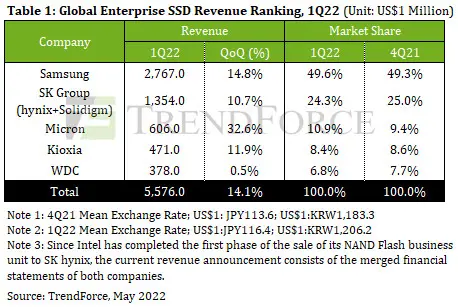

According to the latest research of trendforce, the supply of data center components in the North American market has improved since February this year, driving the recovery of purchase orders. As the server brands gradually returned to normal after the outbreak, the increase in capital expenditure on relevant information equipment also promoted the growth of orders. In addition, kioxia's raw material pollution incident led to the increase in the pricing of some urgent orders, pushed up the overall revenue of enterprise SSD in the first quarter of 2022, reaching US $5.58 billion, a month on month increase of 14.1%**

According to trendforce, Samsung and SK Hynix (including solidigm) are the biggest winners in the first quarter of 2022. At the beginning of this year, the demand for ultra large data centers led to mismatching of components, resulting in high inventory levels, resulting in lower than expected order growth of Samsung. However, due to the impact of WDC and kioxia pollution incidents, the capacity of NAND flash memory was impacted in the first quarter of 2012. Server customers quickly turned to Samsung for additional orders, pushing the company's revenue in the first quarter to reach US $2.77 billion, an increase of 14.8% month on month.

Even in the case of tight supply of control chips (solid state drives), solidigm's bit shipments remained unchanged from the fourth quarter of last year. On the other hand, SK Hynix continued to expand its cooperation with a single customer in North America, driving SK Group's enterprise SSD revenue to grow by 10.7% to US $1.35 billion. The company's main goal this year is to expand SSD shipments, hoping to recover the market share lost due to insufficient supply chain efficiency in the past two years.

The market share of micron, the third largest company, rebounded sharply this quarter, reflecting the company's determination to expand its market share of enterprise solid state drives. Its revenue growth was also the highest in the industry, with a quarterly growth of 32.6% to $606million.

Although Meguiar's main customer is still the server brand, and SATA interface is still its main product, the company's sales of 96 layer PCIe 4.0 solid state drives are also rising, driving the revenue growth in this quarter to exceed that of other competitors.

Trendforce pointed out that Meguiar's PCIe 4.0 products are expected to pass the verification of large-scale data center customers in North America in the third quarter of 22, and begin to increase in volume. However, only by increasing the shipment of mainstream PCIe products can we ensure its future growth momentum.

Kioxia had the opportunity to see a substantial increase in PCIe 4.0 product shipments this year. With the completion of verification in some Chinese customers by the end of 2021, the shipment volume in the Chinese market increased significantly in the first quarter of 22 years. Especially with the follow-up of mass production of PCIe 5.0 SSD in the second half of the year, there will be an opportunity to further expand cooperation with large-scale data center customers. Although the pollution incident affected the confidence of some customers in the cooperative relationship, resulting in the slowdown of enterprise SSD shipments, the number of PCIe interface products still drove the quarterly revenue growth by 11.9%, reaching $471million, ranking the fourth.

In the first quarter of 2022, the fifth ranked Western Digital's enterprise solid state drive revenue was $380million, basically the same as that of the quarter. The competitive strength of its enterprise SSD products is not obvious. Except that PCIe 3.0 products are currently dominant and PCIe 4.0 products will not be shipped until the second half of the year, the supply of SAS products, which were previously dominant, continues to decline.

Given that the mass production plan and production process of the company's PCIe 4.0 products lag behind competitors, it is unlikely that the shipment volume will increase significantly. Unless the development of next-generation PCIe 5.0 products can be accelerated, the company's market share may continue to be eroded.