Last month, Netflix, the "king of streaming media", gave a bad answer. In the first quarter, 200000 paying users were lost, and the net profit fell by 6.4% year-on-year. Even considering launching low-cost packages with advertising in the future... who could have thought that Netflix, which has been popular for ten years, hit the south wall this time. Netflix exploded. The new financial report of iqiyi, the domestic head video streaming platform, has attracted much attention.

Compiler / woodcutter

On Thursday, iqiyi released its financial report for the first quarter of 2022. According to the financial report, the company's net profit based on non GAAP financial indicators was 162million yuan, compared with a loss of 1billion yuan in the same period last year. Iqiyi, which has been losing money for years, has finally made a profit for the first time in 12 years.

However, iqiyi's online advertising, content distribution and other revenue fell year-on-year, and only the revenue of member services increased by 4% year-on-year. In the first quarter, iqiyi's average daily subscription members totaled 101.4 million, compared with 105.4 million in the same period last year. In addition, the average monthly income of members increased to 14.69 yuan from 13.64 yuan in the same period last year.

Behind the profit, iqiyi is still facing the peak of membership growth. However, iqiyi has not found a way out to avoid the situation faced by Netflix.

Is streaming still worth investing in

In recent years, many multimedia groups have been making efforts in streaming media business, while watching Naifei These media groups have to start thinking about whether these investments are worth it?

At the time of launching the fourth quarter of its two popular dramas, ozark) and strange things, Netflix announced the loss of users and predicted that it would continue to reduce 2million users in the next quarter.

So far, Netflix, which has made Hollywood the underdog for many years, finally fell to the altar this week, and its myth of rapid growth in subscriptions for ten years has also drawn a stop. As soon as the news came out, Naifei's share price fell nearly 40%. In November last year, the market value of Naifei was as high as $300billion, but now it has fallen below $90billion.

It is time to take a comprehensive look at the streaming media industry represented by Netflix.

In the past few years, the great success of Netflix has prompted many large media groups in the United States to launch their own streaming media platforms, such as Disney Hulu and disney+, Warner HBO max of brother exploration company, peacock of NBC global and Paramount's paramount+. In addition, the technology giant Amazon And Apple Streaming media studios are also available. These streaming media platforms have adopted the operation mode (membership subscription system) initiated by Netflix.

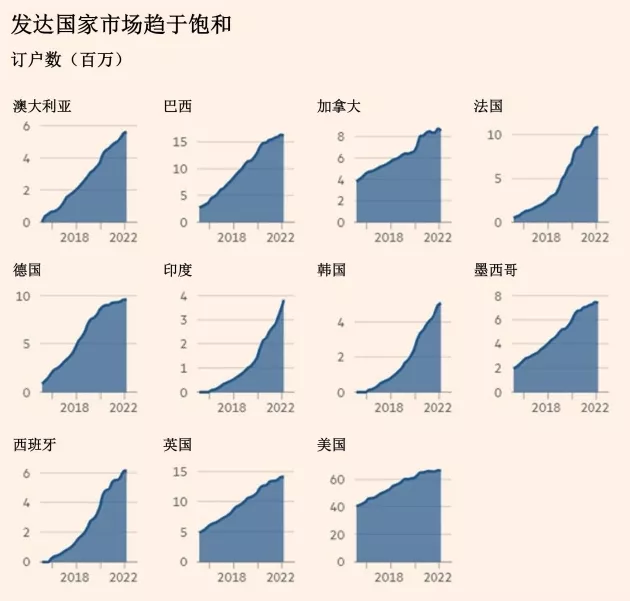

Netflix mode has reshaped the film and television entertainment industry and triggered a fierce user battle. The growth of the streaming media industry in the past is based on the following market assumption: the potential paying users (households) of global streaming media services are up to onebillion. But now, some analysts say that the actual market capacity is much smaller than this figure.

The expected decline in subscription volume of Netflix sounded an alarm: the prospect of the streaming media industry may not be as good as expected.

Burn money as king

Netflix's recent dismal performance seems to mark the end of an experimental era of streaming media. This era is characterized by rapid growth( http://stock.finance.sina.com.cn/usstock/quotes/CKHUY.html ) Burn money like crazy.

Before Naifei came into being, the basic operation mode of the television industry was to create a popular drama and update it constantly, so as to cultivate an increasingly large audience in the process. But Naifei's appearance has overturned this model.

In 2007, Netflix launched a streaming media service in the United States, taking viewers' attention away from cable TV.

This model has achieved great success. In the following ten years, Netflix has developed nearly 222million users in 190 countries and regions around the world, an increase of more than 750%, and achieved profit for the first time at the end of last year.

Naifei's rise benefited from the long-term loose monetary policy and the historical bull market. Under such abundant market conditions, as long as investors recognize the Naifei model, the company can continue to burn a lot of money. In the low interest rate environment, investors eager to obtain income bought a large number of Naifei's bonds, providing funds for the company's unrestrained expenditure on content production.

From 2018 to 2021, Netflix invested a total of US $55billion in film and television production, and launched fierce competition with major television stations and Hollywood studios. Naifei's move triggered a market battle in the whole industry. Every company is frantically burning money just to survive and kill all its competitors. In 2019, Amazon spent $1billion just to shoot the TV version of the Lord of the rings, which is the most expensive TV series.

Some insiders said that the reason why the streaming media industry has been heavily invested in the three years from 2017 to 2019 is that incoming players are scrambling for users, seizing market share and betting on the future. Naifei is convinced of this.

With more and more powerful players entering the game, and people staying at home during the epidemic, the demand for movie viewing surged, and an "arms race" of streaming media content began. It is estimated that this year, the total investment in content production in the streaming media industry will exceed US $100billion, with Naifei alone accounting for us $17billion.

Tom Noonan, a professor at the school of drama, film and television at the University of California, Los Angeles, and the producer of the 2004 Oscar best film "impact effect", said that these investment amounts were "unprecedented". "It is generally the US Department of defense that has such a level of capital budget. It can be seen that this is not sustainable."

Sudden change

Until recently, Wall Street was still cheering for the huge capital investment in the streaming media industry. In december2020, Disney announced that it would produce heavyweight marvel and Star Wars new series through disney+, and its share price once reached a new high.

Now, this optimistic market sentiment has been greatly diluted. In February this year, the streaming media industry ushered in the first bad omen - the day after paramount announced its large-scale investment in paramount+, its share price plummeted by nearly 20%.

At that time, Wall Street was reluctant to believe that streaming media was in a deep quagmire. It was not until they saw the Q1 financial report of Naifei that investors were convinced that in the era of streaming media, no matter how good the program is, it is difficult for the film and television group to make as much money as in the past.

The latest popular series "Strange Tales" to be launched by Naifei

A former head of streaming media said: "streaming media is definitely more expensive than cable TV."

In response to the decrease in the number of subscribers, Netflix announced a series of measures.

At the conference call after the release of the financial report, Spencer Neumann, chief financial officer of Netflix, said that the company would "recover part of the funds used for expenditure", and also said that it would continue to surpass its competitors in terms of film and television production costs.

In terms of advertising, Naifei finally decided to put down his body. Netflix co-founder reed Hastings has said that in order to curb the loss of users, it may launch lower price services that support advertising within a year or two. He said: "although I have always opposed complex advertising and advocated simple subscription, I respect consumers' choices more."

Amazon's TV version of the Lord of the rings

Hastings also said that Netflix's top priority is to improve the quality of the program - which is in the charge of Ted salandos, the joint CEO.

Analysts agree. According to the recent analysis report, Netflix should create more high-quality dramas and develop them into normalized high-quality brands. The report said that "the quality of Naifei's dramas, especially those in English, is totally out of proportion to the production cost."

Gongyu, the founder and CEO of iqiyi, also said at yesterday's financial report meeting that the production capacity of original content in the industry needs to be further improved. He pointed out that an important factor affecting the growth of the number of members is that the content overlap between peers is still too high, and each company has too few exclusive broadcast header content, which will lead to the number of paying accounts owned by the same paying user at the same time.

At present, Netflix is facing fierce competition with veteran HBO, Disney, NBC Universal and paramount. Amazon and apple are two giants that should not be ignored. Although streaming media is not their main business, after all, the big guys can afford it.

Sarandos, who has been trying to integrate Naifei into Hollywood, defends the quality of Naifei's dramas. He said that many films produced by Netflix, such as "don't look up", "red wanted", "super time Adam plan" and so on, have been widely popular in the world recently, but he didn't give the ratings and other data of these films.

Netflix co founder reed Hastings

Sarandos also reminded investors that Netflix is still a novice in content creation. He said: "we have been engaged in content creation for only ten years, but many of our friends are 'time-honored brands'."

But Wall Street may have lost patience with the media. Some analysts have asked film and television companies to rethink their streaming media investment strategies. Sony It has been adopting the so-called "arms dealer" strategy, that is, to make money by selling its film and television programs to streaming media companies. Some analysts believe that traditional manufacturers such as NBC global and paramount can consider abandoning the streaming media business and adopting Sony's strategy to transform into a streaming media content provider.