The Dow fell 630.97 points, or 2.01%, to 30761.82; The NASDAQ fell 416.11 points, or 3.67%, to 10923.91; The S & P 500 index fell 113.02 points, or 2.90%, to 3787.84. On Monday, MSCI global stock index fell by more than 20% compared with the closing record level in November 2021. US bond yields soared and the yen almost collapsed. Cryptocurrency was heavily sold off. Bitcoin fell below US $24000 for the first time since december2020, falling nearly 10% within the day.

As investors generally bet that the Federal Reserve may have to raise interest rates more actively to curb inflation, the yield of us two-year Treasury bonds rose 15 basis points to 3.2% on Monday, the highest since 2007. The yield of 10-year US Treasury bonds reached 3.24%, the highest level since october2018.

At a certain point in the trading period, the yield of the two-year Treasury bond was higher than the 10-year yield for the first time since April, that is, the yield curve reversal, which is regarded as an indicator of economic recession, showed that people were worried that the sharp interest rate hike by the Federal Reserve would trigger a hard landing for the economy.

Market sentiment is still dampened by pessimistic economic data. The CPI inflation data for may released by the United States last Friday hit a 40 year high, far exceeding market expectations. To make matters worse, the consumer confidence index hit a record low in June. The pessimistic data strengthened the market's expectation that the Federal Reserve would continue to raise interest rates aggressively and even stop economic growth, raising concerns about the increased risk of US economic recession.

Ed Yardeni, President of Yardeni research, said: "the CPI report in May shows no sign of inflation peaking at all. The report suggests that the Federal Reserve will be more hawkish and the risk of economic recession is higher."

Affected by this, the Dow fell 880 points, the NASDAQ fell more than 3.5% and the S & P 500 fell 2.9% last Friday. Last Wednesday, all major stock indexes recorded large declines. The Dow fell 4.58% in one week, the 10th week of decline in the past 11 weeks. The S & P 500 index fell 5.05% and the NASDAQ fell 5.6%, both of which were the ninth week of decline in the past 10 weeks.

With the rapid rise of consumer prices, concerns about the U.S. economic recession continue to rise. So far this year, the U.S. stock market has been in a difficult situation. By the end of last Friday, the S & P 500 index had fallen 18.2% and was 19.1% lower than the intraday record set in January. The Dow fell 13.6% over the same period. The NASDAQ index fell 27.5% over the same period, 30% lower than the historical high set in November last year, and has long been trapped in a bear market.

If the S & P 500 index closes below 3837.25 on Monday, it means that it is down 20% from its historical high set on January 3, which is technically a bear market.

Goldman Sachs warned that if the recession comes, the S & P 500 index will fall to 3150 points, which means it is expected to continue to fall by 19% compared with the current level.

The focus of the market this week is the upcoming Federal Reserve monetary policy meeting. The Federal Reserve will hold a two-day monetary policy meeting on Tuesday and Wednesday. At 2:00 p.m. EST on Wednesday, the Federal Reserve will release its interest rate resolution, policy statement and quarterly economic forecast (SEP). At 2:30, Federal Reserve Chairman Powell will hold a press conference.

Traders currently predict that the Federal Reserve will raise interest rates by 175 basis points before September, which means two interest rate hikes of 0.5 basis points and one interest rate hike of 75 basis points. If it meets expectations, this will be the first time the Federal Reserve has taken such drastic measures since 1994.

Goldman Sachs economists predict that if the Federal Reserve raises interest rates by 50 basis points in June, it will also raise interest rates by 50 basis points at the September meeting. With this in mind, David kostin, chief stock strategist of Goldman Sachs, warned that the US stock market is far from bottoming out.

Barclays economists said that the US inflation data may be at an alarming high level, which means that the Federal Reserve is very likely to raise interest rates by 75 basis points this week, rather than 50 basis points.

Focus stocks

Affected by the decline of cryptocurrency, blockchain concept stocks generally fell.

Oil stocks fell sharply.

Wolfspeed, maywell technology, NVIDIA, Italy France semiconductor, AMD, NXP, microchip technology, Globalfoundries, Texas Instruments and other semiconductor sectors fell.

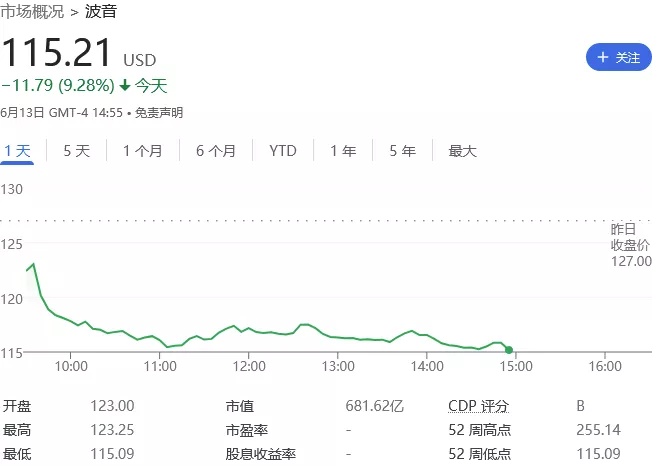

Boeing shares fell. It is reported that Boeing decided to suspend the production of its popular Boeing 737max aircraft due to a shortage of titanium. The main reason why Boeing suspended the production of 737max aircraft may be that Europe and the United States imposed restrictions on Russia, and the important production raw material titanium of this American aircraft manufacturer mainly comes from Russia.

Like Boeing, the European aviation giant Airbus is looking for alternative sources of titanium other than Russia. About 50% of Airbus' titanium comes from Russia.

NVIDIA may postpone the release of new graphics cards.

Astra space shares tumbled. The rocket launch mission failed and NASA meteorological satellite was lost.

American Rocket Company Astra space shares fell. Because the second stage booster engine was shut down early in space, the company failed to send a small weather monitoring satellite for NASA.

Goldman Sachs shares fell. It is reported that the company is facing an investigation by the US Securities and Exchange Commission (SEC) to determine whether the four ESG (environmental, social and Governance) funds of the group have violated the standards promised in the marketing materials.

Robinhood Securities shares fell. SEC plans to reform US stock market maker trading rules.

Goldman Sachs downgraded Netflix to "sell".

French vaccine maker valneva shares fell. The company's contract with the European Union for COVID-19 vaccine is at risk.

Five below's performance was not as good as expected, and several institutions lowered their target prices.

Daily Youxian, Jianan technology, tiger securities, Zhihu, pinduoduo, vipshop, shell, futu, tal and other popular Chinese stocks fell before the market.

It is reported that due to the equipment procurement problem, TSMC may not be able to increase its output at the rate previously expected in 2023 and 2024. At present, TSMC is trying to solve the problem.

In other markets, European stocks closed lower on Monday, with Germany's DAX index down 2.43%, France's CAC40 index down 2.67% and Britain's FTSE 100 index down 1.53%. The European Stoxx 600 index closed at its lowest level since march2021.