On June 10, the market value of BYD broke trillion yuan for the first time, becoming the first auto company in China with a market value of more than trillion yuan. In the track of new energy vehicles, BYD is not the first enterprise to obtain a trillion market value bonus. Under the market dividend of new energy vehicles, the market value of power battery manufacturer Ningde times has soared all the way, breaking through RMB trillion in May 2021. It is called "ningwang" in the industry, leading the car companies in the new energy vehicle industry chain and becoming the first enterprise with a market value of RMB trillion in China.

The track of new energy vehicles has produced two trillion giants, but the success of the capital market can not offset the turmoil and frustration of the supply chain.

In terms of the power battery field involved by Ningde era all in and BYD, the rising raw materials and other uncertain factors have narrowed the profits of many power battery manufacturers, and dozens of new energy vehicle companies have increased their prices.

"We will buy mining companies in the future." Tesla CEO Elon Musk said in a recent interview.

Tesla buy mine? It is not a helpless move.

Recently, the soaring of battery raw materials has also made Tesla unable to sit still.

In the era of new energy vehicles, "half a car with one battery" is not an empty statement.

Ningde times and other leading power battery enterprises have taken advantage of the new energy to gain momentum in the capital market.

However, the power battery manufacturers, who used to be the industrial center, now need to face the impact of the rise in raw materials, which is really painful and happy.

It's hard to make money in turbulent years

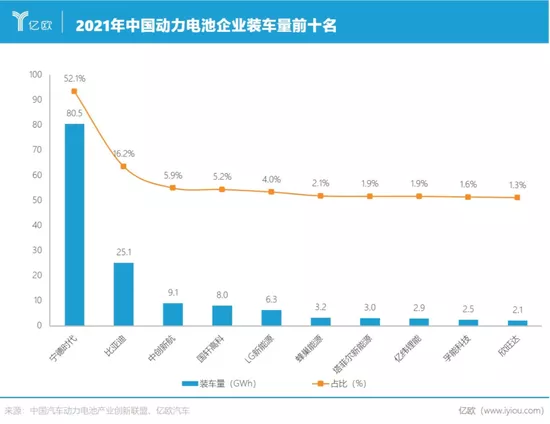

According to the data of China automotive power battery industry innovation alliance, in 2021, Ningde times ranked first among Chinese power battery enterprises with a loading capacity of 80.5gwh, accounting for 52.1% of the market.

BYD followed closely, ranking second with an annual loading volume of 25.1gwh. Ningde times and BYD jointly occupy nearly 70% of the power battery market in China.

Among the top ten Chinese power battery loading enterprises in 2021, in addition to BYD, which has diversified businesses, and LG new energy, which was just listed at the beginning of this year, there are five Chinese Listed Enterprises: Ningde times, GuoXuan high tech, Yiwei lithium energy, Funeng technology and Xinwangda.

From their financial reports released in recent years, we can get a glimpse of the current situation of the power battery market.

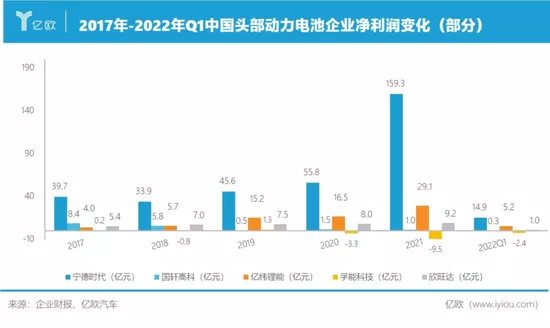

According to the financial report data of five power battery enterprises, from 2017 to 2021, except for Funeng technology, the revenue of other listed enterprises showed an overall growth trend.

In 2021, Ningde times' revenue exceeded 100 billion yuan for the first time, reaching 130.36 billion yuan, a year-on-year increase of 159.1%; Its net profit attributable to the parent company also reached 15.93 billion yuan, a year-on-year increase of 185.3%.

From the change trend of net profit in the past five years, except that Ningde times can maintain a certain profit level, the net profit of the other four listed companies is basically below 1billion, which is generally shown as increasing income without increasing profit.

Funeng technology has failed to turn a loss into a profit since it began to lose money in 2018.

In 2021, the net loss of Funeng technology increased to 950million yuan. Funeng technology explained that it was mainly affected by the decline of the company's power battery product price in 2021.

The reasons for the price decline include that in order to maintain a good customer relationship, it cooperates at a more favorable price, and the material cost increases, but the price adjustment lags behind, and the product price fails to rise in time with the rising trend of power battery material price during the year.

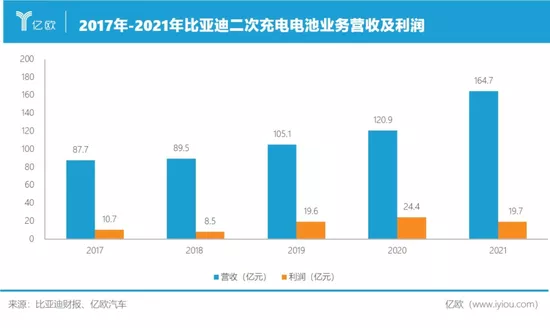

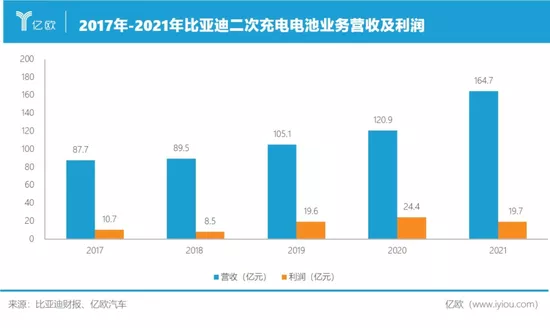

Even BYD, which ranks second in the domestic power battery loading volume, has a far cry from the Ningde era in terms of its secondary charging battery business revenue.

The polarization between power battery enterprises can be seen.

Second line power battery manufacturers often use the method of price war to get a share from Ningde times, which also limits their profitability.

The sharp rise in raw material prices is amplifying the lack of profitability of power battery enterprises.

Cuidongshu, Secretary General of the national passenger car market information joint committee, said that the gap between supply and demand balance of power batteries has not been fully filled, and raw materials will still be in the price rise cycle in 2022.

The storm of rising raw material prices was most affected by Ningde times, which to some extent also gave the rear power battery manufacturers the opportunity to increase their performance.

Car companies do not want to see Ningde times as a dominant company, and Ningde times is unable to swallow the growing power battery market.

According to the data released by the China automotive power battery industry innovation alliance, in April 2022, the loading volume of power batteries in Ningde times was 5.1gwh, accounting for 38.3% of the market, a decrease of 7.2% compared with the same period last year.

The opponents of Ningde era are scrambling for food, and Ningde era will not be complacent.

In this fierce power battery offensive and defensive battle, Ningde times and the second-line power battery enterprises are running a horse to encircle the land and fighting a capacity war.

In 2022, power battery enterprises will not be easy to make money, but they will never be stingy.

Expand production capacity and enclosure

Unlike power battery enterprises, upstream battery raw material manufacturers are full of laughter.

Taking Ganfeng lithium, a leading lithium material enterprise with a market value of 180billion yuan, as an example, its first quarter report released on April 26 showed that Ganfeng lithium achieved an operating revenue of 5.37 billion yuan during the reporting period, an increase of 233.9% year-on-year.

Its net profit in the first quarter exceeded that of Ningde times, reaching 3.53 billion yuan, a year-on-year increase of 640.4%.

Tianqi lithium, another listed lithium material company, realized an operating revenue of 5.26 billion yuan in the first quarter of 2022, a year-on-year increase of 481.4%, and a net profit attributable to the parent company of 3.33 billion yuan, a year-on-year increase of 1442.7%.

The huge profit margin of raw materials undoubtedly makes power battery enterprises envious, and it is also related to their industrial chain layout, which drives power battery enterprises to reach upstream of the battery industry chain.

In the second half of last year, Ningde times and Ganfeng lithium launched a four month "mining war" to acquire Millennium lithium, a lithium mining company with a large number of lithium salt lake projects, but it was eventually pocketed by American lithium.

At the end of September 2021, Ningde Times announced to acquire all the shares of millennium, a Canadian lithium producer, at a price of C $377million.

BYD, Yiwei lithium energy, GuoXuan high tech and other enterprises have also joined the mining boom, and are addicted to the atmosphere of buying.

The explosive growth of new energy vehicles, while the upstream enterprises are not well prepared. The supply of lithium battery raw materials is in short supply. In addition, the price rise has caused the imbalance between supply and demand of lithium materials.

In this context, power battery enterprises all want to start from the source and master lithium resources, which means they have greater bargaining power and risk bearing capacity.

Power battery enterprises are expanding their production capacity while mining and buying ore.

Since december2020, Ningde times has invested more than 73.5 billion yuan to expand the production of six battery projects. At the same time, it has planned eight battery production bases in Fujian, Qinghai, Guangdong and other places, with a total battery capacity of nearly 500gwh.

On April 27, the construction of BYD Xiangyang Industrial Park was officially started in Xiangyang high tech Zone, Hubei Province, with a total investment of more than 18billion yuan. Five major projects will be built, including new energy vehicle factory, auto parts factory, power battery factory, power battery parts factory and zero carbon park.

Second line power battery enterprises are not willing to fall behind. On January 6, honeycomb energy held the commencement ceremony of the honeycomb energy power battery project in Yancheng, Jiangsu Province, with a total investment of 10billion yuan. Zhongchuangxin aviation, Yiwei lithium energy and other enterprises are also expanding their production capacity.

In order to survive in the highly competitive power battery circuit, the production capacity war is imminent.

Power battery enterprises' investment in upstream raw materials is also a necessary preparation for expanding production capacity.

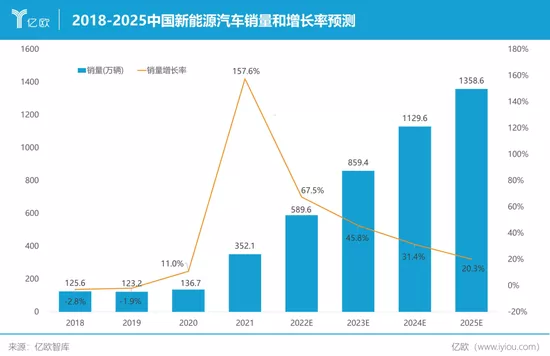

According to the prediction of EU billion think tank, the sales of new energy vehicles in China will continue to grow from 2022 to 2025, and the sales of new energy vehicles in China will exceed 13million in 2025. Power battery capacity will continue to be challenged.

In order to build a more stable industrial ecology and grasp a certain bargaining power, it is justifiable for power battery enterprises to run a horse and seize the land. At present, all enterprises are accelerating the expansion of production, but it will take some time from plant construction to production. In the next few years, the power battery industry will still be difficult to get rid of capacity pressure.

More importantly, investment in mineral resources and expansion of production capacity require a huge amount of money. Where does the power battery enterprise get its money?

Lack of money! Second tier manufacturers compete for listing

2022 is called the first year of listing of power battery enterprises by the market. In addition to LG New Energy listed at the beginning of the year, enterprises such as honeycomb energy and China Innovation airlines have started their own IPO.

On January 13, CITIC Securities disclosed that it had signed a listing guidance agreement with honeycomb energy. The two sides planned to complete the preparation of listing application documents before March 2022. Honeycomb energy has conducted listing guidance and filing in Jiangsu securities regulatory bureau.

Yanghongxin, chairman of honeycomb energy, also said that honeycomb energy plans to IPO in 2022. In 2021, honeycomb energy obtained nearly 20billion yuan of financing, and the current valuation is 46billion yuan.

China Innovation Airlines disclosed the prospectus of the Hong Kong Stock Exchange on March 11, and its financing in 2021 reached 12billion yuan. According to its capital increase price in November 2021, the estimated value of China Innovation Airlines is about 62.9 billion yuan.

The biggest reason why power battery enterprises such as China Innovation airlines are eager to go public is to obtain more financing, improve the layout of the industrial chain and make up for the lack of bargaining power.

According to the prospectus of China Innovation airlines, from 2019 to 2021, its revenue was 1.73 billion yuan, 2.825 billion yuan and 6.817 billion yuan respectively. Although the revenue growth is gratifying, its annual profit will not become regular until 2021, with only rmb112million.

As the third largest power battery loading enterprise in China in 2021, the meager profit of cny12million of China Innovation Airlines is largely due to the lack of bargaining power.

From 2019 to 2021, the unit price of Zhongchuang Chuang aero power battery is 0.87 yuan /wh, 0.64 yuan /wh and 0.65 yuan /wh respectively.

In contrast, the sales unit price of Ningde times power battery in the same period was 0.96 yuan /wh, 0.89 yuan /wh and 0.78 yuan /wh respectively.

Although the sales unit price of Ningde times power battery is slightly higher, it is also declining year by year.

The industrial barriers in Ningde era are not seamless and can be inserted, which also gives the second-line power battery manufacturers the confidence to catch up.

Technological development cannot be achieved overnight. Only by continuously accelerating the layout of the industrial chain can the second-line power battery manufacturers snatch food from the Ningde era.

In this context, Xinwangda and other listed power battery companies are also seeking more investors or secondary listing to obtain the required funds.

On February 24, Xinwangda announced that its subsidiary Xinwangda Electric Vehicle Battery Co., Ltd. received a capital increase of 2.43 billion yuan from 19 enterprises. SAIC, GAC, and weixiaoli are among the investors.

On March 16, GuoXuan high tech announced that it would plan to issue global depositary receipts overseas and list them on the Swiss stock exchange. It planned to increase the construction of power battery capacity and supporting industries in overseas markets such as Europe, North America and Asia, and build its own power battery production line.

The opponents of Ningde era began to make efforts. Although there was a taste of being too hasty, it would also make Ningde era feel a little urgent.

Conclusion

The power battery track is by no means in the stage of win-win cooperation. The new energy vehicle track continues to heat up. This power battery offensive and defensive battle has just begun.

Temporary fluctuations will not affect the long-term development logic of the market. As new energy vehicles continue to grow, the power battery industry will take advantage of the momentum.

Text | meixukang

Editor | haoqiuhui