So far, the sharp shock of the stable currency has not affected the US money market, but investors are vigilant about the risk that the problem will spread to key parts of the global financial system. Some stable currencies are backed by assets such as U.S. Treasury bills and corporate short-term notes, a key component of the dollar financing market. There are concerns that if the redemption scale is too large, it may cause problems in these underlying asset markets.

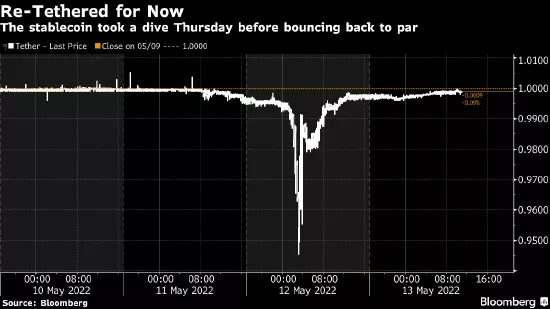

But so far, although the largest stable currency, tether, has fallen below its face value, it does not seem to have caused much spillover impact. Tether is used to facilitate transactions in the cryptocurrency market. Previously, another stable currency, terrausd, collapsed, and cryptocurrency assets also fell sharply.

The pricing of some very short-term treasury bills is obviously misplaced, which may be related to the stable currency. The yield of some securities is inconsistent with the fluctuation of the overall curve. However, except for the overall impact of the recent sharp decline in encrypted assets on the global risk market, there is no sign of widespread spillover effect.

Joseph abate, a strategist at Barclays, believes that only when the redemption scale of tether exceeds half of its total position, it is possible to cause significant pressure in the traditional money market.

One reason is that U.S. Treasury bills may account for the majority in the initial liquidation process, and there is already a balance between supply and demand in these markets, and excess assets should be absorbed relatively easily. He believes that only when the redemption begins to affect tether's commercial paper positions and certificates of deposit can it really have an impact.

"Tether may be forced to sell its position to meet redemption requirements," abate wrote in a report on Thursday. "Money market investors are nervous that if tether is forced to sell commercial paper or certificates of deposit, these normally illiquid markets may freeze as in March 2020."

Although tether fell below par value, abate believes that it is "probably too early to worry about money market assets to some extent".

"If tether needs to sell notes, there is plenty of demand," abate told customers on Thursday. "Only when the redemption ratio of tether exceeds 50% may the traditional money market begin to be under pressure, which may be limited to the small market of lower level commercial paper."