"Don't put all your eggs in one basket" is the consensus of all business owners and investors. But there are few people who have prepared three baskets as soon as they come up. On May 20, Weilai was listed on the main board of the Singapore Stock Exchange and began trading. The stock code is still "NiO". So far, Weilai has become the world's first auto company listed in New York, Hong Kong and Singapore, and the first Chinese company listed in these three places at the same time.

Author / thoughtful

Li Bin, founder, chairman and CEO of Wellcome, said: "the listing of the company in Singapore is of great significance to Wellcome's global business development plan. We will also take advantage of Singapore's international economic and technology center, carry out in-depth cooperation with local scientific research institutions in Singapore, and establish an artificial intelligence and autonomous driving R & D center in Singapore."

For Wei Lai, who was listed in the United States in 2018 and entered the "pre delisting" list this year, the listing in Singapore is a double insurance after its secondary listing in Hong Kong in March this year. As Li Bin said, the layout of the artificial intelligence and automatic driving R & D center will be established in "lion city". Hu olfactory believes that this is an action worthy of attention.

Familiar and unfamiliar Singapore Stock Exchange

For China concept stocks listed in the United States, the past month has been ups and downs. In early May, the CSRC listed Weilai in the "pre delisting" list. The number of China concept shares added before and after the list has risen to more than 100, of which 23 have entered the "confirmed delisting" list. According to the foreign company Accountability Act passed by the U.S. Congress in 2021, companies listed in the "confirmed delisting list" shall submit documents required by the SEC within three years. If the company in the "delisting list" does not submit or the documents submitted do not meet the requirements of the SEC, it will face delisting risk after the disclosure of the 2023 annual report (i.e. early 2024).

In this regard, enterprises including jd.com, Baidu, Xiaopeng, ideal and Weilai have successively completed the secondary listing in Hong Kong and completed the layout of the future. Several other companies that are not listed are basically going through the process. Weilai is the first one to set up the Singapore capital market after listing in Hong Kong.

In this regard, you Tianyu, managing director of kailian capital and President of the Research Institute, told huolf that in his opinion, the reason why Weilai chose Singapore is more to supplement the consideration of external financing channels based on capital risk. After all, as an Asian financial center, Hong Kong has surpassed Singapore in global influence and financial industry leadership. In terms of the volume, capital scale and business development of listed companies, the Singapore Exchange carries more local and Southeast Asian companies. "In fact, the Singapore Stock Exchange has not been active in issuing new shares in recent years, and some local star companies and technology enterprises in Southeast Asia will give priority to listing in the United States and Hong Kong. After all, the total market value of Hong Kong listed companies is about $6 trillion, nearly 10 times that of the Singapore Stock Exchange.

However, although Singapore's capital market is a little strange to most of us, its developed financial derivatives market is widely known by many domestic investment institutions and even retail investors. In fact, this is also the biggest feature of Singapore's capital market.

"The 'FTSE China A50 Index' listed on the Singapore Stock Exchange and its derivative 'FTSE China A50 Index Futures' are important means for international and even domestic investors to observe and invest in a shares." You Tianyu said to tiger sniff. The index, compiled by FTSE Russell index, includes 50 companies with the largest market value in the A-share market, such as Guizhou Maotai and China Ping An. It was introduced to facilitate foreign investors to enter the A-share market. It is also an important tool to hedge the risk of the A-share market in the world.

In fact, Singapore's capital market is inextricably linked with mainland China and Hong Kong. Recently, some funds have also flowed into Singapore from the latter two places.

However, for many listed companies such as Weilai, the stock pricing will still be based on the main listing place, that is, the place with the largest trading volume. "The local currencies of companies listed abroad, especially Hong Kong and Singapore, are freely convertible with the United States, so the prices are generally unified and the difference is very small." "However, the Singapore stock exchange can facilitate Weilai to rely on bond issuance for financing next. After all, this is the first listed electric vehicle enterprise in Singapore, and banks and investment institutions in Southeast Asia are likely to be interested in it," Yu told huolf.

With the help of Singapore, Weilai layout Web 3.0

Although Singapore has a territorial area of only 728.6 square kilometers, which is slightly less than the sum of Haidian District and Chaoyang District in Beijing, one third of the global Fortune 500 enterprises locate their Asia Pacific headquarters here. At present, the company has set up its Asia Pacific headquarters in Singapore, and Alibaba and Tencent also have a large number of businesses in Southeast Asia and even around the world.

At the same time, Singapore has always spared no effort in the introduction of high-end talents, especially in the field of artificial intelligence. In November 2019, Singapore established an 11 year national AI strategy with a government allocation of S $500 million (about 2.58 billion yuan). It plans to upgrade the national infrastructure through five AI plans by 2030. In fact, as early as may 2017, AI Singapore has been released. According to the second Asia Pacific AI readiness index report released by salesforce, an American cloud software company, Singapore leads 10 other Asia Pacific countries and regions with 65.7 points.

Therefore, Weilai's activity of establishing an artificial intelligence and automatic driving R & D center in Singapore seems logical. More importantly, Singapore, like Beijing, is located in the East eighth District, with no time difference. Moreover, English and Chinese are the official languages of Singapore, and the lower cultural threshold is conducive to the collaborative work of Weilai employees.

However, for Wei Lai, Singapore's auto industry and market are not very helpful. After all, although it has good infrastructure and incentive plans for new energy vehicles, the number of motor vehicles in the country by 2021 is only less than 1 million. In fact, the price of a car's "car ownership certificate" (which can be understood as a car purchase index) in Singapore exceeds S $40000, or about 200000 yuan. More importantly, the valid period of this car ownership certificate is only 10 years. When it expires, the owner can only "renew" it according to the new market price. Otherwise, he can only scrap it or move it to Malaysia for licensing. In the Southeast Asian market where the power infrastructure is weaker and the consumption capacity is far lower than that of Singapore and even China, it is unknown how many weilaichun electric vehicles with an average price of more than 300000 yuan can be sold.

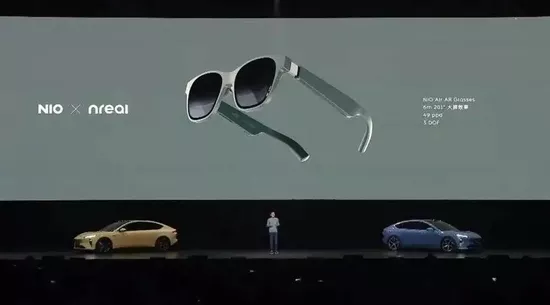

However, compared with the talent market, Singapore's achievements in Web 3.0 seem to be more noteworthy. At present, it is announced that meta, the Facebook parent company of all in metauniverse, has established its Asian data center in Singapore. At the same time, many domestic Web 3.0 talents choose to start businesses in Singapore to obtain a better policy and regulatory environment. For Weilai, which released VR and AR devices at the end of 2021, the layout of Web 3.0 is a logical choice.

Write at the end

Under the current epidemic prevention and control measures in China, a number of domestic car enterprises, including Weilai, have a hard time. In fact, through the congratulatory video on the listing in Singapore, it can be seen that many employees and executives of Weilai in Shanghai, including Li Bin, are still isolated at home.

In terms of market performance, from January to April this year, Weilai automobile delivered 30842 new cars, lagging behind ideal and Xiaopeng automobile. In addition, the financial report shows that in 2021, Weilai achieved an operating revenue of 36.14 billion yuan, including a vehicle revenue of 33.17 billion yuan and a net loss of 4.02 billion yuan, a year-on-year decrease of 24.3%.

For Wei Lai, the listing in Singapore may only be a small footnote in the development process. The long and dangerous journey is still waiting for this new force of Chinese car making.