After the US stock market closed on Tuesday, May 3, AMD, a semiconductor "upstart" who has attracted much attention due to the sharp rise of share price in the past few years, released the first quarter financial report of fiscal year 2021. The company's revenue, earnings per share, gross profit margin and revenue of all departments comprehensively exceeded expectations. At the same time, the performance guidelines for the second quarter of this year and the whole year of 2022 were raised, and the after hours share price rose by more than 4%.

Some analysts believe that AMD's profit prospects will more clearly explain the development direction of the chip industry NVIDIA shares also rose 1.7% after hours, Intel After hours fell 0.3%.

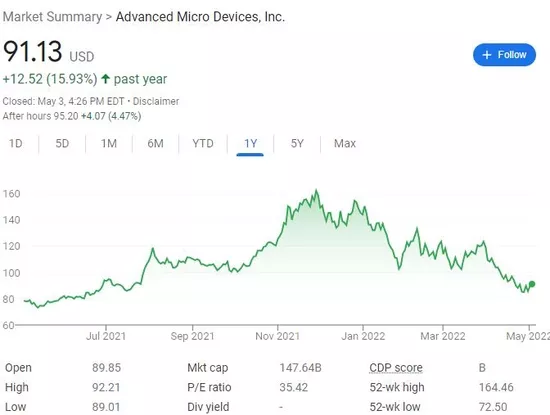

Amd closed up 1.4% on Tuesday, but has fallen nearly 37% this year, outperforming the S & P 500 index by more than 12%, the NASDAQ by nearly 20% and the Philadelphia Semiconductor Index by nearly 23% over the same period. Qqq, the representative of blue chip technology stocks, fell nearly 20% in the same period.

AMD is also in a bear market this year, down more than 44% from the 52 week high of US $164.46 set on November 29 last year, taking back all the gains since late July last year. It rose 57% in 2021, and 2018 and 2019 were the largest component stocks of the S & P 500 for two consecutive years.

However, Wall Street is generally bullish on its performance in the next 12 months. Of the 39 analysts tracked by FactSet, 24 rated "buy", 14 rated "hold", and only one rated "sell". The average target price is $145.20, with 60% room for increase.

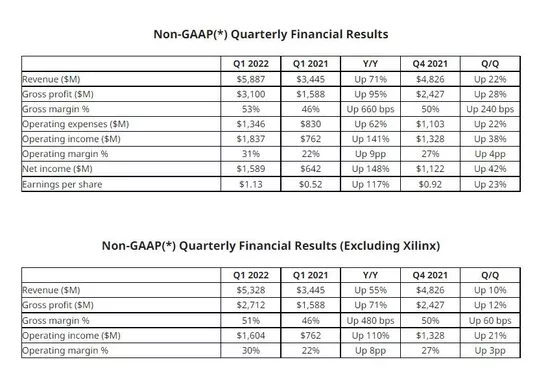

AMD's first quarter revenue, EPS, non GAAP operating profit and net profit, operating cash and free cash flow all reached a record high

AMD's first quarterly report is full of firepower. At present, its revenue and profit have exceeded market expectations in seven quarterly reports.

*The first quarter revenue reached a record high of US $5.9 billion, which was the first time in the company's history that the quarterly revenue exceeded the threshold of US $5 billion *, higher than the expected range of US $5.01-5.5 billion, with a year-on-year increase of 71% and a month on month increase of 22%, thanks to the inclusion of part of the revenue after Xilinx's acquisition.

Even excluding part of Xilinx's revenue, AMD's total revenue in the first quarter also hit a record of $5.3 billion, higher than the range of $4.9 billion to $5.1 billion officially guided by the company. The non GAAP gross profit margin increased to 51% and the non GAAP operating profit margin was 30%.

**The overall adjusted earnings per share was $1.13, a quarterly high in the company's history * *, higher than the market expectation of $0.92, doubled from $0.52 in the first quarter of last year, and increased by nearly 23% month on month from $0.92 in the fourth quarter of last year.

The non GAAP gross profit margin in the quarter was 53%, with a year-on-year increase of 7 percentage points and a month on month increase of 3 percentage points. Thanks to the incorporation of higher server processor revenue and high profit Xilinx revenue, the company originally expected to expand slightly to 50.5% from 50% in the fourth quarter of last year.

Non GAAP operating profit reached a record high of US $1.8 billion, double from US $762 million in the same period last year and US $1.3 billion in the previous quarter. Both year-on-year and month on month growth benefited from higher gross profit. Non GAAP net profit also reached a record high of US $1.6 billion, a year-on-year increase of 149%.

The operating cash was $2.89 billion in the same quarter last year, a record $2.89 billion in the same period last year. Free cash flow was also a record $924 million, up from $832 million in the same period last year and $736 million in the previous quarter.

Amd announced that its board of directors approved a new $8 billion stock repurchase plan, which is an additional supplement to the $4 billion stock repurchase plan announced in 2021.

Dr. Lisa Su, the CEO who has just been elected chairman of AMD, said that the first quarter marked an important turning point in AMD's journey of expansion and Transformation:

"We achieved record revenue and completed the strategic acquisition of Xilinx. Driven by the doubling growth of epyc (Xiaolong) server processor revenue for the third consecutive quarter, each business of the company achieved double-digit significant year-on-year growth. The demand for our leading products remains strong, and the increased annual guidance reflects AMD's higher organic growth rate and growing Xilinx business."

Full opening of firepower: the revenue and operating profit of main business departments reached a new high, raised the guidelines for the second quarter and the whole year, and was better than the market expectation

In terms of business, the first quarter revenue of the computing and graphics division, including desktop and notebook processors, reached a record $2.8 billion, higher than the market expectation of $2.67 billion, an increase of 33% year-on-year and 8% month on month. Driven by the sales of ryzen CPU and radeon graphics card, the average selling price (ASP) of clients increased year-on-year. The operating profit of the Department reached a new high of US $723 million, with a year-on-year increase of 49% and a month on month increase of nearly 28%.

The revenue of enterprises, embedded and semi customized business units including data center and server processors, semi customized system level chips (SOC) and video game console chips also reached a record US $2.5 billion, higher than the market expectation of US $2.35 billion, with a year-on-year increase of 88% and a month on month increase of 13%, which continues to be driven by the sales growth of higher epyc processors and semi customized products. The operating profit of the Department also reached a record high of US $881 million, with a year-on-year increase of 218% and a month on month increase of 15.6%.

*Analysts noted that the revenue of enterprise, embedded and semi customized departments has increased exponentially over the past year and a half, * it was $1.3 billion in the first quarter of 2021 and only $300 million in the first quarter of 2020. Many people predict that this department will surpass the computing and graphics division and become the main source of income of the company in the future.

At present, the revenue of this department accounts for 47.2% of the total revenue of AMD (excluding Xilinx revenue), showing a gradual upward trend, accounting for 43.2% in 2021 and 34.1% in 2020. This sector covers AMD's business areas with chip shortage due to rising demand recently, such as high growth areas such as cars and game consoles.

The financial report also mentioned that Xilinx contributed some quarterly revenue of $559 million and operating profit of $233 million. Based on the full quarter's pro forma, Xilinx generated revenue of more than US $1 billion, with a year-on-year increase of 22%, and all major end market categories increased. All other operating losses of AMD also narrowed to $886 million, compared with $100 million a year ago and $121 million in the previous quarter.

*The company raised the performance guidelines for the second quarter and the whole year of this year, and continued to be better than market expectations *. It is estimated that the revenue in the second quarter is about US $6.5 billion (floating up and down by US $200 million), with a year-on-year increase of about 69%, that is, maintaining a high-speed growth trend, with a month on month increase of about 10%. It is expected to be mainly driven by Xilinx and higher server revenue, and the non GAAP gross profit margin in the second quarter is about 54%. Previously, the market expected revenue of US $6.38 billion.

Amd now expects its annual revenue to be about $26.3 billion in 2022, an increase of about 60% over 2021. Thanks to the addition of Xilinx and higher revenue from servers and semi customization, the previous official guidance increased by about 31%. The non GAAP gross profit margin for the whole year is expected to be about 54%, compared with about 51% in the previous guidelines. The market originally expected the annual revenue to be US $25.15 billion, with an annual gross profit margin of 53.2%.

Pay attention to whether the earnings call will mention the details of the impact of supply chain restrictions. The weak global PC demand in the first quarter of this year is a concern

Multi party analysis pointed out that the main reason why Wall Street is still expected to be optimistic despite the deep decline of AMD's share price in the year before the financial report is that AMD completed the acquisition of Xilinx, the world's largest programmable logic component factory, as scheduled in the first quarter (February 14).

Amd also proudly announced in the financial report that the $35 billion all stock acquisition is the largest in the history of the semiconductor industry. Wall Street generally believes that AMD can not only expand its business to 5g communication and automotive electronics markets to help its customized chip business, but also compete with NVIDIA in the field of data center.

The market focuses on whether the earnings call will provide details of "how supply chain restrictions will affect the company's future business" and the management's comments on the demand of the end market AMD is expected to emphasize the continued strong demand for high-end server chips such as data centers, so as to offset the adverse factors of weak overall demand for personal computers (PCS).

IDC, a market research company, said that in the first quarter of this year, global PC shipments fell by 13% month on month and 5% year-on-year, which was lower than the 3% month on month growth expected by the market. Gartner, another organization, also predicted that global PC shipments fell 6.8% year-on-year in the first quarter, following a 10% increase in 2021. Intel also cited weak consumer PC demand and macroeconomic uncertainty in its second quarter guidance released last week.

As mentioned above, some analysts believe that AMD's profit prospect will more clearly explain the development direction of the chip industry. This is because the performance of the chip sector has been mixed so far. Intel, Texas Instruments, as well as chip equipment manufacturers ram research, KLA and ASML holding, have mentioned that supply chain problems are hindering sales in a high demand environment, although they are optimistic about 2022 as a whole.

Wall Street is optimistic that "2022 is the year of AMD's server chip", and the acquisition of pensando will expand the competitiveness of the data center

The Wall Street consensus expects that at a time when the demand for home PCs is ebbing in the post epidemic era, AMD's data center sales will continue to bring "huge growth momentum" to the company, enabling AMD to continue to seize market share from Intel. Some even joked that the financial reports of AMD and Intel often run counter to each other, that is, AMD's success is based on Intel's fiasco.

However, Christopher Rolland, an analyst at Susquehanna, a securities firm, also noted that Intel released a new H-series alderlake mobile CPU processor on CES earlier this year, which is being sold at a "very competitive price", which may in turn erode AMD's market share in PC chips, but this is not enough to fear, because "2022 is the year of AMD's server (processor)":

"Intel's Sapphire rapids chipset is suffering from performance uncertainty, and early test results are conducive to AMD's Milan chip. Therefore, with AMD gaining the upper hand in server chips, the company is expected to maintain sales momentum throughout the year, and its server chip sales may reach $5 billion or more in 2022, accounting for nearly half of the company's total organic growth prospects."

Raymond James analyst Chris CaSO recently raised AMD's rating from "outperforming the market" to "strong buying", with a target price of $160. He predicted that AMD and NVIDIA would "become a continuous duopoly" in the PC market:

"Given the possibility of slowing consumer demand and rising customer inventory levels, we are increasingly worried about cyclical risks. We prefer semiconductor companies with strong long-term drivers, milder cyclical risks and attractive valuations. Amd seems to be in a favorable position in these aspects, and we are confident in AMD's position and share growth in the data center market."

Vivek Arya, an analyst at Bank of America Securities, also believes that AMD may completely avoid the impact of the decline in PC demand, because most of the adverse factors of PC demand exist in the low-end chromebook product line that AMD does not participate in, and AMD is not as affected by [Apple] as Intel( https://apple.pvxt.net/c/1251234/435400/7639?u=https%3A%2F%2Fwww.apple.com%2Fcn%2Fmusic%2F ) The impact of self-developed chips. It is expected that the analyst day held by AMD on June 9 will give more sales prospects combined with Xilinx.

In addition, Wall Street also continued to pay attention to AMD's announcement in April that it plans to acquire pensando systems, a network and security service provider, for $1.9 billion, which may give amd a competitive advantage in the field of data center. The transaction is expected to be completed in the second quarter of this year.

Amd said in its financial report that pensando's distributed service platform will expand AMD's data center product portfolio through high-performance data center processing unit (DPU) and software stack. These products have been deployed on a large scale in cloud and enterprise customers such as Goldman Sachs, IBM cloud, Microsoft azure and Oracle cloud.