Thank you for the delivery of a large basket of rabbits

Inflation in the United States continued to rise, the highest level in more than 40 years since 1981. For Americans, the biggest problem is the soaring prices of gasoline, groceries and household products, which also leads to the average American family spending nearly $300 more per month. According to the survey data, the average American spends more than this month's budget on the 14th day after his salary is paid.

Inflation in the United States continued to rise. In March 2022, compared with the same period last year, the inflation rate rose by 8.5%, which is the highest level in nearly 40 years since 1981. For Americans, the biggest problem is the soaring prices of gasoline, groceries and household products, which also leads to the average American family spending nearly $300 more per month. Not only that, even with substantial savings in daily expenses, Americans still cannot avoid the embarrassing situation of "Moonlight" after a few days' salary.

Brookings Institution According to a report of the United States, although the data show that the per capita income level has risen, the prices of real estate and stock markets have risen, and the credit card debt has decreased, the situation of Americans has not improved. Couponbirds COM, recently interviewed 3012 office workers from different states and positions, and found out that they spent their monthly budget on the day after they were paid.

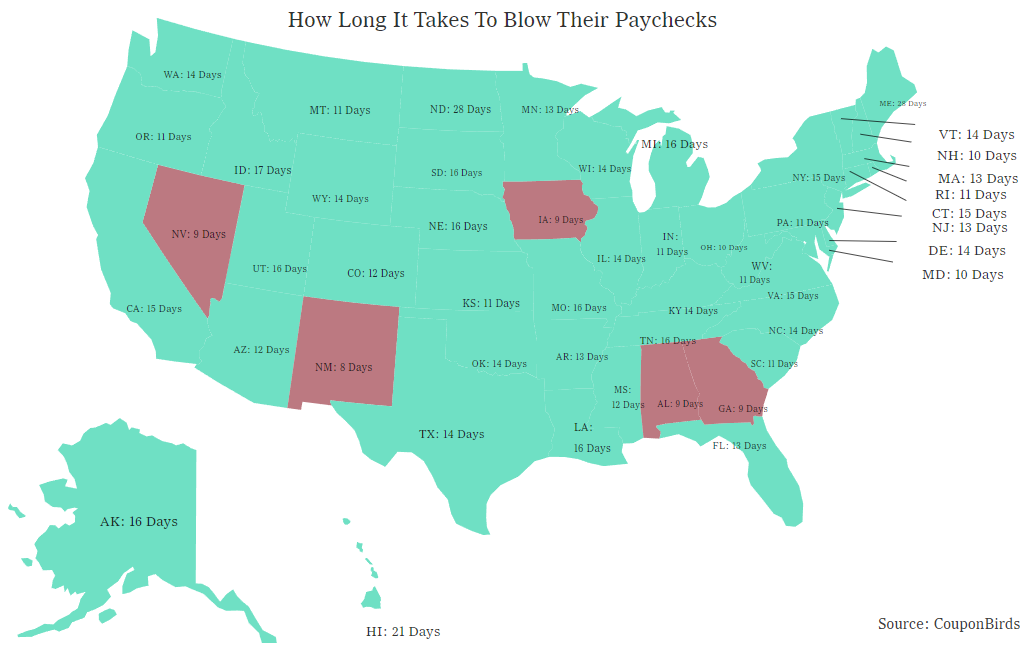

According to couponbirds survey data On average, Americans spend more than this month's budget on the 14th day after their wages are paid, which leads them to either get into financial difficulties and start "eating dirt" in the next half month, or have to use their savings or savings to spend the rest of the month. When we analyze these data across states, we find that people in New Mexico seem to be the fastest spenders after wages. They said they spent all their money in only eight days after they were paid. In contrast, people in Maine and North Dakota seem to have developed the habit of saving money. Respondents in these States say that they basically spend this month's budget 28 days after payday.

Respondents said that if they lost their current jobs, on average, they could only live on their own savings or savings for up to two months, and then these savings would be exhausted. The survey also found that nearly one third (34%) of the respondents often ran out of money before they were paid, so they had to rely on deposits or credit. In fact, more than half (62%) of the respondents said that the financial problems caused by inflation would impose a great psychological burden on them. They did not dare to check their bank statements because they were afraid to see it overdrawn. Everyone said that because of inflation, the things that we could afford last year could no longer be bought this year, and the quality of life has decreased significantly.

In addition, couponbirds Com also analyzed the relevant data of the coupon industry and investigated the changes in the number of online searches for coupon related queries from 2021 to now. For Americans at this time, coupons, discounts and price reductions are all good helpers to help them alleviate inflation anxiety. The data shows that, compared with 2021, the number of online searches related to coupons did increase in the first quarter of 2022. Overall, the number of queries for the word "coupon" increased by 82.35%, and the number of queries for the word "promotion code" increased by 76.47%. When these data changes are further analyzed across states, it is found that the most obvious increase in the number of online searches related to "coupons" is in Montana. Compared with 2021, the number of online searches for "coupons" in Montana increased by 27.27% in 2022, and Vermont ranked second. Their number of searches for "coupons" increased by 26% from 2021 to 2022; North Dakota ranked third, and the number of "coupon" related searches increased by 25.85%.

In terms of daily expenses, Americans at this time need to find ways to save money more than ever, such as spending on basic food such as meat, eggs and milk, and travel necessities such as gasoline. In a word, inflation in the United States continues to rise, and Americans "complain incessantly", but the fact is that frugality can not escape this serious problem. People feel panic when they have no money. This kind of emotion can not be avoided. Therefore, learning to manage money in time, using some money saving tools to reduce expenses, or earning extra income every month, can to a certain extent avoid the panic of lack of money and get rid of the current "Moonlight" dilemma.