LYFT's first quarter earnings per share was $0.07, higher than analysts' expectations; In the first quarter, the revenue was US $876 million, higher than the US $846 million expected by analysts, with a year-on-year increase of 44% and a month on month decrease of 10%; In the first quarter, the number of active users (passengers) reached 17.8 million, lower than the expectation of 17.9 million on Wall Street; Revenue for the second quarter is expected to be between $950 million and $1 billion, lower than analysts' expectations of $1.02 billion.

After the U.S. stock market closed on Tuesday, May 3, Eastern time, American online car Hailing star LYFT released the first quarter financial report and second quarter performance outlook of 2022 as of March 31 this year. Although the revenue and profit were higher than expected, LYFT's share price once fell by 27% to $22.50 after hours due to unclear performance guidance in the second quarter and its continued subsidy to drivers. If the U.S. stock market opens on Wednesday, This will be LYFT's lowest share price since October 2020.

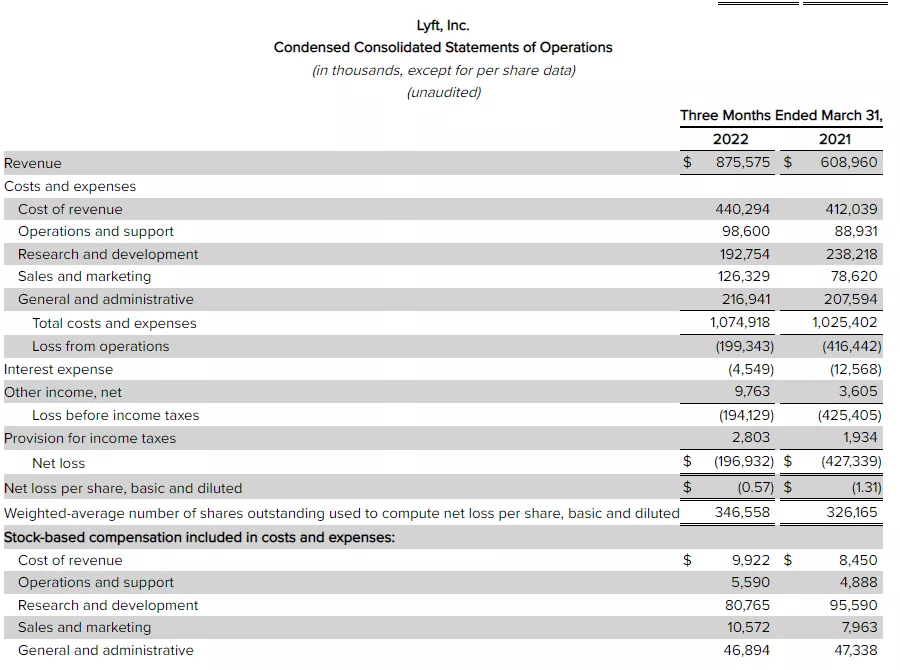

Specifically, its core financial indicators:

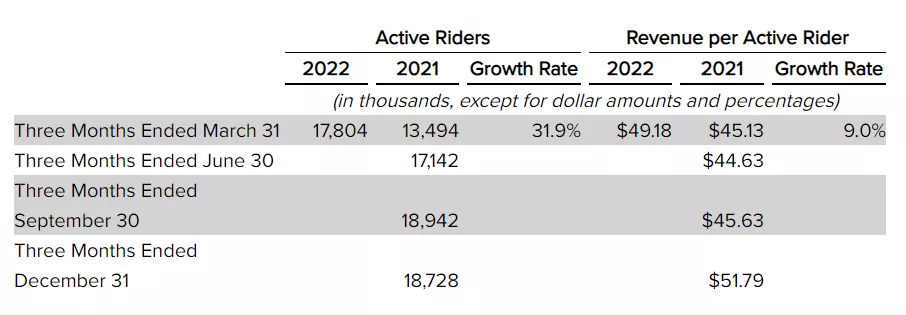

Earnings per share in the first quarter was $0.07, higher than analysts' expected loss of $0.07 per share and a loss of $0.35 per share in the same period last year. The revenue in the first quarter was US $876 million, higher than the US $846 million expected by analysts. The revenue in the same period last year was US $608.96 million, a year-on-year increase of 44% and a month on month decrease of 10%. First quarter net loss of $196.9 million, including $163.2 million in stock compensation and related payroll tax expenses; The net loss in the same period last year was US $427.3 million. The net loss rate in the first quarter was 22.5%, compared with 70.2% in the first quarter of 2021 and 29.2% in the fourth quarter of 2021. In the first quarter, the number of active users (passengers) reached 17.8 million, less than Wall Street's expectation of 17.9 million. In the first quarter, the average revenue of active users (passengers) recorded $49.18, higher than analysts' estimate of $47.07

Let's look at LYFT's second quarter performance guidelines:

Revenue for the second quarter is expected to be between $950 million and $1 billion, lower than analysts' expectations of $1.02 billion.

Logan green, co-founder and CEO of LYFT, commented on this quarterly report:

The first quarter was better than we expected. The number of shared cars reached a new high since the epidemic. LYFT will celebrate our 10th anniversary this month. I am very grateful to this team and very excited about our roadmap to continue to develop the company.

Said Elaine Paul, chief financial officer of LYFT;

Our first quarter results exceeded our expectations. This excess performance is driven by increased demand and flexible driver level. We will continue to improve our service level, benefit our business in the short term and put us in the best position to support long-term growth demand. We also want to make strategic investments in key business initiatives to support our continued growth.

In its last earnings report, LYFT's first quarter performance guidelines did not excite investors. The report predicts that revenue will decline by 12% to 18% in the first quarter, while the adjusted first quarter profit will be between $5 million and $15 million. To some extent, this will be significantly lower than the $75 million in the fourth quarter.

In addition, the incentive measures of continuously subsidizing drivers during the epidemic had an impact on their financial situation. Although the supply of drivers seems to have stabilized, with the surge in natural gas prices across the United States caused by the conflict between Russia and Ukraine earlier this year, some investors worry that drivers will leave their platforms, and the company will have to increase incentives.

LYFT said in a conference call with analysts that it would increase its investment in driver subsidies in the coming quarter, but LYFT believed that it would help "earn returns in a healthier market". It is unclear how much the subsidy will cost.

In addition, not long ago, LYFT reported that the reinsurance problem caused financial loss errors, but this will not affect the financial data of Q1 and Q2 in 2021 or even before. The cost of revenue caused by mistakes is underestimated by US $28.2 million, and the whole year of 2021 is underestimated by US $52.8 million.