Today, an important acquisition event has taken place in the science and technology circle. Semiconductor giant Broadcom announced that it would acquire VMware, a virtual machine software company, for about US $61billion. If nothing unexpected happens, the purchase price will be second only to the amount Microsoft bought Activision Blizzard at the beginning of the year.

Although this technology acquisition is a big deal, we really don't know the two companies that well

Friends who have played virtual machines may also know what VMware is, but I'm afraid not so many people know where the new God of wealth came from.

But in fact, in the field of science and technology, Broadcom is really a semiconductor company that makes a lot of money with a dull voice .

At ordinary times, there is no mountain or dew. Once you look at the financial report, you will be among the best every year. In 2020, the revenue will even be ahead of NVIDIA and AMD.

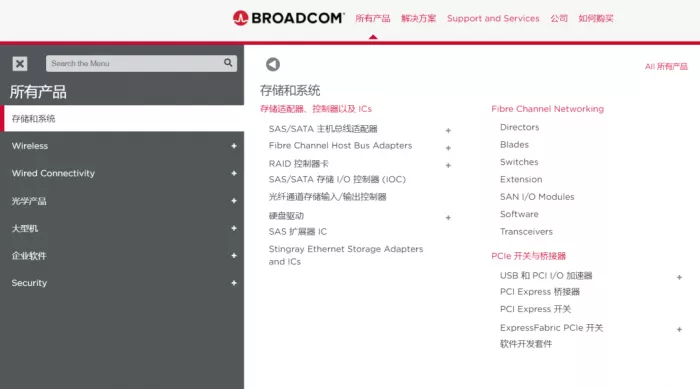

This is not the case with Broadcom playing the pig and eating the tiger . After all, the business they do is not consumer oriented. The chips they mainly produce are the processors of server storage systems and wired / wireless network devices. in the past, the processors of high-end routers were their own**

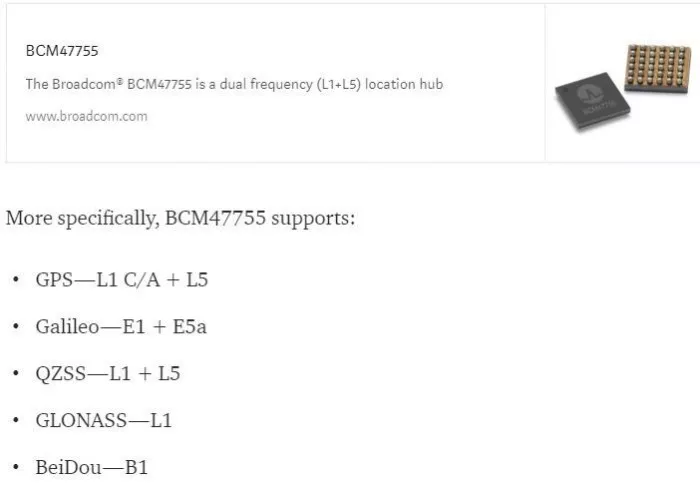

At the same time, they also produce Bluetooth, Wi Fi and GPS chips for PCs, mobile phones and other mobile devices.

For example, on the Xiaomi 8 mobile phone at that time, the dual band GPS function was officially introduced as a selling point. The L1 + L5 dual band positioning components that needed to be used came from the bcm47755 of Broadcom.

If you don't check it or take the mobile phone apart for research, the public's focus must be on the function itself. Few people will care which family owns the parts to realize this function.

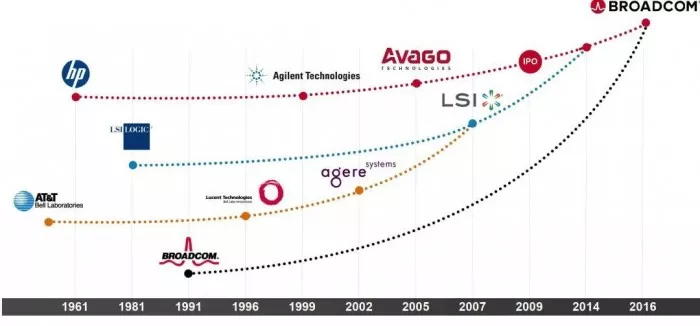

Interestingly, the growth of Broadcom itself did not depend on fame, but on the continuous buy buy merger with the company, which has become what it is today.

The source of all this has to start from the current boss of Broadcom

Tan hock Eeng, the CEO of Broadcom, is actually a semiconductor tycoon who acts like a dragon without seeing the tail.

In particular, compared with the chip industry, Huang Renxun, the son of NVIDIA and suzifeng, the speaker of AMD, who have achieved the same status as him, are too low-key.

In 1953, chenfuyang was born into a poor Chinese family in Penang, Malaysia.

Like all the successful counter attacks, Xiao Chen applied for a MIT scholarship at the age of 18.

It took only four years to get the bachelor's and master's degrees in mechanical engineering

However, he was always more interested in business administration. Not long after that, he went to Harvard Business School for an MBA, which also foreshadowed his future business acquisition.

Although he studied science and engineering, Chen Fuyang's behavior and style are completely a Wall Street elite.

He worked as vice president or president of various well-known semiconductor companies. Soon, in 2006, he joined Anhua high tech in Singapore.

Chenfuyang, who knows both technology and management, knows what the semiconductor industry will face next.

He believes that only through industrial integration can semiconductor companies be well managed, and he plans to start a big show here.

Obviously, the most direct way of industrial integration is acquisition

In 2015, anwarco acquired the world's largest Wi Fi chip manufacturer Broadcom at a price of 37billion US dollars.

After the acquisition, chenfuyang reorganized and merged the two companies and renamed them as Broadcom Co., Ltd. during this period, a wave of changes were made, and 1900 people were "optimized".

After eating Broadcom for 10 months, chenfuyang bought brocade as if it were on the hook, setting off a bloody "acquisition storm" in the industry.

From the network communication chip of Broadcom before the acquisition to the optical fiber switch and storage area network infrastructure of Boke communication, chenfuyang has upgraded the technical advantages in semiconductor high-performance design and integration that Anhua Gao was good at.

Different from the pure technology schools of "Su Ma" and "Lao Huang", chenfuyang carried out technology upgrading by means of acquisition and capital operation, which immediately increased the revenue of Broadcom from US $4.543 billion to US $13.22 billion in one year, jumping to the position of the world's fifth largest semiconductor company.

Next, he aimed his acquisition at Qualcomm

In 2017, Broadcom proposed to acquire Qualcomm at a price of $70 per share, totaling about $130billion.

If it succeeds, the market value of Broadcom will catch up with Intel and Samsung and become the third largest semiconductor enterprise in the world.

For this acquisition, chenfuyang specially went to the White House to meet with Wang, and announced in front of American media and reporters that he would move the headquarters of Broadcom to the United States.

Understand Wang: I know what you are thinking

It's a pity that the bid was not submitted successfully

The two boards of directors agreed, the headquarters of Broadcom has also moved to the United States, and the regulatory authorities have also begun to follow the process.

As a result, on March 12, 2018, Trump gave them a "national security considerations" , and made an emergency stop.

Chuanbao prevented Broadcom from acquiring Qualcomm. ▼

Chen Fuyang, who was just short of the last step, was also quite unwilling. He had already moved the company from Singapore to the United States for Qualcomm, and there was still a "national security problem". I'm afraid Trump was not making a fuss about me.

After the failure to acquire Qualcomm, Chen Fuyang quickly turned his gun and targeted major software companies in the United States.

This time, it was faster. At the end of 2018, Broadcom purchased it management software giant CA technologies with us $19billion.

A year later, it acquired Symantec, the parent company of Norton antivirus software, for its enterprise security business at a price of US $10.7 billion.

Putting aside the irrational drama of "revenge", it is indeed imperative for Broadcom to acquire a software company.

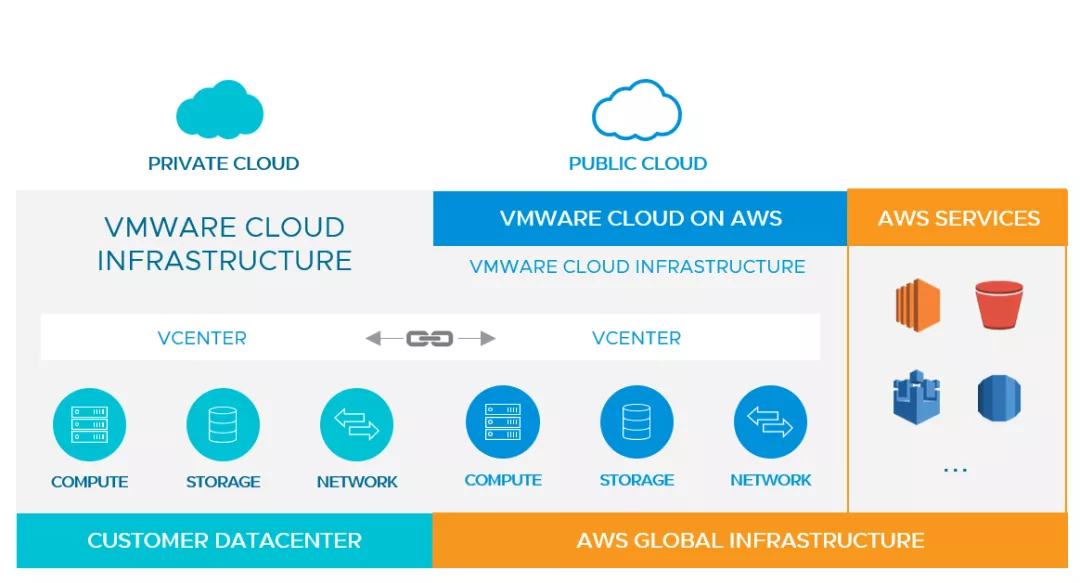

At present, Broadcom has been in the chip industry and has the ability to provide thousands of kinds of products to the market. However, in the current hot cloud computing and data center field, only hardware but not software is obviously inferior in market competitiveness.

After all, no one can guarantee that the chip business will have such a high growth rate in the future. According to chenfuyang's own estimation, the chip business may slow down to about 5% growth in the future.

For example, Microsoft and Google spend money on hardware to sell Apple The "hard and soft" establishment of ecological barriers also belongs to the fact that ropes are left on N trees - not to be hanged on one tree.

Returning to the acquisition of VMware by Broadcom, it is not difficult to understand the purpose of their acquisition. More questions will focus on the value of the $61billion spent.

It is hard to say whether the money is worth it, but at least it is meaningful to Broadcom

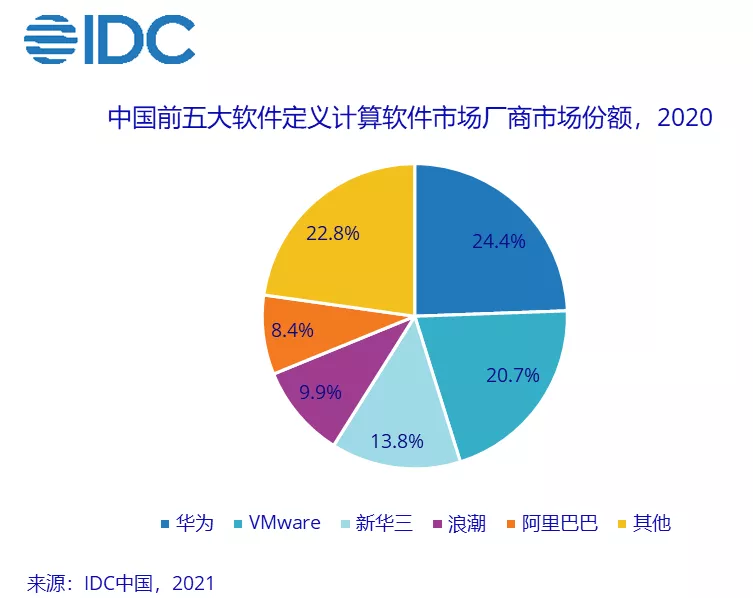

Let's start with the virtual machine business. In 2019, VMware is the world's No. 1 in the cloud system and service management market; In 2020, their market share in China will rank second, which is a little less than that of Huawei**

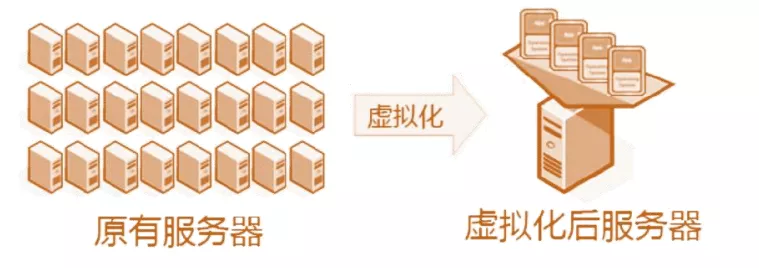

You should know that virtual machines can provide software manufacturers with different test environments, so that they can complete all test projects on one device without switching between different hardware devices.

For example, in the early years of Web front-end development, it was necessary to test the stability of web pages on different versions of IE browsers, but as we all know, one windows Only one version of IE can be installed on the computer.

At this time, the importance of virtual machines is self-evident

But in fact, VMware is more than just helping you hang Android and Linux virtual machines in windows.

VMware has more applications, in fact, it is server-side oriented

Simply put, in order to avoid waste, the cloud service chamber will provide cloud servers to different users, and each user's use environment is also different.

So how can we meet everyone's needs?

Let the server use the virtual machine

In addition, VMware's virtualization technology is also the cloud computing foundation that can dynamically expand performance. If Broadcom wants to go further in the server field in the future, it will inevitably need VMware's technical support.

After purchasing VMware, Broadcom can not only strengthen its original server business, but also pay licensing fees if other manufacturers want to use VMware technology**

Even if there is no room for profit improvement in the chip industry in the future, VMware's core technology team can do other things.

Generally speaking, other technology manufacturers are reluctant to see the deal of Broadcom's acquisition of VMware.

Before the dust settles, this transaction will have to go through rounds of equity negotiations, anti-monopoly investigations, customer exclusivity agreements and other difficulties.

Compared with the previous failure to acquire Qualcomm and the failure of NVIDIA to acquire arm this year, this transaction is still very difficult.