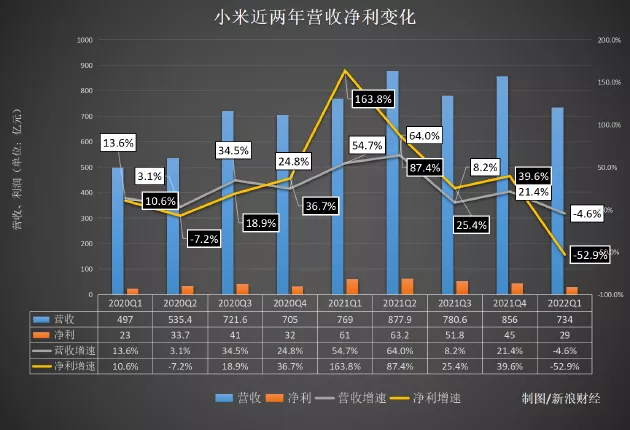

Under the global epidemic, low-end chip shortage and other factors, Xiaomi handed over a less ideal first quarter financial report Data show that the total revenue of Xiaomi in the first quarter of this year was 73.4 billion yuan, a year-on-year decrease of 4.6%; The adjusted net profit was 2.9 billion yuan, a year-on-year decrease of 52.9%.

(sina science and Technology Co., Ltd. Zhang Jun)

Editor: Han Dapeng

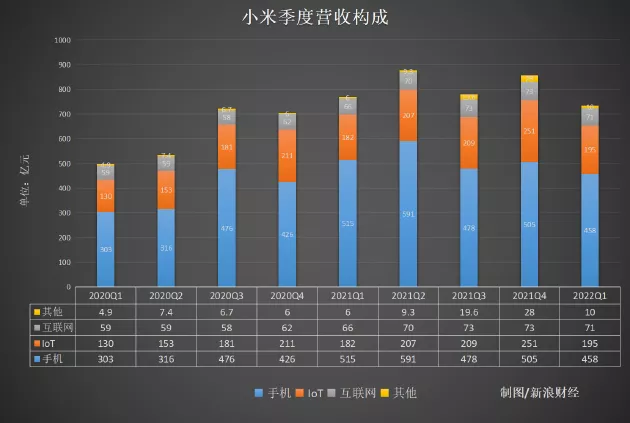

The decline in revenue is directly related to the decline in mobile phone business revenue. In this quarter, Xiaomi's smartphone business revenue decreased by 11.1% to 45.8 billion yuan from 51.5 billion yuan in the same period last year; The decline in profits was mainly related to the changes in the fair value of investment, from a gain of 2.1 billion yuan in the first quarter of 2021 to a loss of 3.6 billion yuan in the first quarter of 2022.

Wang Xiang, President of Xiaomi, said in the financial report teleconference that Xiaomi was affected by the continuous shortage of core parts supply, the repeated COVID-19 and the global macroeconomic environment in the first quarter. It is believed that the serious shortage of chips in the second quarter will gradually improve, but it also depends on the development of the epidemic and the changes of the international situation.

Revenue fell for the first time, dragged down by mobile phone business

It is worth noting that this is the first year-on-year decline in Xiaomi's quarterly revenue since its listing in 2018.

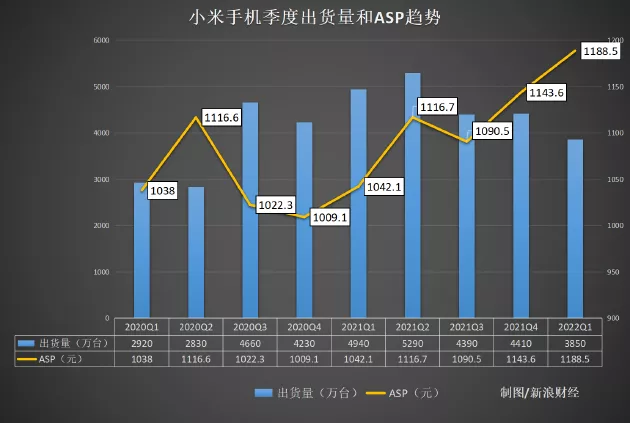

The main reason behind this is the decline in mobile phone shipments and revenue. According to the financial report, in the first quarter of this year, Xiaomi's smartphone business revenue was 45.8 billion yuan, compared with 51.5 billion yuan in the same period last year, a year-on-year decrease of 11.1%; In the first quarter of this year, Xiaomi's global smartphone market shipped 38.5 million units, compared with 49.4 million units in the same period last year, a year-on-year decrease of 22.1%.

The impact of the epidemic and the shortage of chips are the main factors.

Wang Xiang said that the epidemic had a great impact on production and logistics. The closure of offline stores superimposed by the epidemic in Shanghai affected consumers' desire to buy; In addition, the shortage of low-end chips has a great impact on overseas markets such as India and Europe. "The shortage of 4G chips has a negative impact. There is a gap of more than 10 million models under $150 for Xiaomi." He said.

In fact, Xiaomi is not the only one facing these challenges, but the whole mobile phone industry.

According to the data released by canalys, in the first quarter of this year, the global shipment of smart phones was 310 million, a year-on-year decrease of 11%; From a domestic perspective, according to the data of the information and Communications Institute, from January to March this year, the overall shipments of mobile phones in the domestic market totaled 69.346 million, a year-on-year decrease of 29.2%.

There is also good news for the mobile phone business. Although shipments fell, Xiaomi's global smartphone ASP reached 1188.5 yuan in this quarter, a year-on-year increase of 14.1%.

According to the data disclosed by Xiaomi, in the first quarter of this year, driven by the high-end strategy, the global shipments of Xiaomi high-end smartphones priced at 3000 yuan or more in Chinese Mainland and 300 euros or more abroad were nearly 4million; According to third-party data, in the first quarter of this year, Xiaomi ranked first among Android smartphone manufacturers in terms of smartphone market share in the price range of RMB 4000-6000 in Chinese Mainland.

While the revenue of mobile phone business decreased, Xiaomi maintained growth in IOT and Internet business this quarter, which also offset the impact of mobile phone business on the overall performance.

In the first quarter, the revenue of Xiaomi IOT and consumer products reached 19.48 billion yuan, a year-on-year increase of 6.8%; The gross profit margin reached 15.6%, a record high in a single quarter.

In terms of Internet revenue, the revenue in the first quarter reached 7.1 billion yuan, a year-on-year increase of 8.2%; Among them, the overseas Internet business revenue reached 1.6 billion yuan, a year-on-year increase of 71.1%, and the proportion of the overall Internet service revenue continued to increase.

The net profit from changes in fair value of investment decreased significantly

Compared with the year-on-year decrease of 4.6% in revenue, Xiaomi's adjusted net profit in the quarter decreased by 52.9% year-on-year, which attracted more attention from the outside world. After the release of the financial report, it also boarded the hot search.

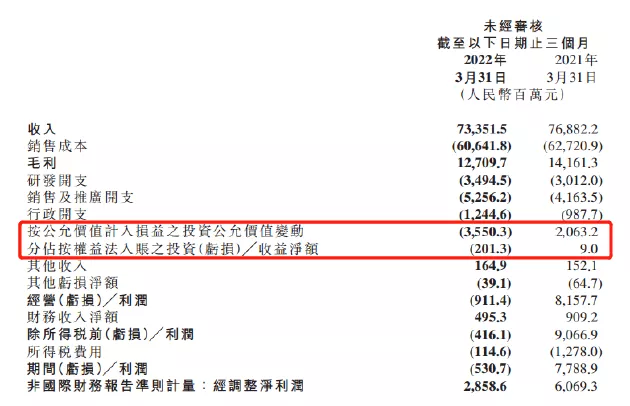

Hu Qimu, chief researcher of Sinosteel Economic Research Institute, said that the main factors affecting the profit of Xiaomi during the period came from the impairment of about 3.6 billion yuan accrued from the change of fair value of investment and the increase of about 1 billion yuan in sales promotion expenses for adjusting the business structure.

According to the financial report, the sales and promotion expenses of Xiaomi increased by 26.2% from 4.2 billion yuan in the first quarter of 2021 to 5.3 billion yuan in the first quarter of 2022, mainly due to the increase of publicity and advertising expenses and the increase of overseas logistics unit costs. Publicity and advertising expenditure increased by 47.9% from 1.1 billion yuan in the first quarter of 2021 to 1.7 billion yuan in the first quarter of 2022, mainly due to the increase in overseas promotion expenditure in the first quarter of 2022.

From the specific structure of sales and promotion expenses, the proportion of mobile phone business decreased, and the proportion of IOT and Internet increased.

In terms of changes in the fair value of investments included in profit or loss at fair value, the financial report shows that the income in the first quarter of 2021 changed from 2.1 billion yuan to 3.6 billion yuan in the first quarter of 2022, mainly due to the fair value loss of listed equity investments in the first quarter of 2022.

According to the financial report, Xiaomi's share of the net investment (loss) / income recorded according to the equity method changed from a net income of 9 million yuan in the first quarter of 2021 to a net loss of 201 million yuan in the first quarter of 2022, mainly due to the losses attributable to several invested companies such as iqiyi and jinshanyun.

Overseas revenue accounts for more than 51%, and the Indian market is facing challenges

According to the financial report, in the first quarter of this year, Xiaomi's overseas market revenue was 37.5 billion yuan, accounting for 51.1% of the total revenue. This is also the manifestation of its strategy of continuously promoting globalization.

According to canalys data, in the first quarter of 2022, according to smartphone shipments, Xiaomi ranked the top three in 49 countries and regions and the top five in 68 countries and regions. Among them, the market share of smart ⼿ machines in Europe is 19.7%, ranking third.

Xiaomi is also promoting the channel construction of overseas operators. In the first quarter of 2022, Xiaomi's smartphone shipments exceeded 5.7 million in overseas markets (excluding India, Sri Lanka, Nepal and Bangladesh), with a year-on-year increase of more than 10%. According to canalys data, Xiaomi ranks among the top three in terms of smartphone shipments among 38 overseas market operator channels.

However, Xiaomi's globalization strategy is also facing challenges due to changes in the international situation.

In the Indian market, according to foreign media reports, Xiaomi was detained by the Indian government for $725 million on suspicion of illegal remittance. Wang Xiang said in the teleconference that Xiaomi is actively responding to the Indian government's investigation of Xiaomi's tax situation. First of all, Xiaomi is a legal and compliant enterprise. All taxes and expenses strictly comply with the laws and regulations of the host country, and all data have been audited by a third party, so there is no problem of violation. "While communicating frankly with relevant parts of India, we also appeal through legal channels. At present, the Indian court has lifted the freezing of US $725 million of Xiaomi's assets. We will continue to maintain frank communication with relevant parties in India and hope to reach a consensus."

Overall, under the unfavorable start of the first quarter, Xiaomi will still face a complex situation in the second quarter.

Hu Qimu believes that from the current situation in Russia and Ukraine and the domestic epidemic, there is no obvious sign of mitigation in the second quarter, so Xiaomi's performance in the second quarter is not expected to rebound. However, the impairment pressure of changes in the fair value of Xiaomi investment in the second quarter may be reduced.

Wang Xiang also said on the conference call that the shortage of low-end chips could be improved in the second half of the second quarter. At the same time, the second quarter also depends on inflation and macroeconomic conditions in order to judge the future.