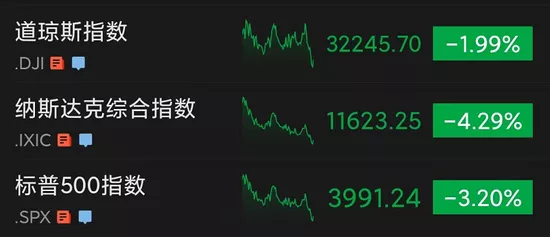

On May 9 local time, the three major indexes of US stocks fell across the board. As of the close, the Dow fell 1.99%, the NASDAQ fell 4.29% and the S & P 500 index fell 3.20%. After rising for three consecutive days in early May, the main indexes of US stocks experienced three consecutive declines and continued to refresh their recent lows. Over the past three trading days, the market value of the seven major technology giants in US stocks has evaporated by more than $1 trillion.

The market value of technology giants has evaporated by more than trillion US dollars

On the same day, the three major indexes of US stocks all fell by more than 1% at the opening, and the intraday decline further expanded.

As of the close, the Dow Jones index closed at 32245.70 points, down 653.67 points, or 1.99%; The Nasdaq composite index closed at 11623.25 Points, down 4.29%, the lowest closing price since November 10, 2020; The S & P 500 index fell below 4000 points to close at 3991.24, down 3.2%, the lowest since March 2021.

On the disk, the consumer sector performed relatively well, with 3M and Wal Mart up more than 1% and home depot up 0.92%; Food companies led the gains, with Campbell soup up 3.46%, general mills and Tyson food up more than 2%, and kraft Heinz up 1.38%.

Large tech stocks fell, Tesla and NVIDIA fell more than 9%, Amazon fell 5.21%, Apple , Microsoft and Facebook parent company meta fell more than 3% and Google fell 2.8%. Over the past three trading days, the market value of the seven technology giants has evaporated more than $1 trillion (equivalent to about 7 trillion yuan).

Popular Chinese stocks led the decline, with the NASDAQ China Jinlong index down 7.79%; Xiaopeng automobile fell 10.05%, Weilai and ideal automobile fell more than 9%, JD, pinduoduo and Baidu fell more than 8%, Alibaba fell 5.79% and Netease fell 4.4%.

In the commodity market, gold futures recorded a decline. The June gold futures price, which was the most actively traded in the gold futures market of the New York Mercantile Exchange, fell $24.2 from the previous trading day to close at $1858.6 an ounce, down 1.29%.

The decline of international oil prices was more obvious. The futures price of light crude oil delivered in June on the New York Mercantile Exchange fell by 6.68 US dollars to close at 103.09 US dollars a barrel, a decrease of 6.09%; London Brent crude oil futures for July delivery fell $6.45, or 5.74%, to $105.94 a barrel. Energy sector stocks fell sharply, with western Petroleum down 10.93%, ConocoPhillips down 9.74%, ExxonMobil down 7.89%, Chevron down 6.7% and shell down 5.81%.

The yield of us 10-year Treasury bonds exceeded 3.2% in the session, hitting the highest point since November 2018; Although there was a drop in the late trading, it was still above 3%.

Jeff kilburg, chief investment officer of sanctuary wealth, said that the current market performance is a major asset repricing and a serious imbalance, which is stimulated and promoted by the Fed's policies. The only way for the stock market to bottom out and recover in the short term is whether the Fed can use the tools in its toolbox to stabilize interest rates. Us 10-year Treasury yields need to return below 3%.

DBS report pointed out that based on the monetary tightening policy and seasonal economic slowdown, it may have a short-term impact on investment sentiment, but investors in the medium and long term should seize the opportunity of valuation correction. It is suggested to increase the holdings of industries with long-term growth prospects, and select high-quality enterprises with stable profit growth, stable cash flow and low leverage; Increase the holdings of dividend paying assets to counter the risks brought by inflation and the resulting negative real interest rate.

Bitcoin once plummeted by more than 10%

In response to inflation, the Federal Reserve announced on May 4 that it decided to raise the federal funds rate to the range of 0.75% - 1.00%, the first significant interest rate increase of 50 basis points since 2000; Since June, the scale has been reduced at the pace of US $47.5 billion per month, and the upper limit of scale reduction has been gradually increased to US $95 billion per month within three months. After US Federal Reserve Chairman Powell said that he would not consider raising interest rates by 75 basis points for the time being, US stocks recorded a sharp rise on the same day, but since then, investors began to worry that it might be difficult for the US Federal Reserve to control inflation and avoid the economy falling into recession, and the decline of US stocks has continued to this day.

Kristina Hooper, chief global market strategist of INVESCO group, believes that the market is digesting the Fed's monetary policy that is beginning to return to normal, and radical interest rate hikes will make the prospect of recession emerge, especially considering high inflation, the situation in Ukraine and the chaos in the epidemic related supply chain.

On the 9th, a survey released by the Federal Reserve Bank of New York showed that American consumers' inflation expectations for the next year decreased in April, but their views on medium-term inflation and household expenditure expectations climbed to an all-time high. The survey showed that the median expectation of American consumers for the inflation level in the next year decreased by 0.3 percentage points to 6.3% in April, while the three-year inflation expectation increased by 0.2 percentage points to 3.9%.

Raphael Bostic, chairman of the Atlanta fed, said the Fed could raise interest rates by 50 basis points at the next two to three meetings, and then assess the response of the economy and inflation to decide whether further interest rate increases are needed. Bostik believes that the 50 basis point interest rate increase approved by the Federal Reserve last week "is already a quite radical measure" and there is no need to take more radical measures. Some analysts pointed out that this also seems to rule out a larger 75 basis point interest rate increase.

"I think we can maintain this pace and rhythm and really see how the market develops... We will raise interest rates several times, maybe twice, maybe three times to see how the economy reacts and whether inflation continues to approach our 2% target, and then we can pause and see how things are going," Bostick said

On the same day, bitcoin also showed weakness, plunging more than 10% to below $31000. US Treasury Secretary Janet Yellen is scheduled to deliver a speech to the Senate Banking Committee on the 10th. In her prepared speech, she talked about digital assets, new products and technologies that bring new opportunities in improving innovation and efficiency, but may exacerbate financial risks. The financial stability Regulatory Commission (FSOC) is trying to identify the risks that digital assets will pose.

For the financial market situation, Yellen said that he would not be surprised by the continued volatility of the market in the summer in the future. Although the valuation of some assets is still high compared with history, the US financial system is still operating in a relatively orderly and stable manner. The situation in Ukraine and China's COVID-19 prevention and control policy have made commodity prices more expensive.

Biden signed a democratic defense lease bill for Ukraine

In response to the situation in Ukraine, US President Joe Biden signed a democratic defense lease bill for Ukraine. According to CCTV news, the bill will greatly simplify the procedures for the United States to provide military assistance and other necessary resources to Ukraine.

According to the agreement in the bill, Ukraine will be able to request weapons and armament needs from the United States and its allies, and the U.S. government will accelerate the transfer of weapons, military equipment, medicine, food, etc. to Ukraine by using the military leasing plan. Ukraine needs to pay rental fees to the United States according to the content of the bill, but its current payment capacity is worrying, and it is expected that the payment will be postponed to the future.

It is reported that the bill aims to restore a plan during World War II, allowing the government to lend or rent military equipment to U.S. allies. The US Senate and house of Representatives previously voted to pass the bill in April.

In addition, John Kirby, spokesman of the US Department of defense, said at the briefing that there was still $100 million left in the "presidential appropriation authority"; Together with the $150 million in aid to Ukraine announced on the 6th, the United States can continue to provide military assistance to Ukraine through this financial channel until "about the third week of this month". The Biden administration has asked Congress to pass a $33 billion supplementary assistance plan to continue to provide humanitarian and military assistance to Ukraine.