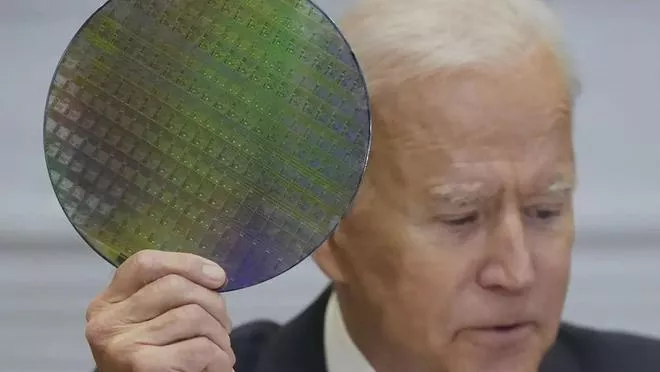

On May 20, the first stop of U.S. President Biden's three-day trip to Asia chose the Samsung Semiconductor Factory located in pyeong taek, Gyeonggi do, South Korea. Biden said in his speech after the visit, "thanks to Samsung's $17billion investment, the United States will build a factory like this in Texas and create 3000 high paying jobs."

In March, 2020, the global pandemic of novel coronavirus triggered a supply chain crisis in the global manufacturing industry. The serious shortage of semiconductors used in mobile phones, computers and electric vehicles caused a large-scale shutdown of manufacturing enterprises. According to the statistics of investment bank Goldman Sachs, about 169 industries are affected by semiconductor shortage.

Semiconductor supply has therefore been brought into the national security vision of major European and American countries. The United States, Spain and other countries have successively announced that they will invest heavily in semiconductor manufacturing. Since taking office, the Biden administration has repeatedly urged Congress to pass bills and budgets to support the return of the semiconductor manufacturing industry to the United States, but Congress has still failed to reach a consensus.

For the semiconductor manufacturing industry, how the business prospect of manufacturing in the United States has become the focus of debate in the industry. In an interview in April, Zhang Zhongmou, founder of TSMC, who changed the semiconductor industry through OEM manufacturing, pointed out that TSMC "under the encouragement of the US government", decided to invest 12billion US dollars to build a 5-nanometer wafer factory in Phoenix, Arizona. However, in his view, "this will be a very expensive but futile move".

Setting up factories in the United States by major semiconductor enterprises can indeed enable the United States to increase local manufacturing, "but it will be very expensive and will not be competitive in the global market." Zhang Zhongmou explained that although the United States is willing to provide tens of billions of dollars in subsidies, "I think this is far from enough."

Semiconductor industry analyst Dan Nystedt pointed out to Caijing that from the perspective of industrial structure, Zhang Zhongmou believes that the United States is at the top of the semiconductor industry chain, not only maintaining a leading position in semiconductor design, but also dominating the production of semiconductor manufacturing machines and electronic automation design software, Therefore, there is no need to go back and pursue manufacturing capacity at a manufacturing cost 50% higher than that of Taiwan, China.

Global core shortage

In March, 2020, the global economy was impacted by the epidemic, and many manufacturing enterprises listed reducing parts inventory as their main task under the assumption that the epidemic would lead to consumption contraction. Customers' expectations were lowered, and semiconductor manufacturing enterprises also lowered their production capacity to the low point.

However, the large-scale closure of cities in Europe and the United States in 2020 has led to consumers' urgent purchase of consumer electronic products such as home computers, televisions and tablets due to the demand for office work and entertainment at home. In addition, the school closure has also led to an instantaneous increase in teenagers' demand for game equipment. What is more unexpected than the market expectation is that the automobile industry that stopped production at the early stage of the epidemic also faced strong demand unexpectedly because the American people avoided taking public transport and Uber based on epidemic prevention considerations. The supply of new cars in the United States was in serious shortage, the price of used cars rose with the tide, and the overall price of cars rose sharply.

The demand for semiconductors in consumer electronics and automobiles has unexpectedly formed a competitive relationship under the condition of insufficient supply. For semiconductor foundries such as TSMC, because the revenue of automotive semiconductors accounts for a small proportion, emergency needs are easy to be ignored.

Over the years, mobile phones and game platforms have contributed 50% to TSMC's revenue due to their quantitative advantages, while automotive semiconductors have never contributed more than 5% to its revenue. In 2019, for example, the global market produced 1.4 billion mobile phones, but only 93million cars; From the perspective of profit and operation, semiconductor manufacturers choose to supply to consumer electronics manufacturers first, such as mobile phones, computers and game consoles.

The reason why automotive semiconductors are relatively ignored by the OEM industry is the industrial structure problems that have existed for many years. General automobiles need 1000 chips, and electric vehicles need 2000-3000 chips. With the improvement of automobile automation, the number of chips will continue to increase. The automotive semiconductor industry has been controlled by five European and American enterprises for many years, including Infineon, NXP, Renesas, Ti and STMicroelectronics. When the market is stable, these enterprises usually outsource twoorthree percent of their production business to OEM enterprises such as TSMC, but they also give priority to cutting off these outsourcing orders when the Automotive demand is weak.

In 2020, automotive semiconductor enterprises also operated as usual, but at that time, consumer electronic products were in great demand. The OEM reminded automotive semiconductor enterprises that if the orders were cancelled or reduced due to the epidemic, the OEM would transfer the production capacity to other products, and the production capacity originally used for automotive semiconductors would be gone forever.

Because of such industrial structure problems, automotive semiconductors have been seriously out of stock since the second half of 2020, resulting in the forced shutdown of some production capacity in the automotive manufacturing industry. In April, 2021, the German Minister of Commerce even asked Taiwan, China for help for his country's automobile industry.

Since the Biden administration took office in early 2021, it has continuously sought to solve the problems of supply chain security and semiconductor shortage. In September 2021, the US Department of Commerce conducted a large-scale questionnaire survey on semiconductor manufacturers and customers to seek to improve the supply-demand relationship. Finally, the US Department of Commerce concluded that the solution should start with "manufacturing more semiconductors in the US". At present, only 12% of the world's semiconductors are produced in the United States.

American manufacturing relocation dilemma

Considering the serious shortage of global semiconductors, major semiconductor enterprises have announced investment to expand production capacity. TSMC announced in April, 2021 that it would invest US $100billion in three years to expand its factory capacity. Samsung Semiconductor of South Korea announced in October, 2021 that it would triple its OEM capacity by 2026. In March, 2021, Globalfoundries, the third largest OEM plant, announced that it would invest US $1.4 billion to increase its factory capacity in the United States, Singapore and Germany.

Thomas Caulfield, chief executive officer of Grosvenor, said that before the outbreak, the chip industry was expected to grow by 5% in five years, but after the outbreak, there was an obvious acceleration trend, with an increase of 10%. He estimated that in the next 8-10 years, the production capacity of the whole industry would need to be doubled to meet the market demand.

Stimulated by the Biden administration's policies, Samsung announced that it would invest $17billion in Texas and $30billion in Texas Instruments. Micron, a storage chip company, also announced that it would expand its production capacity in the United States. However, it is not easy to produce semiconductors with price competitive advantages in the United States. In the past decades, the original complete semiconductor industry chain and talents in the United States have largely disappeared.

For security reasons, the U.S. Department of defense has invited TSMC to set up a plant in the United States since 2019, but TSMC has been stagnant based on cost factors. It did not announce the establishment of a plant in Phoenix, Arizona until 2020. Then in June 2021, Wei Zhejia, President of TSMC, confirmed that the construction of a plant with an investment of $12billion in Arizona had started. It is estimated that the production of 5-nanometer chips will begin in 2024, It mainly supplies artificial intelligence equipment for American cars.

Setting up a factory in the United States is an unforgettable thing for Zhang Zhongmou, who has worked in Texas Instruments for 25 years. He said that after TSMC set up a plant in Washington state in 1997, "various tragic accidents occurred". It was originally expected that the cost would be similar to that of production in Taiwan, China, China, but the results showed that the assumption at that time was "too naive". He pointed out that since the establishment of the factory, various managers and engineers have been sent from Taiwan, China to try to improve the production. After many attempts, the problem has been finally solved, but the cost is still too high - the same products are 50% more than those made in Taiwan, China. Although the products are still profitable, the profits are far lower than those produced in Taiwan, China.

Meguiar, which has been maintaining the production of some products in the United States, also confirmed that the domestic manufacturing in the United States is 35%-45% more than that in other countries that already have a complete manufacturing ecosystem.

Not only the cost, but also the shortage of manufacturing talents and cultural problems are obstacles to American manufacturing. Zhangzhongmou pointed out that the United States has considerable advantages in cheap land and electricity, but it will be a challenge to find competitive technicians and workers in Arizona. After all, manufacturing jobs are not popular in the United States.

Not only that, he also pessimistically pointed out that it would not help to send Taiwan, China's management to American factories. "Computers of different brands can be used together, but people of different cultures cannot be put together and run." The management in Taiwan, China can deliver the best results, which does not mean that they can deliver similar results overseas.

At the beginning of 2022, the construction of TSMC's plant in Phoenix was delayed due to the shortage of workers. Then TSMC began to recruit engineers, which caused a cultural conflict with local manufacturing talents in the United States. TSMC required engineers to work for 12 hours and be on standby at weekends, making American engineers think it is "militarized management" and difficult to find a balance between work and life. The media reported that in order to solve the talent shortage, TSMC is currently recruiting engineers in the United States and Taiwan, China.

In fact, although the United States has tried to relocate manufacturing industry to the United States since the trump administration, the United States faces a serious shortage of technicians and engineers after decades of continuous relocation of manufacturing industry. Jeannine Kunz, vice president of tooling u-sme, who helps enterprises recruit talents, pointed out that the shortage of manufacturing talents facing the United States is a "national disaster", and many enterprises are forced to refuse orders because they cannot recruit people.

Harry Moser, chairman of the nonprofit "reshoring initiative" foundation, pointed out to Caijing that the United States is indeed facing a manufacturing talent crisis, but this can be alleviated by attracting foreign talents. At the same time, a training base is set up near the semiconductor factory. Moreover, the "salary" of the semiconductor factory is very high, which is attractive to some young people, In particular, in recent years, the college enrollment rate has declined, which will help manufacturing talents, because these people always want to find a career worth pursuing. He believes that these semiconductor factories can finally recruit enough technicians and engineers.

The third president of Intel, Gelsinger, who took office in early 2021, holds a completely different view from Zhang Zhongmou. After taking office, he was determined to catch up with the times with Intel, which had missed several rounds of product wars, and simultaneously strengthen and integrate Intel's OEM and chip design businesses.

He acknowledged that the United States made Gelsinger, who lacked competitiveness, chose "safety" as his pursuit. He came to power in the global semiconductor shortage crisis and said, "the world needs a stronger and more diversified semiconductor supply chain." Later, Gelsinger announced that he would invest 20billion dollars to build a new factory in Ohio and expand production capacity in Oregon, Arizona and New Mexico. In addition, he also announced the establishment of new factories and R & D centers in Germany, Italy, Spain and Ireland.

When attending the Davos forum at the end of May, Gelsinger further pointed out to the media that global semiconductor manufacturing cannot be separated from its dependence on Asia, but the current situation of 80% manufacturing in Asia and 20% in Europe and the United States is too unbalanced. He believes that the strategically balanced supply chain should be 50% in Asia, 30% in Europe and 20% in the United States. "If we turn it into 50% to 50% by 2030, we will achieve the goal."

Wall Street investors are still skeptical of Intel's plan, believing that investment in made in the United States is not only challenging but also has a long return time.

But Gelsinger's plan made him hit it off with Biden's government. Biden even invited Gelsinger as a guest in his state of the Union address to Congress in March. The common goal of Gelsinger and Biden to Congress is to persuade Congress to pass the semiconductor local manufacturing subsidy bill. Semiconductor analysts generally believe that Gelsinger's main plan to expand production in the United States is to obtain high government subsidies.

In order to assist semiconductor manufacturing in the United States, the Senate and the house of representatives have passed two independent bills respectively. The $52billion subsidy bill passed by the U.S. Senate on March 28 and other resolutions supporting industrial innovation and manufacturing relocation have been wrapped up as "cross party innovation bill". Although the executive department has repeatedly urged the Congress, the members of the Senate and the house of Representatives began to negotiate on the contents of the bill in mid May, and it is expected that the bill may be passed in mid June.

Biden and U.S. Commerce Secretary Raymond have repeatedly called on Congress to pass the bill as soon as possible, threatening that the delay of Congress may cause the United States to miss the next round of technology competition. Raymondo pointed out at the Davos forum that when Intel, Samsung and micron are building future factories, "if Congress does not pass the bill quickly, they will not set up factories in the United States, and they will continue to cover Asia and Europe."

Reporter | caitingyi editor | Haozhou