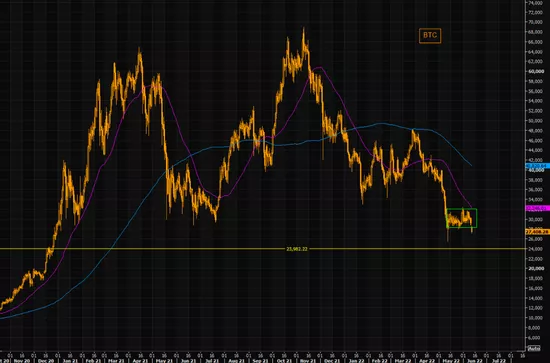

Bitcoin plummeted to the lowest level in about 18 months. Last Friday, the inflation data in the United States continued to impact the global risk assets. The withdrawal freeze of crypto digital currency lending giant Celsius also became the trigger for the sharp fall of digital currency. At the beginning of European stock market on Monday, June 13, the transaction price of bitcoin (BTC), the cryptocurrency with the highest market value in the world, fell below US $24000 / piece, falling more than 13% within the day.

In early trading, US stocks fell below US $23000 for the first time since december2020. In early trading, US stocks once fell below US $22600, down more than US $5000, or slightly more than 20%, compared with the daily high in early trading in Asia. U.S. stocks rose to $23000 in midday trading. U.S. stocks closed above $23400, down nearly 15% in the last 24 hours.

As the broader sell-off continued, other cryptocurrencies also fell. Ethereum (ETH), the second largest cryptocurrency with a market value second only to bitcoin, fell below $1200 in the European stock market, the first time since January last year. It fell by more than 20% within 24 hours. The US stock market recovered to $1200 in the midday session. The US stock market closed at $1200, with a decline of more than 16% in the last 24 hours.

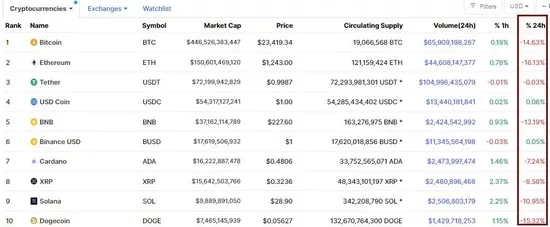

According to coinmarketcap data, among the top ten cryptocurrencies in the world by market value, except for the three stable currencies tether (usdt), USD coin (usdc) and binance USD (bus) linked to the US dollar, the 24-hour decline of other cryptocurrencies exceeded 10%. By the close of the US stock market, seven of the top ten cryptocurrencies had a slight decline, and the 24-hour declines of Cardano (ADA) and XRP had narrowed to less than 8% and 9% respectively.

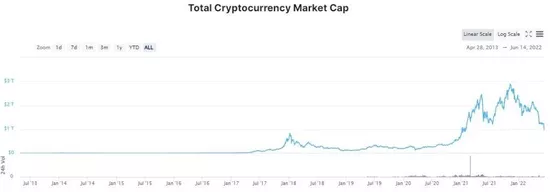

According to coinmarketcap statistics, by midday trading of US stocks on Monday, the total market value of global cryptocurrencies had fallen to less than $970billion. For the first time since January last year, the market value had fallen below $1trillion, and by the close of US stocks, it had reached $970billion.

At the same time, the liquidation of derivatives has also become a fuel for the sharp rise and fall. According to the statistics of coinglass, in the midday trading of US stocks, more than 270000 people broke their positions in the last 24 hours, with a total amount of $1063 million, including more than $92.7 million for bitcoin and more than $42million for Ethereum. By the close of the US stock market, the number of positions exploded in the last 24 hours was nearly 270000, and the total amount of positions exploded was nearly US $1.06 billion, of which the amount of positions exploded in bitcoin dropped significantly to more than US $16 million, and the amount of positions exploded in Ethereum exceeded US $13million.

Hawkish expectations of the Federal Reserve continue to hit the market

From the weekend to Monday morning, the entire cryptocurrency market has evaporated more than 150billion dollars Macro factors have contributed to the pessimism of the cryptocurrency market, inflation continues to be rampant, and it is expected that the Federal Reserve will continue to raise interest rates this week to control price inflation.

The data released on Friday showed that the US inflation rate jumped to a 40 year high in May, and traders increased their bets on a more aggressive interest rate hike by the Federal Reserve In recent months, cryptocurrency has been particularly severely suppressed in the policies of the Federal Reserve.

According to media reports, Antoni trenchev, co-founder and managing partner of NEXO, a cryptocurrency lender, said:

- cryptocurrency is still at the mercy of the Federal Reserve , maintaining a close relationship with NASDAQ and other risky assets.

The prediction we heard about bitcoin is only 10% or even 1% of a thousand, which tells you the type of macro environment faced by cryptocurrency for the first time and the degree of fear about it.

Last week, the U.S. stock indexes fell sharply, and the decline of the NASDAQ index, which is dominated by technology stocks, was even worse Bitcoin and other cryptocurrencies are often associated with stocks and other risky assets. When these benchmark indexes fall, cryptocurrencies also fall

Vijay ayyar, vice president of enterprise development and international of the cryptocurrency exchange luno, told the media:

Since november2021, market sentiment has changed dramatically due to the Fed's interest rate hike and inflation management. Given that the Fed may eventually need to address the demand side to manage inflation, we may also face a recession.

All this suggests that the market has not yet reached a complete bottom, and unless the Fed can take a breather, we may not see a return to bullish sentiment.

Joanna ossinger, an institutional analyst, said that cryptocurrency now looks very bad. For the tokens that are already struggling to cope with the Fed's interest rate hike and the selling of risky assets, the hot US inflation data is just adding to the difficulties. Bitcoin has fallen for the seventh consecutive day and has broken through the recent decline range. This makes it possible for bitcoin to lower its 200 week moving average, or about $22300, or even its 2017 high of $1951100.

In the previous bear market, bitcoin fell by about 80% from the previous record high. At present, the currency is more than 60% lower than the record high set in November last year.

Trenchev also said: "if Ethereum continues to fall towards $1200 (200 week moving average), the prospects for other cryptocurrencies will become even more bleak."

Digital currency lending giant Celsius freezes withdrawals

Since the collapse of the so-called algorithm stable currency terrausd (UST) and its sister cryptocurrency Luna in mid May, the cryptocurrency market has also been in a tense state.

On Monday, a cryptocurrency lending company called Celsius said that due to extreme market conditions, the company will suspend all withdrawals, swaps and transfers between accounts**

Celsius said:

We take this action today to enable Celsius to better fulfill its withdrawal obligations after a period of time.

Celsius claims to have 1.7 million customers, and advertises to users that they can get a yield of 18% through the platform. Users deposit their cryptocurrencies in Celsius, which are then lent to institutions and other investors, and users receive income from the income earned by Celsius.

But the sell-off in the cryptocurrency market has done great harm to Celsius According to the company's website, as of May 17, the company had assets worth US $11.8 billion, down from more than US $26 billion in October last year.

According to the data of coingecko, Celsius' own cryptocurrency cel promised investors "actual economic returns", including an additional return of up to 30% per week, but the currency fell by more than 50% in the past 24 hours.

Investors worry that the cryptocurrency market will be more widely affected. However, the company added that users would continue to receive such benefits during the suspension period.

The collapse of Terra's ecosystem in May, coupled with the tightening of global monetary policy, curbed the demand for high-risk assets, and people's doubts about supporting products such as the sky high yield offered by Celsius were also growing

London based competitor NEXO announced on twitter that it was preparing to acquire all "remaining eligible assets" of Celsius, which it defined as "mainly their mortgage portfolio". NEXO then posted a letter of intent on twitter outlining the acquisition plan. A NEXO spokesperson confirmed the tweets.

NEXO also said that they had extended a helping hand to Celsius, "but our help was rejected". A spokesman for Celsius said in an email that the company had "strong liquidity and equity position".

Ayyar said:

The news from Celsius added fuel to the fire and increased the uncertainty of the market. As the market will focus on the pace of the Fed's interest rate hike this week, coupled with concerns about the agreement to provide high-yield products, the price of cryptocurrency faces great pressure.

According to coingecko, tokens related to loan agreements performed poorly on Monday, with their overall value down 10%, while the value of the broader cryptocurrency sector fell 6.4%.

Ayyar also believes that the price of bitcoin may continue to fall sharply in the next oneortwo months**