Shantanu narayen, CEO of adobe (ADBE. US), has been advocating that the company has nearly $5 billion in cash on its balance sheet and said that the company has been looking for opportunities to acquire other companies in the market. "We've been looking for it," narayen said in an interview with Bloomberg on Monday. "Our standard for the target company is to have technology worthy of investment and match our corporate culture; from a financial point of view, it needs to be a good deal for our shareholders."

It is understood that earlier, Adobe acquired frame and acquired workfront Inc. for us $1.5 billion in 2020. The two acquired companies mainly develop tool software for video collaboration. Narayen believes that these transactions "have proved to be correct".

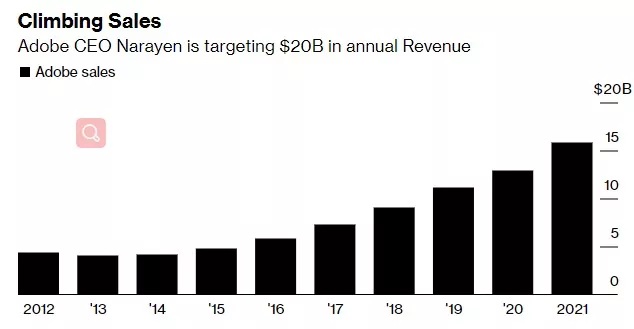

Adobe's target annual revenue this year is $20 billion

Under a series of acquisitions, Adobe has expanded the scale of marketing, analysis and e-commerce products, which narayen expects to stimulate the company to achieve its annual revenue target of $20 billion.

However, although Adobe currently estimates that the value of this market may be as high as $110 billion, it also faces competition from powerful competitors such as CRM. Us and twilio (twlo. US). At the same time, the global economic downturn may reduce enterprises' spending in these areas.

Narayen said that many smaller technology companies will be "impacted" by the current decline in valuation, but this is an opportunity for large companies with diversified businesses such as adobe. "Our balance sheet remains healthy, so we have huge investment opportunities," he said

Adobe, as a leading enterprise in the industry, has suffered a rare decline from investors this year. They are worried that some enterprises will cut spending in the company's business areas, while smaller competitors such as canva Inc. and lightricks Ltd. are grabbing more and more users. Narayen is dismissive of competition. He said: "we are the largest company in this field. We have an incredible number of business types." "We will win the competition because we have created these markets. Therefore, we have a unique vision for the market."

Adobe's share price has fallen about 28% so far this year as software stocks have generally fallen. In March, Adobe said it was adjusting the price of its flagship products, the first major adjustment since 2017.

As of press time, the stock fell 2.15% before trading.