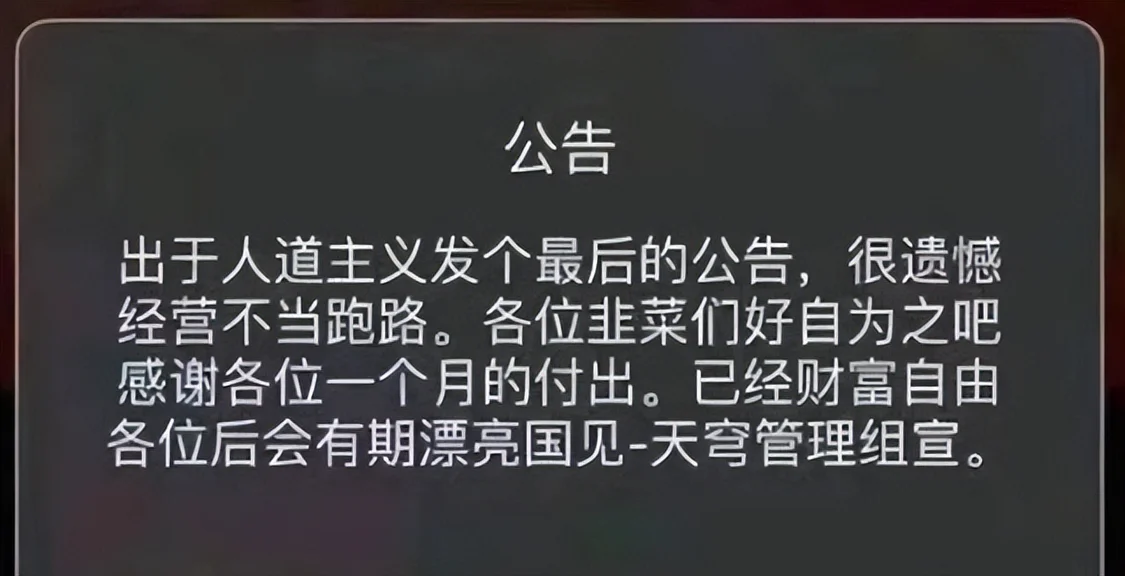

For humanitarian reasons, the leek announcement was issued. Recently, a digital collection platform went out of the loop because of running away. Although the company immediately came out to clarify, this mischievous announcement was deeply rooted in the hearts of the people. Coincidentally, not long ago, Ibox, a digital collection platform, also exploded. Product prices almost fell across the board. There are not a few cases where "30000 buy and 10000 sell". These two events undoubtedly sounded an alarm for investors. Will digital collections become a financial trap again?

We need to figure out a concept first. What is a digital collection? Such as the payment code skin of Alipay, the digital collection Commemorative Ticket of the stage play, the 3D model of cultural relics, or a pixel avatar. As long as works with digital copyright have unique digital credentials after using blockchain technology, they can be called digital collections.

At present, the domestic digital collection market is booming. In January this year, the market issued more than 45million yuan, 60million yuan in February, 200million yuan in March and 300million yuan in April. With these rising figures, big factories also pay close attention to layout. At present, 12 domestic Internet companies have deployed digital collection platforms, such as the whale probe of Alibaba, the magic core of Tencent, and the Lingxi of JD.

At the same time, the foreign NFT market has quietly cooled down. According to the Wall Street Journal, the recent NFT market has dropped 92% compared with the peak of 225000 sales in September last year, and the number of NFT active wallets has also dropped 88%.

Under the high pressure of domestic regulation, platforms replaced the words of NFT with digital collections. The biggest difference between the two is that NFT has a strong financial attribute and can be invested, hyped and traded freely in the secondary market. Digital collections, on the other hand, draw lessons from virtual currencies, weaken their financial attributes, amplify their artistic value, and cannot be traded again.

However, as long as the digital collection can circulate, even if it is a gift, transactions can also breed in the dark. Therefore, there are not few speculators entering the market. Virtual currency, NFT and even the current digital collections are essentially the same. In the final analysis, they are all a game of beating drums and passing flowers. Buy at a low price and sell at a high price. As long as someone takes the offer, the game will not end.

Large domestic manufacturers do not take this as their main business. In order to avoid regulatory risks, the transfer conditions are set very strictly. For example, the phantom core of Tencent cannot be transferred directly, while the whale detector of Ali can only be transferred after 180 days of purchase, and can only be transferred again after two years of donation. At present, the platform's profit-making mode basically relies on handling fees. Compared with cutting leeks with money, it is more like occupying the pit in advance.

While big factories castrate themselves, smaller platforms have begun to test. The most ambitious is station B, which can be donated after 30 days. The digital collection "Gede" launched by it gives collectors the right to commercial development, that is, users can take the image of Gede as a peripheral to realize secondary realization. However, in other platforms, the copyright of digital collections belongs to the author, and buyers can not modify and use them at will.

Xiaohongshu has made an issue of publishing the number of collections. In recent months, collections have been sold almost every day. The overall number is much higher than that of jd.com and tmall.com.

The loss of station B increased sharply last year, with a loss of 6.8 billion yuan. It is eager to find the next growth curve; Little red book has repeatedly jumped between the plight of the community and e-commerce, and digital collections are regarded as a breakthrough. In general, the more difficult the platform is, the more radical it is.

Digital collections are still a new product, and all aspects are in the exploration stage. In terms of security, Jay Chou's NFT Avatar was stolen; In terms of copyright, unauthorized works are also used for profit; In terms of artistic value, a random picture can become a digital collection, which is difficult to evaluate; In terms of investment value, the return cycle is too long and it is easy to explode.

The digital collection market looks like a fire, but the supervision is still blank, and the industry is mixed. Although domestic regulators have repeatedly issued signals to prevent NFT related financial risks, the specific laws are still blank. There are still variables whether the pricing of digital collections is fair and whether the technology of the operating platform is safe.

The game of drumming and passing flowers has just begun. As long as the market is still there, the next leek is on its way.