The dawn of building a local battery industry chain in Europe is beginning to appear. Recently, Swedish battery manufacturer northvolt began shipping, becoming the first European enterprise to provide power batteries to automobile manufacturers. Moreover, hydrovolt, a European power battery recycling enterprise, has also launched a commercial recycling business.

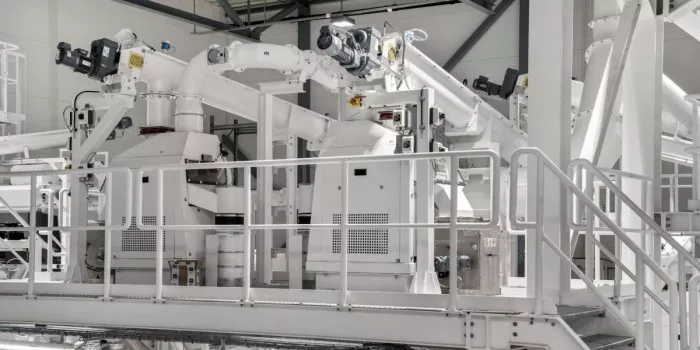

The above-mentioned companies are star enterprises in the European battery industry. Although it has only been established for six years, northvolt has been invested by BMW, Volkswagen, Goldman Sachs, spotify and other companies. A private equity investment of US $2.75 billion was obtained in June last year. Established by northvolt and hydro, hydrovolt is the largest electric vehicle battery recycling plant in Europe, which can handle about 25000 waste batteries every year.

Guo Fangjie, head of the investment and research team of new energy vehicles of Unionpay's big data company and a special overseas automobile researcher of dolphin investment and research, said in an interview with China business news that the construction of local battery enterprises in Europe has begun to be put into operation smoothly, which can alleviate the supply problems in the upstream of new energy vehicles and accelerate the development of new energy vehicles in the region. "Some European battery enterprises are good at supply chain management, and battery recycling technology has begun to be commercialized, which is expected to help battery enterprises avoid the problem of raw material supply to some extent." He said.

Building a local battery industry chain in Europe

Northvolt said that due to the shortage of upstream raw materials and high prices, the company's increase in battery shipments can help car companies increase production capacity. For European car companies, northvolt can also change its dependence on external suppliers in Europe and improve the safety of battery supply.

According to Bloomberg New Energy Finance (bnef), at present, the sales volume of new energy vehicles in Europe accounts for nearly 34% of the global share, making it the second largest market in the world. However, in the new energy vehicle industry chain, it does not have an advantage in battery supply and mineral resources. According to SNE research, a market research organization, in the first quarter of this year, the top 10 global power battery loading enterprises were all Asian enterprises, with an overall market share of more than 90%. According to the data of the U.S. Geological Survey, the upstream raw materials required for power batteries are mostly in Latin America, Africa and Australia.

Northvolt's customers are mostly local European car companies. The company said it had received more than $50 billion in orders from carmakers including BMW, Volkswagen and Volvo and would expand production for the rest of the year. As one of northvolt's largest investors, Volkswagen has launched a plan to build a battery factory in China and hopes to build six large battery factories in Europe by 2030.

Guo Fangjie believes that the core competitive advantage of northvol and its joint venture subsidiary hydrovol is to understand and control all links of the supply chain. "In the battery supply chain, the most important thing is to understand the location, output and quality of the mine. In addition, the company also attaches great importance to data collection, modeling and traceability. From raw materials to batteries, to packaging, and finally realize recycling, and collect data in the whole process to create the best model." He said.

In order to reduce transportation costs and carbon emissions during transportation, northvolt generally chooses to build a refinery near the mine. Most of the other battery companies do this by transporting spodumene (the raw material for refining lithium) to distant refineries (even multinational) for operation.

This has something to do with the background of its founders. Before founding the company, Peter Carlsson, founder of northvol, had many years of experience in supplier search and management. He served as Tesla supply chain director and chief manufacturing Officer (CPO). Before that, he was also responsible for purchasing and looking for suppliers at NXP semiconductor (NXP).

Emma nehrenheim, chief environmental officer of northvol, said the company had taken an important step in recycling battery technology and commercialization. Due to the good sales of new energy vehicles in Europe, this provides more resources for the battery recycling business. Due to the high price of upstream raw materials, this business also sees great economic benefits.

Northvolt started a battery recycling project called reverse. The technology is to use nickel manganese cobalt (NMC) cathode to recover the metal from battery waste through low-energy hydrometallurgical treatment. Each of northvolt's plants has a reverse recycling program and is expected to use 50% of the recycled materials in its battery production by 2030. In addition, according to bnef data, by 2035, the scale of decommissioned batteries available for recycling in the world will reach about 5 million tons, which is enough to meet the demand of 15% ~ 30% of the main metals used in battery production.

Intensified competition in the international battery industry

In addition to Europe, many countries around the world are also stepping up the layout of the battery industry chain. Not long ago, Argentina, Chile and Bolivia, which are rich in lithium resources, were also seeking to build an electric vehicle supply chain. "We are working together to develop new technologies to go further in the battery value chain." Said Fernanda Avila, Argentina's Deputy Minister of mining. Last year, the United States also released a national blueprint for lithium batteries.

Guo Fangjie believes that the battery industry is a capital, technology and manpower intensive industry. Whether countries can stand out in the competition of the battery industry in the future depends on industrial policies and financial support.

Since the beginning of this year, global power battery enterprises have welcomed the wave of listing. Among them, LG new energy, the world's second largest electric vehicle battery manufacturer, raised about US $10.6 billion in the largest initial public offering (IPO) in South Korea's history in January.

Guo Fangjie also said that the battery industry is in the middle reaches of the new energy vehicle industry, and its development is not only related to the reserves of upstream raw materials (the number of mines and the quality of production materials), but also depends on the downstream demand for lithium-ion batteries with new energy vehicles as the main application scenario. "Areas with policies, funds, mines and markets will undoubtedly have great competitive advantages in the future." He said.

For how to reduce the supply risk of upstream raw materials in the battery industry, sun Zn, an R & D expert of China Automotive Data Co., Ltd., said in an interview with the first financial reporter that from the technical level, we can promote the R & D and application of new battery packs.

"First, reduce resources and promote the R & D and application of low cobalt and cobalt free batteries for the most risky cobalt resources; second, replace resources, explore the use of sodium ion batteries in different scenarios, and use sodium ion batteries in electric bicycles, low-speed vehicles and commercial vehicles operating in the city without long-term endurance demand to replace part of the market share of lithium-ion batteries; third, rationalize resource use scenarios and explore hybrid electricity For the application of pool package, the application scenarios of lithium iron phosphate and ternary lithium battery shall be reasonably arranged. " She said.

Sun zinc also said that the improvement of battery density is also one of the most effective technical measures to reduce resource risk. In addition, carry out the ecological design of power battery, explore and improve the ecological product value of power battery, and open the closed-loop cycle of resources, so as to further improve the resource efficiency of the whole life cycle from raw materials to battery production, use and recycling. (author: Kang Kai editor in charge: Feng Difan)