On May 5, SAIC Corporation, the controlling shareholder of SAIC Group, spent 311 million yuan to increase its holdings of 19.035 million a shares of SAIC Group This is only the first step of SAIC's shareholding increase plan. Within six months from May 5, 2022, SAIC plans to increase its shareholding of SAIC Group with its own funds, with an additional shareholding amount of 1.6 billion yuan to 3.2 billion yuan. Before the implementation of this shareholding increase plan, SAIC held shares of SAIC Group, accounting for 67.66% of the total share capital of the company.

In September last year, SAIC just said that it planned to invest 1.6-3 billion to buy back shares in the next 12 months, and the repurchase price would not exceed 28.91 yuan / share. Now, before the repurchase is completed, the controlling shareholders have started to increase their holdings. Recently, SAIC Group has made constant efforts to protect the plate.

When a listed company repurchases shares, the management feels that the company's share price is seriously undervalued and makes a repurchase to increase investor confidence. Since the company announced the repurchase, SAIC Group's share price has indeed rebounded. After the announcement of increasing holdings, SAIC Group also rose by 4 points yesterday. But for a long time, it does not stimulate the stock price. SAIC's share price has fallen from the highest point of 33 yuan in 2018 to 16 yuan today.

In recent years, the concept of new energy vehicles has become popular, and the shares of BYD and great wall have soared all the way. BYD's share price has quadrupled since the beginning of 2020, and Great Wall Motor's share price has also doubled. SAIC Group, known as the largest sales volume of new energy vehicles, why is its share price so unsatisfactory?

01. Sales volume and revenue have declined year after year

According to the annual report data just released in April, SAIC Group achieved a double increase in revenue and net profit in 2021, realizing a revenue of 779.85 billion yuan, a year-on-year increase of 5.1%; The net profit was 24.53 billion yuan, a year-on-year increase of 20.1%.

Let's look at the sales volume. The retail sales of complete vehicle terminals of SAIC Group reached 5.811 million in the whole year, with a year-on-year increase of 5.5%, ranking first in the whole country for 16 consecutive years. Among them, 733000 new energy vehicles were sold, with a year-on-year increase of 128.9%, ranking first in China and third in the world.

On the surface, the growth rate is indeed good, but this is based on the low base affected by the epidemic in 2020. If the data in 2020 are excluded, the revenue and profit will not increase but decrease compared with that before the epidemic. SAIC's revenue in 2021 was lower than that in the same period in 2019, and decreased by nearly 100 billion yuan compared with the same period in 2017.

In terms of net profit, it also did not return to the pre epidemic level. The net profit attributable to the parent company in 2021 is about 1.1 billion less than that in 2019 and 10 billion less than that in 2018 and 2017!

Obviously, SAIC's performance in 2021 seems to have soared, but it has not actually returned to the pre epidemic level, which is far from the peak period of performance and share price in 2018.

But the skinny camel is bigger than the horse. In terms of total revenue, it actually makes more money than BYD; The sales volume of complete vehicles has remained the first in China for 16 consecutive years.

Then why is the share price and market value lower than BYD?

02. Old era of fuel vehicles vs new era of new energy

Different times, different stories.

SAIC is the king of the era of fuel vehicles. It has joint venture brands and independent brands. The joint venture brand is its cash cow. The existence of Volkswagen and GM has made SAIC Group lie and earn for many years. At the same time, the independent brand Roewe has also performed well in recent years.

However, there is no doubt about the general trend of new energy vehicles replacing fuel vehicles: all global automobile manufacturers are working in the direction of new energy vehicles, the new forces of new energy vehicle manufacturing are rising, and BYD has stopped the whole vehicle production of fuel vehicles in March this year.

Fuel vehicles are gradually lonely. New energy vehicles are the future. Who can occupy the highland on the track of new energy vehicles is the king of the future.

The stock market looks at the future. If we can't make achievements in the new era of new energy, the decline of stock price will naturally be unstoppable.

For a long time, the sales volume of SAIC Group mainly depends on SAIC Volkswagen, SAIC GM, SAIC passenger cars and SAIC GM Wuling, and the net profit mainly depends on the two joint ventures of SAIC Volkswagen and SAIC GM.

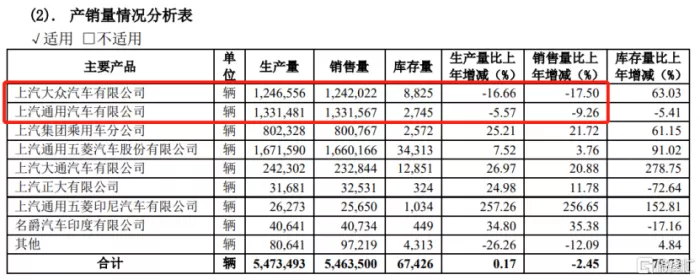

After 2018, the main reason for the decline of the group's performance year by year is also the decline of fuel vehicle sales: the production and sales volume of SAIC Volkswagen and SAIC GM, which contribute the most revenue and profit to SAIC Group, declined to varying degrees in 2019-2021.

In 2021, the sales volume of SAIC Volkswagen decreased by 17.5% year-on-year, and that of SAIC GM decreased by 9% year-on-year.

Of course, the current global shortage of automotive chips is part of the reason for the decline in SAIC's output and sales, but it can not be an excuse. Moreover, there is still uncertainty risk in the recovery of global chip supply, which will continue to have a lasting impact on SAIC.

In 2021, SAIC GM Wuling sold more than 1.66 million vehicles. SAIC GM Wuling has both fuel vehicles and new energy vehicles.

SAIC announced that the sales of 733000 new energy vehicles in 2021, with a year-on-year increase of 128.9%, ranking the first in China and the top three in the world. Most of the first sales were contributed by small new energy vehicles such as Hongguang miniev, Wuling nanoev and kiwi EV under SAIC GM Wuling. Among them, Wuling Hongguang miniev picked the new energy beam alone and sold about 420000 vehicles.

However, SAIC GM Wuling focuses on the low-end market. Wuling Hongguang miniev, the first in sales, sells for only 28800-43600, which means that it sells more but doesn't earn much. According to the data, Wuling Hongguang has known that the cost of parts is 15000-23000 yuan. If you add the expenses of R & D, management and sales, you can know that you can't make much money.

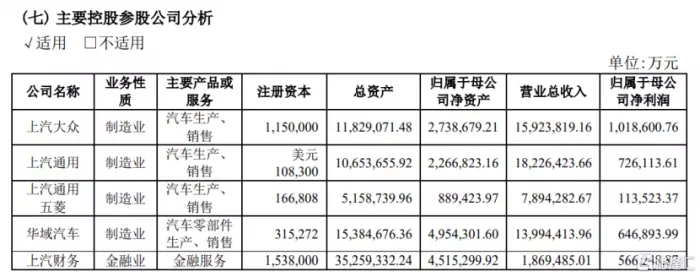

The annual report of SAIC in 2021 also confirmed that it did not make money:

SAIC GM Wuling only contributed 78.9 billion revenue to the group, but the profit was only 1.1 billion yuan; SAIC Volkswagen and SAIC GM contributed more than 17 billion in profits. It can be seen that the performance of SAIC Group is still driven by the two traditional fuel vehicle brands of SAIC Volkswagen and SAIC GM. the sales of new energy vehicles are not worth money, which is in great contrast to the number one sales of SAIC new energy vehicles.

03. Can independent brands be the Savior

In fact, SAIC Group began to enter the new energy vehicle track as early as 2012. SAIC Volkswagen, SAIC GM Wuling, SAIC passenger car and SAIC Maxus all carry out new energy vehicle business.

However, in terms of sales volume, the biggest splash in the new energy vehicle market over the years is the Wuling Hongguang brand, which covers the medium and low-end market.

In the medium and high-end and high-end new energy vehicle market, joint venture brands such as SAIC Volkswagen and independent brands such as Roewe are also trying.

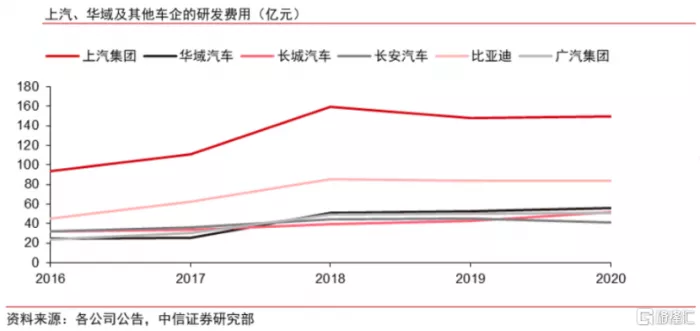

In terms of R & D investment, SAIC's R & D scale ranks first among domestic main engine manufacturers all year round, and its R & D investment reached 19.3 billion yuan in 2021. The money is spent, but SAIC has achieved little in the field of medium and high-end new energy vehicles.

In the face of the general trend of new energy vehicles, it is urgent for SAIC to improve the medium and high-end layout of new energy vehicles and build a new engine for transformation. In fact, SAIC is also accelerating the layout in this regard.

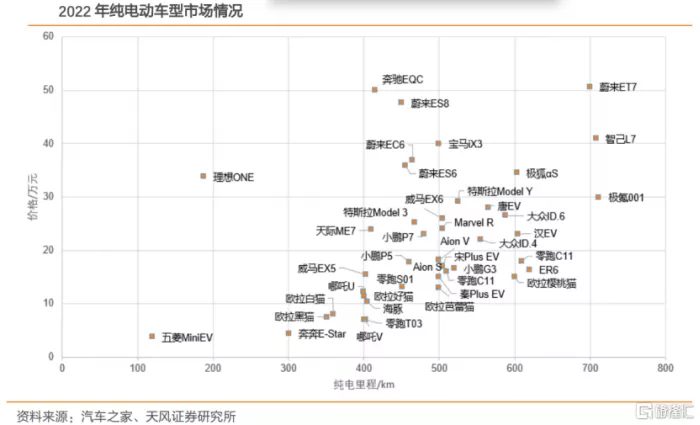

In January 2021, SAIC Group, together with Shanghai Pudong New Area and Alibaba, invested 10 billion to build Zhiji automobile, a high-end intelligent pure electric vehicle project, and has launched the star model Zhiji L7, which is expected to be mass produced this year; Zhiji brand is positioned as high-end + luxury in the market of more than 300000 yuan.

In October 2021, Feifan automobile was established to separate the R brand originally owned by SAIC passenger car branch, and Feifan operated in a market-oriented manner with light assets. Feifan automobile mainly focuses on medium and high-end new energy intelligent models with a price range of 200000-400000. As of March this year, there were 188 Feifan automobile experience centers nationwide.

So far, SAIC has laid out two independent brands "magic weapons" of Zhiji automobile and Feifan automobile in terms of impacting the medium and high-end of new energy.

But SAIC is not the only one speeding up on this track, and its competitors seem to run faster. The middle and high-end market is led by BYD and Tesla. The new forces of car making are coming, and the ideal is not willing to fall behind.

BYD, in particular, went against the current and outperformed the industry in sales in April this year: the sales of new energy passenger vehicles reached 105500, a year-on-year increase of 321.33%, significantly surpassing the market; The cumulative sales volume from January to April has reached 390200 vehicles. If we make more efforts, it is estimated that the sales volume of 59000 vehicles in the first half of last year will be exceeded.

Can the two independent brands, Zhiji and Feifan, help SAIC Group occupy a place in medium and high-end new energy vehicles? It will not be known until the new models are launched as soon as possible.

However, this year's unexpected epidemic in Shanghai has led to limited production. SAIC wanted to rely on Feifan and Zhiji to restore SAIC's reputation in the field of new energy vehicles. It has to be postponed, and I don't know whether it can be realized this year.

However, no matter whether it is successful or not, new energy vehicles are the fortress that SAIC Group must win. Otherwise, the former king may be a hero in the future. In the era of rapid changes in science and technology, there are not a few giants who have been hit on the beach by the waves, such as Kodak and Nokia.

From the investment and trend of SAIC Group's real gold and silver, it is naturally unwilling to be a hero of the past, but although the blue ocean of new energy is vast, it is also crowded, and it is not easy for the giant ship to turn. If SAIC wants to become the overlord of the sea, it needs to increase its horsepower.

The future is difficult and the task is heavy and the road is long.