It's the time for home appliance enterprises to show their muscles once a year. Recently, Haier, Midea and Gree, the three major white power giants, successively released their 2021 financial reports, and their business performance surfaced As the three companies not only belong to the white power industry, but also have been the leader in the industry for many years, and have been catching up with each other in business performance for a long time, the three companies are often compared and evaluated by the outside world, which is also known as the "Three Kingdoms kill" of white power.

(Sina Finance and economics, Zhou Wenmeng)

Editor: Han Dapeng

Key points:

- The white power industry staged a performance "Three Kingdoms kill". In fiscal year 2021, Midea's revenue led, Haier's net profit was the lowest, and Gree's net profit margin was the highest, but there were signs of falling behind.

- It has become a new choice for giants to replace the price war mode of "small profit and quick turnover" with the refined mode of "pushing up and selling fine". However, Haier has yet to break a high-end way, while the other two giants are still lost in high-end.

In the past fiscal year, which of the three giants is better? Whose new business layout is better?

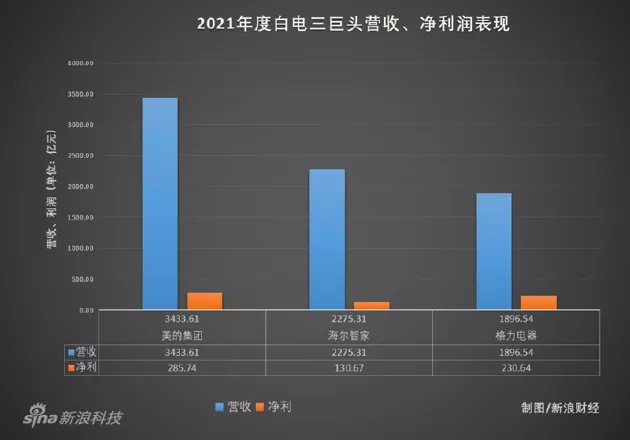

Midea leads in revenue and Haier has the lowest net profit

Haier, ahead of Midea and Gree, first released the 2021 annual report. The annual report shows that Haier Zhijia achieved a total operating revenue of 227.56 billion, a year-on-year increase of 8.5%. After restoring the impact of CAOS business, it increased by 15.8% year-on-year. Then Midea and Gree released their annual reports respectively. In 2021, Midea Group's total revenue was 343.4 billion yuan, a year-on-year increase of 20.2%. Gree Electric Appliance achieved a total operating revenue of 189.654 billion yuan in 2021, with a year-on-year increase of 11.2%.

In terms of net profit, Midea Group achieved a net profit of 29.02 billion yuan in 2021, a year-on-year increase of 5.5%; Haier Zhijia realized a net profit of 13.07 billion yuan, a year-on-year increase of 47.1%; Gree realized a net profit of 23.064 billion yuan, a year-on-year increase of 4%.

In terms of total revenue, Midea Group is far ahead, more than 110 billion yuan higher than the second Haier Zhijia, exceeding 50% of the annual revenue of Haier Zhijia; Nearly twice as high as the third place Gree Electric appliance. Of course, the revenue performance does not represent the overall picture of the enterprise. In terms of net profit, Midea has the highest revenue net profit among the three enterprises. Although Gree has the smallest revenue scale, its net profit reaches 23 billion yuan, nearly 10 billion yuan higher than the third Haier Zhijia.

Only in terms of the single annual financial report in 2021, among the three giants, Midea has the highest revenue scale and net profit, while Gree has the smallest scale, but the highest net profit margin; Although Haier Zhijia is larger than Gree, its net profit margin is at the bottom. If the time is extended to three years, it can be further found that among the three white power giants, the three enterprises have different performance in revenue and net profit growth.

Data show that from 2019 to 2021, Midea Group's revenue increased from 279.4 billion yuan to 343.4 billion yuan, an increase of 23%; Haier Zhijia's revenue increased from 2008 billion yuan to 227.6 billion yuan, an increase of 13%; The revenue of Gree Electric Appliance decreased from 2005 billion yuan to 189.7 billion yuan. In the past three years, Midea and Haier Zhijia both experienced a 10% increase in revenue, while Gree's revenue declined. In terms of net profit attributable to parent company, in 2019 and 2021, the net profit attributable to parent company of Midea Group was 24.2 billion yuan and 28.57 billion yuan respectively; Haier Zhijia's net profit attributable to its parent company was 8.2 billion yuan and 13.07 billion yuan respectively; The net profit attributable to the parent of Gree Electric Appliance in the same period was 24.7 billion yuan and 23.06 billion yuan respectively, which was also in a downward state.

From a medium and long-term perspective, Midea and Haier Zhijia's revenue scale and net profit are growing, but Gree's growth in scale and net profit began to stall and fall behind.

High end has become a "stumbling block" for the development of various companies

Behind the release of financial reports, the changes in the growth rate of revenue and net profit reflect the differentiation trend among the three giants of white power. Of course, in the process of different financial reports, one common feature is that the whole white power industry is slowing down and the situation is getting worse.

On the one hand, with the whole household appliance industry entering the era of stock competition, the window period of rapid development of this industry has gone forever. According to GfK data, in 2021, the average sales of game TVs increased by 57%, TVs with 70 inches and above increased by 49%, smart refrigerators increased by 33% and smart washing machines increased by 71%, while the average sales growth rate of the whole category of consumer electronics market in 2021 was only 11%.

On the other hand, in the past two years, affected by many factors such as rising raw material prices, repeated outbreaks and tightening of real estate, the profit space of the home appliance industry has been greatly squeezed, and the gross profit margin has shown a negative growth trend as a whole.

According to the data of three annual reports, in 2021, the gross profit margin of Midea Group was 22.48%, a year-on-year decrease of 2.63 percentage points; The gross profit margin of Gree Electric Appliance was 24.28%, a year-on-year decrease of 1.86 percentage points; Haier Zhijia was 31.2%, an increase of 1.6 percentage points year-on-year. When the growth rate of giants has slowed down, small and medium-sized players in the industry will become more difficult.

At present, by carrying out high-end transformation and upgrading, it has become a new choice for giants to replace the price war mode of "small profit and quick turnover" with the refined mode of "pushing up and selling fine". However, from the development of each company, in addition to Haier Zhijia, the other two giants still have difficulties in building the company's second growth curve through high-end.

In 2018, Midea officially launched Colmo, a high-end household appliance brand. Four years later, according to Midea's 2021 financial report data, the overall sales of Colmo, which serves high-end intelligent products and elite users, exceeded 4 billion in 2021, with a year-on-year increase of 300%. Although the growth rate is gratifying, the proportion of RMB 4 billion in the total revenue of RMB 343.4 billion is only about 1.1%.

Gree also divided its products into high, medium and low levels, but from the latest financial report, the revenue disclosure of high-end products is not optimistic.

"Under the stock competition, the sale of products in the white electricity industry mainly depends on product upgrading. However, due to the slow technical iteration, small range and high replacement cost of white electricity products, there is little demand for product replacement in this industry, and the high-end market is also affected." Insiders commented that.

(main business composition of Gree)

(main business composition of Midea)

(main business composition of Haier Zhijia)

After diversified business layout, several families are happy and several families are sad

Under the high-end transformation, trying to layout in more and more new fields and carrying out diversified business layout are also becoming the common choice of the three white power giants.

Since 2016, Midea has launched the to B business development strategy by launching the acquisition from KUKA. By 2021, Midea Group has established five business segments: smart home, industrial technology, intelligent building, robot and automation, and digital innovation. According to the financial report, in 2021, Midea Group's consumer electronics business accounted for nearly 40% of the revenue, accounting for 38.64%, while its robot and automation system business scale also gradually increased, accounting for 7.99% of the revenue. In addition, its industrial technology and building technology business revenue were 20.1 billion yuan and 19.7 billion yuan respectively, with a year-on-year increase of 43.5% and 54.8%.

In addition, Gree also continues to accelerate the development of diversification strategy. In addition to ice washing and small household appliances related to household appliances, Gree has also successively entered mobile phones, chip manufacturing, medical treatment, renewable resources, automobiles and other industries. However, it is a pity that so far, the effectiveness of Gree's diversification strategy is not obvious. In the financial report of 2021, Gree air conditioning business accounted for 70% of the total revenue, and domestic appliances, intelligent equipment and other businesses accounted for less than 5%.

Unlike Midea and Gree, which have expanded their diversified business layout to new areas, Haier Zhijia's new business layout focuses more on the home appliance industry. In recent years, Haier Zhijia has been making layout around the whole industrial chain of household appliances and promoting the scene, high-end and ecological transformation of the household appliance industry through digital technology. According to the financial report, in 2021, the revenue of Haier Zhijia high-end brand Casati reached 12.9 billion yuan, a year-on-year increase of more than 40%. Focusing on the smart kitchen scenario, Haier's kitchen electricity business revenue increased by 26.1% year-on-year. In addition, Haier Zhijia has expanded new categories such as clothes dryers and dishwashers, which has also opened a new channel for growth.

Comparing the financial reports of Midea, Haier and gree in 2021, it is found that they are the same three giants of white electricity, but their realizations in terms of revenue volume and net profit acquisition are inconsistent, and they are also leading in the layout of new businesses. However, compared with the growth trend of Midea and Haier Zhijia, Gree's pace is slowing down.