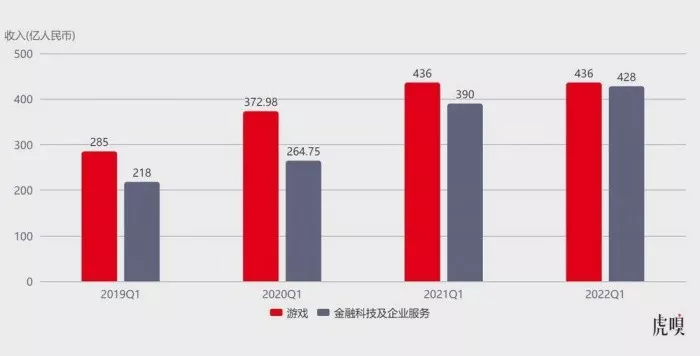

In fact, in the past two years, Tencent has been trying to remove the label of game company and strive to transform to digital economy. At least the revenue structure has continued to change from virtual to real - the proportion of Tencent's total revenue from financial technology and enterprise services has increased to 33% in 2021q4, surpassing the game sector for the first time and becoming Tencent's largest revenue sector. Tencent's first productivity has quietly changed from game business to financial technology and enterprise services business. Unexpectedly, after a short quarter, fintech and enterprise services were overtaken by the game sector.

Secondly, the financial technology and enterprise service sector increased by 10% year-on-year to RMB 42.8 billion. As a new growth engine that Tencent has high hopes, the 10% growth rate is the lowest in the history of the business. Caibao said that mainly affected by the epidemic, the amount of commercial payment transactions and enterprise service income decreased in March this year.

In 2015, Tencent began to lay out the industrial Internet. Since then, even if its short-term performance is under pressure, Tencent still maintains its continuous investment in strategic business and scientific and technological innovation. Especially after the reform of 930 in 2018, Tencent has significantly accelerated the speed of embracing the industrial Internet and gradually cultivated financial technology and enterprise services into a new growth engine of the group. As of April 2022, Tencent has disclosed more than 56000 patent applications in major countries and regions around the world, with more than 26000 patents authorized, of which invention patents account for more than 90%.

Amount of game service revenue and Tencent technology enterprise first disclosure (2019q1 ~ 2029q1)

In fact, this ambition is not difficult to understand - when Tencent has become a link channel running through tens of thousands of enterprises and 10 billion jobs, and supervision focuses more on the promotion and construction of industrial Internet, whether Tencent can build a complete self-research system of the company, including servers, operating systems, chips, SaaS, etc., will largely affect the progress of Tencent's ecological reconstruction and whether it can degenerate into a broad Internet portal.

However, taking Alibaba as an example, at present, ant has been split from Alibaba group. Since Alibaba's financial services have been split, Tencent probably needs to adjust its financial business - especially in the second half of 2021, the continuous deepening of anti-monopoly regulation is forcing Tencent to restructure its investment territory in coordination with its business.

Even, compared with other large Internet companies, Tencent faces a more complex situation. An analyst who has long paid attention to large companies believes that Tencent games, financial technology and other businesses are facing regulatory pressure, and financial technology is not isolated, which will involve the transformation of wechat ecology. "Can Alipay exist independently from Taobao, and can TenPay leave the wechat ecosystem?"

At present, Alibaba's business integration with Tencent and Tencent's business integration with Alibaba are not obvious. However, the above-mentioned people believe that despite the data, there is also the uncertainty brought about by antitrust. "How Tencent's ecology is compatible with competitors is a big problem, at least not too closed. At this stage, some businesses of Alibaba have been opened to wechat payment, but how to be compatible with wechat ecology is not as easy to solve as capital grafting ecology such as Tencent's reduction of holdings, withdrawal from jd.com and meituan."

Finally, the revenue of online advertising business in the first quarter decreased by 18% year-on-year to 18 billion yuan. Caibao said that this is due to the weak advertising demand in education, Internet services, e-commerce and other industries, as well as the impact of regulatory changes in the online advertising industry itself, but the advertising expenditure in the FMCG industry is still stable.

Among them, social and other advertising revenue decreased by 15% to RMB 15.7 billion, mainly due to the impact of regulation and supervision of advertising business of Tencent mobile advertising alliance; Media advertising revenue decreased by 30% to RMB 2.3 billion, and the revenue of media advertising such as Tencent News and Tencent video is continuing to decline.

From 2021 to 2022, affected by the epidemic, the whole Internet online advertising business was impacted to varying degrees. Especially when the whole advertising market is shrinking, resources are increasingly gathering to emerging channels.

For example, the plundering of short video to the whole advertising market - Quest mobile data shows that the proportion of short video information flow advertising increased from 24.6% in the first half of 2020 to 30.8% in the first half of 2021; The annual insight report on China's online advertising in 2021 also shows that more than 50% of advertisers have increased the budget for short video advertising.

In addition, online education, games, finance and other fields have encountered strong supervision, advertising investment has shrunk, and Tencent's cake has naturally decreased again and again.

However, the functional components such as video numbers and applets in the wechat ecosystem have good data - the financial report shows that the daily active accounts of applets exceed 500 million, and on average, more than 200 million users use government services on applets every day; The volume and duration of playing video numbers increased significantly year-on-year, and the revenue of live broadcasting service also increased in the quarter, but most of it was offset by the decrease in the revenue of music live broadcasting and game live broadcasting.

In this regard, CITIC Securities expects that wechat video number will start to realize information flow advertising by the end of 2022. According to the calculation based on the situation of circle of friends advertising and Kwai advertising, video Number advertising is expected to contribute about 37billion yuan of incremental revenue in 2023.

A Hong Kong stock analyst also told Hu olfactory, "from the perspective of financial performance, Tencent is worth looking forward to and the only thing to see in the future is the acceleration of the commercialization of wechat, especially the video number." It can be seen that the market has great confidence in the connection of key sections of wechat ecology, but many people are worried that the accelerated commercialization of wechat may damage the original wechat ecology.

"Warm water" boiled Tencent

As early as two days ago (May 16), Ma Huateng said through the Tencent sustainable social value report 2021 that Tencent is facing a new stage of coexistence of challenges and development. "On the one hand, the growth rate of revenue and profit slows down; on the other hand, Tencent believes that it can take this shift to create higher quality development."

Now, this is not only Tencent's senior management's early statement of the company's transformation and business pain, but also the business has been in a comfortable growth state for a long time. After encountering the rapid changes in the external environment, the management tries to improve the group's anti risk ability and actively "change".

From the perspective of user volume, Tencent is the largest Internet enterprise in China. Social networking is the basic plate of Tencent traffic. The user data of two trump products QQ and wechat have always been mentioned in the financial report.

Let's start with wechat. By the end of the first quarter of 2022, the number of combined monthly living accounts of wechat and wechat was 1.288 billion, a year-on-year increase of 3.8%. On the premise of infinitely close to the upper limit of Chinese Internet users, wechat's basic disk still maintained penetration, and Mau slowly climbed to a new high of 1.288 billion. It can be seen that there is still room for imagination in the prosperous state of wechat.

Followed by QQ, the number of monthly live accounts of QQ mobile terminals was 563.8 million, a year-on-year decrease of 7%. On the one hand, the rapid loss of QQ users is caused by the diversion of wechat and other entertainment products (Tiktok, Kwai and station B); On the other hand, as a social product after 80, 90 and 00, QQ has been floating and sinking in the wave of mobile Internet for 23 years, and it is still in the forefront of top applications. Now with the decline of domestic birth rate, QQ will naturally be affected based on young users.

However, Tencent is still trying to extend the life cycle of QQ. For example, the launch of super qq show and gray scale test "companion" function are all to embrace young people.

From the perspective of profit source, Tencent is the world's largest game company. After the snowball of Tencent games, it has an unshakable market position from R & D to channels, and the whole industry is unparalleled. Therefore, the biggest profit point expected by the market is also the game business. Many investors once regarded Tencent as a "weathervane" of game concept stocks, and the saying "Tencent is to games as Maotai is to Baijiu" came into being.

Throughout Tencent's history, its share price has plummeted six times, four of which are closely related to the game business - respectively, the lack of explosive funds in 2008 combined with the impact of the financial crisis, and Tencent's share price (no resumption of rights) is close to halving; In 2010, the growth of the game industry slowed down, and the high point of Tencent's share price retreated by 30%; In 2015, the proportion of IOS game bestsellers fell, and Tencent's share price retreated again; The issuance of 2018 game edition was suspended, and Tencent's share price nearly halved, which shows the importance of the game business to Tencent.

However, the original God has torn open the defense line of traditional channels and is reshaping the channel pattern. The deeper worry is that Tencent is losing its sense of smell and does not see the essence of the change in the wind direction of the game - Tiandao does not conform to the latest trend, the income of Tianya Mingyue swordsman tour and call of duty tour continues to decline, and the original God and ghost valley are not its own. From this, Tencent invested and increased its holdings of 80 game manufacturers in 2021 alone, which attracted the attention of the whole industry.

Especially since the second half of 2021, with the continuous deepening of the antitrust work of the regulatory authorities, first, the merger of fighting fish and tiger teeth led by Tencent was stopped; Then he was asked to cancel the exclusive copyright of music; Then, the core game business has also ushered in strong supervision. From the restrictions of game live broadcast and game accelerator to the delisting of Tencent's direct Penguin e-sports, Tencent's layout and content control in the game industry have been weakened a little.

As for the market performance of 2022q1 Tencent games, the long-term development of its five novice games to the market, such as bright star path, the phoenix flying in the strategy of Yanxi, xuanzhongji, wolongyin 2 and returning to the Empire, did not meet the expectations; Although there are incremental contributions from "golden shovel war" and "hero League mobile games", but "glory of the king" and "peace elite" have already exceeded the life cycle of other mobile games. Under the long-term operation, Tencent urgently needs new models to drive the growth of the game plate.

The good news is that on April 11, the State Press and Publication Administration approved and issued the latest batch of game version numbers, which "loosened" the eight month old hoop curse binding the game industry; "Apex mobile game" jointly developed by Tencent photon studio group and rebirth studio was officially launched on May 17. Previously, more than 16 million players were pre registered on the official website.

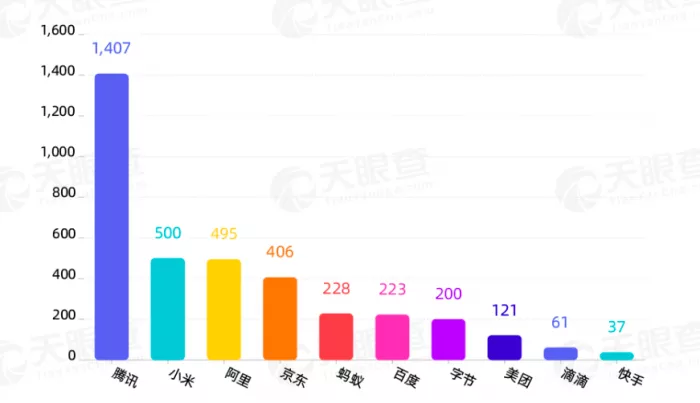

In terms of investment scale, Tencent is also one of the largest CVC (Internet strategic investment) investment institutions in the world. "New fortune" once wrote an article concluding that "through investment and M & A with a scale of 500-600 billion yuan in recent years, Tencent and Alibaba have built an ecosystem with a market value of 10 trillion yuan respectively, which has expanded 10 times in five years. In contrast, the total market value of domestic and foreign listed companies controlled by Shanghai is 2.8 trillion yuan; the total market value of 367 listed companies in Shenzhen is 11 trillion yuan. The capital energy of Tencent and Alibaba can even match that of a first tier city."

Number of domestic CVC investment cases

However, under the rapid change of the external environment, the investment income reflected in the 2022q1 financial report has become one of the reasons that drag down Tencent's net profit. For example, the "net other income" in the financial report decreased by 6.4 billion yuan compared with the same period last year, which was mainly offset by the impairment provision made by several investment companies in the fields of transportation services (didi) and online media; The "share of net losses of associates and joint ventures" was as high as 6.3 billion yuan, compared with a profit of 1.3 billion yuan in the same period last year.

Of course, as an atypical Internet company, Tencent also has its particularity. Wang Ruchen said, "First, related to the track, other peers have a transmission period to respond to the external real economic situation. For example, the 2020q1 epidemic has an impact on the e-commerce field, but Tencent games and social networking benefit from the home economy. After unsealing, the home economy will be weakened, but the advertising load can form a crawler effect internally; second, value-added services, advertising business and deferred income can create a buffer and smooth the overall industry fluctuation; third, wechat The touch power of small programs not only plays an ecological effect, but also has the ability to resist risks. "

To sum up, Tencent can't withstand the impact of multiple factors such as regulation (games, content, financial technology), epidemic, economic situation and weak consumption - and Tencent's current performance can better reflect the complex and diversified external pressure than other Internet companies.