In the morning of May 20, Beijing time, it is reported that ten years ago today, Facebook's IPO (initial public offering) in naskedak set the largest ever listing of American technology companies Ten years later, Facebook changed its name (meta), but it is still led by Mark Zuckerberg. The dilemma faced by the company is surprisingly similar to that at the beginning

A decade ago, Facebook told people that it was investing a lot of money in smart phone applications (APPs) because the use of mobile devices was the key to Facebook's growth, although it didn't get any meaningful revenue directly from these businesses at that time.

This quote was made by Facebook on [NASDAQ] ten years ago( http://stock.finance.sina.com.cn/usstock/quotes/.IXIC.html ) Announced in the IPO prospectus. That year, Facebook IPO also became the largest listing activity of American technology companies in history, with a market value of more than $100 billion, becoming one of the most valuable technology companies in the world.

But less than three months after listing, Facebook's share price fell by half. The main reason is that although consumers are crazy about embracing smartphones, investors are worried that the days of Facebook's rapid growth will soon be over because the business model of advertising on "small screen" is not yet mature.

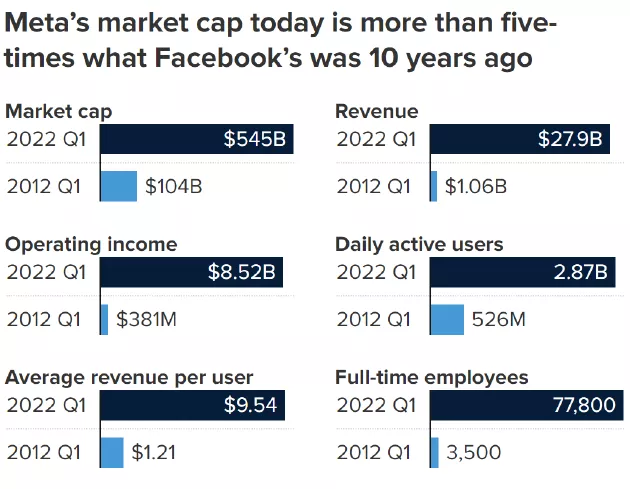

Today, Facebook's revenue is more than 25 times that of 2012. In 2018, more than 90% of advertising sales came from mobile devices. In 2021, Facebook's market value peaked at more than $1 trillion, mainly due to its core mobile application (Facebook) and the acquisition of instagram and WhatsApp.

Now, Facebook has a new name: meta. As for the company's executives, only two of the six executives at the time of the IPO remained: co-founder and CEO Zuckerberg and chief operating officer (COO) Sheryl Sandberg.

Nevertheless, for investors, Facebook's dilemma now looks very similar to that in the beginning. The landscape of science and technology is changing, and Zuckerberg is making another bet on its future. Facebook said last October that it would invest about $10 billion in the next year to develop various technologies to build a "metauniverse", a virtual work and entertainment world that consumers can access through head display devices.

As in the beginning (2012), there is no ready-made business model for "metauniverse", and it is uncertain whether Zuckerberg's vision will be realized as he predicted.

Brian yakktman, chief investment officer (CIO) of YCG investments, an investment company, said: "my concern about metauniverse is that this investment is more like drilling oil wells. You may be empty handed or get rich. My question is how large it will be and who will be the winner."

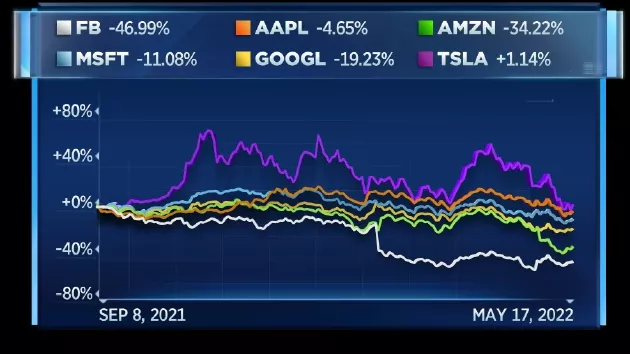

The vague future of "metauniverse" is only one of the reasons why Facebook's share price has fallen by 47% since its peak in September last year (the worst performance among the six most valuable technology companies in the United States in the same period). In addition, the number of Facebook users fell for the first time in history in the fourth quarter of last year, while Apple The privacy policy changes have also undermined Facebook's ability to provide targeted advertising.

Facebook share price trend in the past eight months

In addition, Facebook's reputation has also been hit since former employee Frances Haugen leaked a series of internal documents to expose Facebook's "crimes". The documents leaked by Hogan show that Facebook is aware of the harm caused by its products, especially to young users, but does not take action to make up for it.

Ackerman still holds Facebook shares, but his company hasn't increased its holdings for a long time. He said the sell-off reflected the market's view that the "meta universe" was a cash pit and just Zuckerberg's "plaything". Meanwhile, Facebook remains the second largest online advertiser in the United States. It is estimated that the size of the U.S. digital advertising market will reach $300 billion in 2025.

Record IPO

Over the past decade, Facebook has experienced a magnificent journey.

Facebook's 2012 IPO is historic. At that time, Facebook raised $16 billion, making it the third largest IPO in U.S. history, after [visa] in 2008( http://stock.finance.sina.com.cn/usstock/quotes/V.html ) IPO and 2010 [General Motors]( http://stock.finance.sina.com.cn/usstock/quotes/GM.html )IPO。 In the technology market, the largest IPO before Facebook was the listing of Agere systems, raising $4.1 billion.

At the time of listing, Facebook was already one of the leading brands on the Internet, with more than 500 million daily active users and $1 billion in quarterly revenue worldwide. Morgan Stanley Is the lead underwriter of Facebook's IPO, but the listing did not proceed as planned.

First, Facebook raised its offering price range, despite internal concerns about the company's performance prospects for the year. Subsequently, a group of shareholders sued Facebook and Morgan Stanley, saying they concealed important information.

Facebook (meta) is now more than five times as valuable as it was 10 years ago

On the day of listing, NASDAQ also encountered the so-called "technical failure", which delayed the opening time of Facebook trading and made some orders unable to be fulfilled normally. At the close of the first day, Facebook's share price hardly changed. But then it began to plummet, falling 19% over the next two days.

After more than 14 months of listing, that is, in August 2013, Facebook's share price rebounded to the IPO level of $38. Kevin Landis, chief investment officer of investment management services firm firsthand capital management, witnessed the farce in his office in San Jose, California.

In 2011, firsthand capital management began to buy Facebook shares in the closed market. Landis said the purchase was "short-term wisdom" until it plummeted after the IPO. But he held the investment until around 2014. At that time, Facebook's share price began to rise, so it began trading at about $70.

Landis also said that in his other fund, he began to buy after the share price fell, when the share price was about $20. He had been buying until the outbreak began in 2020, when the share price reached about $200.

"The reason for buying was simple: Facebook would become a powerful advertising platform. The only comparable model was [Google]," Landis said( http://stock.finance.sina.com.cn/usstock/quotes/GOOG.html ) , although Facebook may be worth only a fraction of Google. "

Nevertheless, Landis said he never created his own Facebook page because he hated losing privacy by handing over so much personal data. "I broke one of my principles: investing in something I think is big, but I didn't support it deeply," he said

Obviously, this is a profitable bet. By the end of 2013, mobile advertising accounted for 45% of Facebook's advertising revenue, up from 11% in 2012. Between 2013 and 2018, Facebook's revenue grew by about 50% annually.

The "engine" is so powerful that even seemingly catastrophic news does not bother Facebook's financial situation. First, after Donald Trump was elected president in 2016, Zuckerberg repeatedly played down the role of Facebook in spreading false information and interfering in elections.

Then came the "Cambridge analysis scandal" in 2018. It is reported that Cambridge analytics obtained the data of 87 million Facebook users in an improper way and used these data to help trump provide targeted advertising for the 2016 election.

Finally, the "Hogan incident" at the end of last year. It began with a series of reports in the Wall Street Journal and then spread to many other publications, detailing Facebook's focus on growth despite the negative consequences of its products.

Great complex emotions

Facebook's actions have led to a number of government investigations, and company executives are often summoned to testify in Congress. Last September, several US lawmakers accused Facebook of continuing the strategy of large tobacco companies. In the words of ED Markey, a Democratic senator from Massachusetts, "sell a product they know is harmful to the health of young people".

Hogan's disclosure coincided with the end of Facebook's share price rebound. At the same time, technology stocks are generally approaching their peak and began to fall in November last year.

For Facebook shareholders, the worst day on record occurred in February. At that time, Facebook's share price plummeted by 26%, mainly due to the downturn in revenue expectations and the possible loss of $10 billion to Facebook due to Apple's privacy policy adjustment.

In contrast to the rapid growth a few years ago, Facebook may face shrinking revenue today (in the second quarter) due to inflationary pressure and international turmoil, as well as the soaring popularity of the video application tiktok, which is eating into Facebook's users and advertising revenue.

"It's not about life or death. They won't go bankrupt or run out of money. It's just that in the near future, it's no longer a very fascinating story," said David golden, a partner at revine ventures, a San Francisco technology investment firm Golden said that with the emergence of social media and alternatives to other channels, Facebook's control of the market has significantly weakened.

Recently, Zuckerberg, 38, has rarely talked about social media and mobile advertising. His main business is "metauniverse" and meta's reality labs. In the first quarter of this year, Facebook's "meta universe" department had a revenue of $695 million and a loss of nearly $3 billion.

Zuckerberg said on the earnings conference call last month that there is still a long way to go to make profits, and it may take more than 10 years to blossom and bear fruit (after 2030). "Until these products are really put on the market and expand their scale in a meaningful way, now they are laying the foundation," he said

Landis has not held Zuckerberg's stock for two years. He said he was more afraid than excited about Zuckerberg's vision. He believes that immersing in virtual reality is very "dystopian". "I hope it will not change people's lives, but improve people's lives," Landis said

Given Facebook's knowledge of its users and the way Facebook handles data and privacy that the public has learned in recent years, Landis doesn't believe Facebook will do the right thing. "You can't look at this company without having a lot of complex emotions about it," he said