The annual reports of 30 "fruit chain" enterprises hide the transformation of the machine circle. The smartphone market spent the first quarter of 2022 in a howl. The sales volume of more than 74 million smartphones in Chinese Mainland was 14% lower than that of last year. Among the top five manufacturers, the sales volume of oppo, vivo and Xiaomi, the three domestic top players, fell by more than 20%.

Looking back at the smart phone market in the past 10 years, only the first quarter of 2020, when the COVID-19 just broke out, saw worse sales.

▲ sales of Q1 mobile phone market in mainland China in 2022, source: cinno

Not long ago, apple put iPhone The output of has increased by 10 million. One side is worried that they can't sell, and the other side is worried that the goods are not enough to sell.

Although the voice of Apple's supply chain enterprises "escaping from the fruit chain" has become louder and louder in the past two years, it is undeniable that when everyone is not full, the fruit chain still seems to be like a "golden rice bowl", and the gold content is getting more and more sufficient.

With the end of April, most fruit chain enterprises have shown their annual reports for 2021, and many giants have shown beautiful revenue and net profit figures. Of course, some fruit chain enterprises did not have an easy time last year.

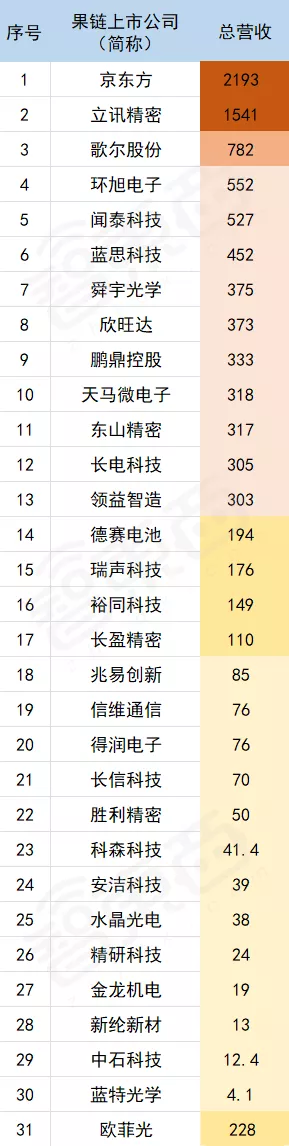

▲ not all fruit chain enterprises in the table, and the data are from the official financial report

Apple is an undisputed technology giant in the consumer electronics industry represented by smart phones. These fruit chain enterprises are often the head players of the track, such as Lixun precision in the field of whole machine OEM, BOE in the field of screen, Shunyu optics in the field of lens, or Zhaoyi innovation in the field of memory chips.

Fruit chain enterprises have played those new tricks this year. What are the important trends and changes in the industry and technology behind them? How do giants judge the industry trend? Dig more than 30 fruit chain enterprises, consumer electronics industry this year, worthy of fine products.

Benefits of this article: Apple's supply chain enterprises have an in-depth analysis, which can be downloaded by replying to the keyword [smart thing 303] in the chat bar of the official account.

01.

Money is not earned less, and the share price is not falling less

It is true that the financial data alone can not fully reflect the real situation of the company, but we can roughly understand how fruit chain enterprises are doing in 2021, whether they earn or lose, and how the capital market votes with their feet.

At a glance, the most intuitive feeling from the revenue and profit data of dozens of annual reports is that the "gradient division" of fruit chain enterprises in mainland China is relatively obvious, or the "gap between the rich and the poor" is relatively significant.

▲ unit: 100 million yuan

For example, the highest revenue of BOE and Lixun precision has exceeded 100 billion yuan, and the revenue of BOE has reached 219.3 billion yuan.

In addition to these two figures, about one-third of the fruit chain enterprises in the statistics have a revenue scale of about 30-50 billion yuan, and the rest have a revenue scale of less than 10 billion yuan. The highest revenue is 548 times of the lowest revenue, with a wide difference.

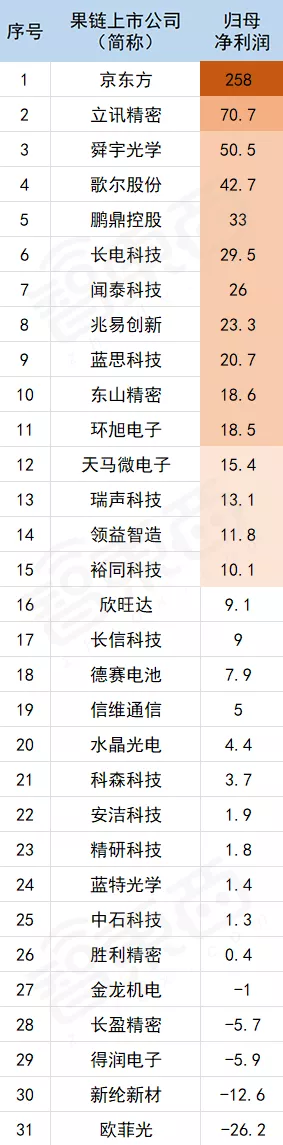

In terms of net profit, BOE has a net profit of more than 25.8 billion yuan, and the net profit of other fruit chain enterprises is less than 10 billion yuan. The net profit of the top 10 fruit chain giants in market value is mostly between 2-5 billion yuan.

▲ unit: 100 million yuan

Although the gap between earning more and earning less is not small, on the whole, "making money" is still the main theme of fruit chain enterprises.

Among the 24 enterprises that have issued annual reports, 23 have year-on-year revenue growth, while the average year-on-year revenue growth is about 19%. In terms of profits, three companies have issued a notice that there will be a net loss, and one company has actually incurred a net loss.

It is worth noting that the year-on-year decline in net profit or net loss is more likely to occur in fruit chain enterprises with relatively small market value. Among the top 10 fruit chain enterprises with market value, 8 have a year-on-year increase in net profit, and only two have a year-on-year decline in net profit.

Generally speaking, for fruit chain enterprises, especially for large head players, it is still common to earn more and lose less in 2021.

However, the situation of the capital market is obviously more complex. In 2021, the economic and political situation at home and abroad is relatively complex. These factors may have a certain impact on the stock price of fruit chain enterprises.

In short, among the 31 fruit chain enterprises counted, the share prices of 14 fell in 2021, with an average decline of about 20%.

▲ stock price changes of major mainland fruit chain enterprises in 2021, data source: wind

It is noteworthy that the share prices of the two leading fruit chain enterprises with the largest market value and revenue, Lixun precision and BOE, both fell by more than 10% during the year. These giants seem to be more cautious about the choice of capital.

02.

See the future through financial reports

Five key trends of consumer electronics industry

In any case, 2021 has passed, and fruit chain enterprises have made great strides towards a new year, whether they earn or lose, earn more or earn less.

2021 is not an easy year for any enterprise. In this year, many enterprises are trying to break through the transformation, and they also have their own in-depth thinking and judgment on the development of the industry.

Behind these 30 thick annual reports, the consumer electronics industry is quietly transforming, and it is very important for every fruit chain player to grasp the key development trend.

- Mastering core technology can earn more

In the middle of last year, Apple announced the latest list of TOP200 suppliers, and 12 new manufacturers in the mainland attracted extensive attention in the industry.

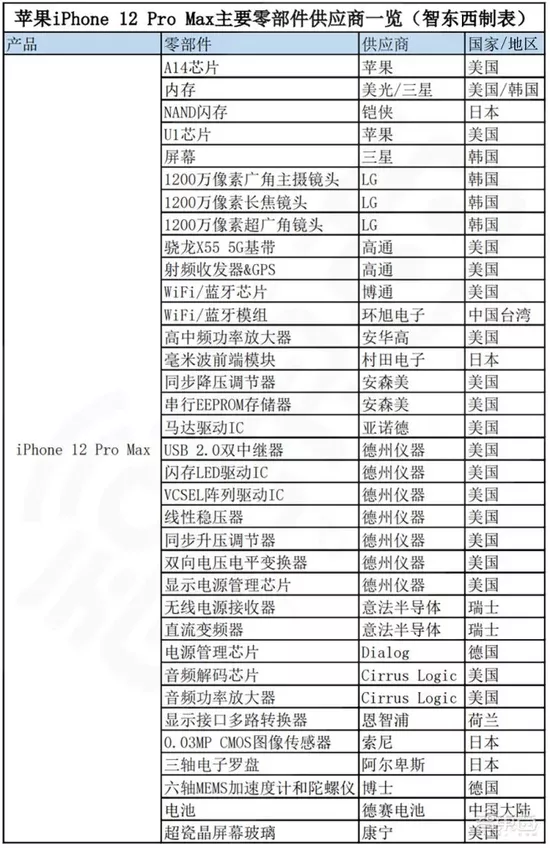

However, at that time, according to the disassembly of iPhone 12 Pro Max by ifixit, we can see that processors, baseband and and RF chips, camera modules, screen modules and storage chips accounted for more than 70% of the cost, which is the absolute majority. However, in these fields, we can see almost all suppliers from the United States, South Korea and Japan.

▲ data source: electronics360, techinsights, ifixit

In the annual report of fruit chain enterprises in 2021, we can see that enterprises with obvious increases in revenue and net profit are mainly involved in the fields of screens, optical lenses, memory chips and semiconductor packaging and testing.

BOE's net profit was 25.8 billion yuan, and Zhaoyi innovation realized a net profit of 2.33 billion yuan with a net interest rate of 27.4%.

The net profit of sunny optics is 5.05 billion yuan. Among the top ten fruit chain giants in market value, its net profit rate is second only to Zhaoyi innovation.

Screens and chips are the core components with high cost in smart phones, and mastering the core component technology does have positive feedback on the revenue and profits of enterprises.

In contrast, enterprises with year-on-year decline in net profit or net loss are more concentrated in the fields of whole machine OEM, precision parts manufacturing, structural parts and so on.

As a smartphone OEM giant, although the total revenue of Lixun precision exceeded 150 billion yuan and achieved a year-on-year increase of 66%, the net profit was 7.07 billion yuan, a year-on-year decrease of 2.1% and the net interest rate was 4.6%.

- The mobile phone market will rebound in 2021, but everyone wants to get rid of "mobile phone dependence"

The sales volume of smart phones in the world has rebounded for the first time in four consecutive years. Although it is certain that the sales volume and sales volume of smart phones have rebounded for the first time in 2021, this is not only the result of the downturn, but also the uneven performance of the global smart phone market.

Pengding holding believes that the impact of the epidemic has gradually slowed down, the global economy has gradually recovered, and the global shipments and sales of electronic products represented by smart phones have rebounded. Pengding holding's flagship products are all kinds of PCB boards, which can be said to be one of the most basic parts of all electronic products.

Many other fruit chain enterprises have given the statistical data of many market research institutions in the annual report analysis to illustrate that although the overall development of the smartphone market in 2021 is slow, it has maintained a relatively stable state.

However, it is worth noting that the vast majority of fruit chain enterprises have an obvious tendency to "get rid of the dependence on mobile phones", and smart cars, VR / AR, smart home, IOT and other fields have become their new focus.

Shunyu optics mentioned that although the shipment volume of mobile phones has increased, the average price of mobile camera modules has decreased. The reason behind this is that mobile phone manufacturers began to configure "downgrade" terminal products, and the proportion of high-end products has decreased.

In contrast, sunny optics has a strong interest in VR and automotive fields. At present, sunny has completed the research and development of a class of VR spatial positioning lens, which has improved the key pain points of the industry such as temperature drift and improved the stability of spatial positioning.

Even Shunyu's VR binocular display module has been developed to improve the distortion and color difference of visual display.

In the field of intelligent vehicles, the shipment volume of on-board lenses of sunny optics increased by about 21% compared with last year, reaching nearly 68 million pieces, and the shipment market share has ranked first in the world.

At present, Shunyu and HUD products are still available.

As judged by Shun Yu, the digital economy and green economy have brought new growth space and development opportunities to the optoelectronic industry. Among them, emerging markets such as autonomous driving, VR / AR and robot vision have great development space.

When it comes to VR, how can we get the world's largest VR head display generation factory, goer shares.

▲ Goethe is the main OEM of Pico VR head display

In addition to the VR head display OEM business we already know, goer is currently developing VR / AR precision optical devices and modules, as well as wireless lightweight ar glasses. According to the information in the annual report, this ar glasses applies optical waveguide, silicon-based led and other optical and micro display technologies, which can process data and conduct wireless communication.

Although Apple's first generation ar head display is expected to be produced by Heshuo, a contract manufacturer in Taiwan, China, it is possible for goer to win some orders with the improvement of contract manufacturing technology and production capacity in the mainland ar field. Just like the iPhone OEM industry monopolized by Taiwan enterprises in the early years, it is now eaten away by Lixun precision.

In Goethe's view, the smartphone industry has developed relatively slowly in recent years, and the global technology and consumer electronics industry has begun the transition from the mobile Internet era to the mobile era. Under such a general trend, emerging smart hardware markets such as VR / AR, smart TWS headphones, smart wearable devices and smart home are growing rapidly.

In the field of VR / AR, Wentai technology, as a complete machine OEM and semiconductor giant, has also made new moves. Wentai technology believes that new energy smart cars, smart IOT and other industries are showing an accelerated development trend, which is expected to become the main driving force leading innovation and economic growth in the future.

Under such judgment, Wentai technology began to apply its technology and products in vehicle optics, AR / VR optics, notebook computers and other fields.

Last year, Nexperia, a subsidiary of Wentai technology, officially acquired Newport wafer fab, the largest wafer factory in the UK. Wentai technology specifically mentioned that the production capacity and process capacity of Newport wafer factory in vehicle specification IGBT, power MOSFET, analog chip and other fields can be well integrated with the product and process capacity of anseri semiconductor, so as to help the company seize the opportunities in the era of electric vehicles and aiot.

▲ ANSYS semiconductor, a subsidiary of Wentai Technology

Another acquisition of Wentai technology has also accumulated ammunition for them to advance in the emerging track. Through the acquisition of Guangzhou delta Image Technology Co., Ltd. of oufeiguang, Wentai technology began to officially layout the optical module business.

As we all know, Delta has previously supplied for apple, so its advanced sealing and testing technology capability, the development capability of some sealing and testing equipment and the ability to supply for top customers such as apple are guaranteed.

Wentai technology said that the follow-up delta technology will enter windows New fields such as laptop, automobile, aiot and AR / VR.

It can be said that every important acquisition of Wentai technology makes it more competitive in the emerging track outside the mobile phone.

In this excavation of the annual report, we also found that many fruit chain enterprises that seem to have little business to do with VR / Ar are also very interested in VR / ar.

For example, PCB leader Pengding holdings also believes that the meta universe wave will bring prosperity to the VR / AR industry. In addition, the accelerated development of intelligent vehicles, the growth of data geometry and the rapid development of AI technology will also promote the rapid growth of the demand for server HPC and other related products, and Pengding Holdings has room to play in these fields.

Also optimistic about VR / AR and intelligent vehicles are Lansi technology, lingyizhi manufacturing and other enterprises. According to the information in the annual report, lingyizhi manufacturing has completed the VR project development for the first time and began to layout the VR field.

From optics, semiconductors, OEM to precision parts, fruit chain enterprises are making rapid progress towards emerging tracks other than mobile phones. A transformation relying on the mobile phone industry is already brewing, while smart phones seem to have been "out of favor".

- Can it be smaller, lighter and lower power consumption?

Behind the weakness of the smartphone market, the lack of attractiveness of products caused by the slowdown of technological innovation is one of the key factors. The era of competing parameters and specifications seems to have passed. Not only mobile phones, but the whole consumer electronics industry represented by mobile phones seems to have to find a new direction in technological innovation.

In the process of in-depth combing, lightweight, miniaturization, thinness and low power consumption have become several keywords with high frequency in the annual report of fruit chain enterprises.

▲ comparison of front face ID module between iPhone 13 pro and iPhone 12 pro, source: wekihome

Sunny optics clearly mentioned in its annual report that they are developing ultra-thin lenses. In sunny's view, thinness will become one of the important trends in the development of mobile phone lens modules.

Nowadays, mobile phones have more and more functions and need more and more parts, but the internal space of the fuselage is stretched. At the same time, with the upgrading of consumption, people also put forward higher requirements for the portability and use experience of the device, rather than focusing on the "what can be done" of the product.

In this context, we can better understand the judgment of Shunyu optics.

It is worth noting that there are not a few fruit chain enterprises with the same view. Wentai technology mentioned in its annual report that the packaging demand of mobile camera modules is developing towards miniaturization and low power consumption. The traditional CSP and cob packaging modes are expected to be gradually replaced by wafer level integrated packaging technology represented by flipchip, so as to promote the innovation of lighter and low-power optical modules.

Of course, the demand for lightweight and miniaturization is not limited to optical lenses.

In the annual report, Wentai technology said that advanced processes such as SIP packaging are becoming more and more mainstream and in increasing demand.

In short, SIP packaging can enable component modules to achieve more powerful functions and higher energy efficiency under the same size. Therefore, this technology has high application potential in mobile phones, tablets, laptops, aiot and other fields in the future.

▲ perspective view of internal structure of apple airpods Pro

- Pastry in the field of screen: Mini LED

At present, one of the important capabilities of intelligent devices is that they can interact with people, and the interaction methods are mainly voice control and screen touch. Screen has become a necessary component of most intelligent products.

In many annual reports of fruit chain enterprises, we clearly feel that after several years of preheating, mini LED technology seems to have reached the eve of rapid outbreak and become a key track in the eyes of many enterprises.

In the view of BOE, a leading domestic screen enterprise, display technology will still develop in multiple ways, and the commercialization and popularization of small spacing LED is accelerating significantly. Mini led and micro LED are what BOE calls small spacing led, that is, the technology to achieve better screen display effect by making LED beads smaller.

It is worth mentioning that many non screen enterprises are also interested in mini led. For example, Pengding holdings specifically mentioned in its annual report that they have become one of the few manufacturers in the industry who master the mini LED backlight circuit board technology, and the mini LED backlight board will also become a new driving force for the company's revenue and profit growth.

Wentai technology believes that mini led and micro LED are the future of display technology. They have established a new display technology division to focus on this field. The massive transfer technology of Anse semiconductor is also one of the foundation of their entry. At present, Wentai technology has developed Mini / micro led direct display and backlight products.

It can be seen that many fruit chain enterprises from various fields have aimed at Mini LED technology, which is also related to Apple's active layout in the field of mini led and micro led. It is certain that in 2022, mini LED will inevitably become a hot pastry in the field of screen technology.

- Epidemic situation, lack of core and material is a "double-edged sword" for fruit chain enterprises

Nowadays, the capricious epidemic situation, the shortage of supply chain, the lack of core and the complex international environment have become the necessary questions for enterprises.

In the financial reports of almost all enterprises, we can see the words related to the epidemic and supply chain, and these factors are not unilateral good or bad for the enterprises in the consumer electronics industry, but various effects.

The adverse side is easy to see: repeated global epidemics, lack of core and materials in the upstream industrial chain, unilateral rise in raw material prices and transportation costs, and continuous downturn in consumer demand

At the same time, the international environment has also become complex in the past year, with intensified energy shortages, soaring commodity prices and rising inflationary pressure, which have brought greater difficulties to the recovery of the global economy.

When will the epidemic end? What will be the impact of countries' attitudes towards epidemic prevention and control? Whether the interest rate hike in Ukraine will lead to a series of uncertain factors affecting the global economic situation in the United States.

Of course, there are many positive aspects.

For example, for screen giants such as BOE, in the first half of 2021, the residential economy such as telecommuting, telemedicine, online education and online entertainment stimulated the continuous growth of demand for display products, superimposed with factors such as lack of core and materials and capacity shortage, the screen price has been relatively strong, which also brought them intuitive feedback on net profit.

In the second half of the year, it showed that the demand for products slowed down, the sea port was blocked, the price of raw materials and logistics costs rose, the willingness of downstream goods preparation weakened, TV products underwent structural adjustment, it products benefited from the demand and supply concentration of high-end commerce, and the market situation was relatively stable.

In addition to the screen, under the background of "science and technology have national boundaries", chip manufacturer Zhaoyi innovation also mentioned that the growth of terminal intelligent demand and the opportunity of localization of supply chain of integrated circuit industry in 2021 are the factors for them to achieve better performance.

Wentai technology also said frankly that behind the growth of global semiconductors and global power semiconductors in 2021, the price rise of global semiconductor chips and multi link hoarding of global semiconductor industry chain are also one of the main driving forces.

The global shortage of semiconductor chips, especially the serious shortage of semiconductor chips related to automotive electronics, has led to a sharp rise in the global price of semiconductor chips, especially the soaring price of semiconductor chips related to automotive electronics.

Wentai technology, which focuses on the field of automotive semiconductors, can naturally benefit from it.

03.

Conclusion: setbacks, opportunities and changes

Key words of achievement chain enterprise

By deeply combing the financial reports of important fruit chain enterprises, we can see that the fruit chain has gradually faded from the attribute of "golden rice bowl" and become more like a "testing ground" to test the transformation and survival ability of enterprises.

Under the pressure of the economic environment and the weakness of the industry as a whole, most of the fruit chain enterprises still achieved good financial report data performance. However, many enterprises need to accelerate the adjustment in the transformation pains after entering the fruit chain and get out of the loss dilemma.

At the same time, the consumer electronics industry represented by smart phones is brewing many new technologies and industrial development trends. Many once seemingly distant technologies have reached the stage of mass production, and the giants are also speeding up the layout of new technologies.

What is more striking is that the fruit chain giants are actively expanding new fields in addition to their original businesses, and VR, automobile, smart home and other fields have become their goals. Instead of "escaping", they use the fruit chain as a pedal to jump into new areas.